All you have to do is read the S-1 to see that Facebook is a viable and valuable company. The negative sentiment that surrounded the public offering of shares in the past few days is not because the company lacks value, but rather because the value at which the company is being offered does not reflect the risk levels or growth expectations of investors who might reasonably purchase those shares.

Which begs the question, what is a fair valuation for Facebook?

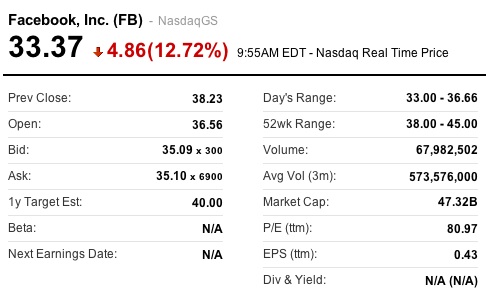

Using traditional measures, we can see what the underwriters and now the market think – it’s worth around $90B. But traditional measures tend to misstate value (above and below) in a case like Facebook. Investors generally are looking for high growth prospects when they take a company like Facebook into their portfolio.

With nearly one billion users, one could argue that Facebook’s user growth is for all intents and purposes complete. Could the user base double again? Perhaps it’s technically possible as more users become available globally, but would you rate it as likely? No. And will it will match the user land grab that has happened in the first decade of the company’s existence? Not likely. That means this measure of growth becomes far less interesting when thinking about value.

What about ARPU? (Average revenue per user) This is an area where Facebook can and will grow revenue. Which means that the metrics an investor should be looking to understand include users, active users, loyalty, churn, alternatives, and ARPU growth per user.

The company states that its active user base is 900 million users as of May, 2012. But does the company’s definition of active user really translate into a valuable and loyal user? For example, I have (and have had) a Facebook account since 2006. I was an active user until 2008. I will show up as an active user in Facebook’s metrics because I do login at least once in a 30 day time span, typically to check the status of a family member prompted by a nag email. An ad impression is generated that I don’t view or click. As a user, even a long standing user, what am I worth to Facebook?

That being said, the AOL-effect is in full swing right now and it wouldn’t surprise me if 100 million Facebook users are truly active, engaged, and for now, loyal users. If Facebook could move the ARPU for this subset of users up, and I believe the team can to some extent, then the company can realize the kind of revenue growth that investors covet. It’s an execution and timing task.

All this being said, subscription models are interesting to watch. Remember the go-go 1990’s and 2000’s where mobile phone companies were all the rage? That was because of the subscriber land rush. Once the rush is over, ARPU becomes predictable and it’s hard, barring some dislocation like the iPhone, to move the model once the subscriber (read Facebook user) rush subsides. This is normally where high valuations come back toward the mid-point.

So, what is a fair valuation for Facebook?

If you believe that the management team will find new ways to monetize the existing user base (hard) and goose revenue and earnings you’re probably pretty happy with the present valuation. You may wait for a dip like today to purchase shares and profit as Facebook executes and increases ARPU.

If you believe that expanding ARPU is a tough proposition and that the real value was created by the user (subscriber) land rush of the past few years, you’ll believe the company is over valued and will wait for it to drift back towards earth before considering it as an investment opportunity. Something more in the $20-$30B range vs. the roughly $90B valuation of this moment.

Personally, I’m a Facebook bear (I hold no position and do not plan to open one, long or short or derivative) in that I believe the earlier private investors have harvested the near- and mid-term value from the stock. Furthermore, I believe increasing ARPU is a tough road, particularly on a “free” product where fickle users can easily bolt to other “free” alternatives as popularity wanes. Already, the “cool” kids are not using Facebook and that’s a trend I see accelerating which will erode the active user base making it even more challenging to grow the company profitably.

But, I could be wrong. And there’s no doubt that there is value in the company and who knows what is possible given the law of large numbers?

What’s your take on Facebook valuation and why? Comments are open…

« Maker Faire 2012

» The Business of Bones

Business, Innovation

What is a fair valuation for Facebook?

05.21.12 | 7 Comments

7 Comments

« Maker Faire 2012

» The Business of Bones

Facebook is going to pursue the acquisition of more mobile app companies that focus on social shopping and in-app purchasing. This is the best way to engage existing users in a new way, use the Facebook platform as a social shopping hub and expand into the mobile space where they are weak. The only real way for Facebook to offer value through profits is not through advertising revenue alone (Zuck hates advertising as much as we all do), but through mobile commerce. It looks like with the purchase of Karma, the gift-giving app, they might just be beginning to act on that strategy.

Thanks for the comment and the insight on Facebook. Mobile definitely is a place to improve and mobile at the intersection of commerce is very interesting. But other than size, why should we think FB can make this pivot?

Why do you hate Facebook so much? its worth every penny to connect to my friends and family and I couldn’t live with out it. i wish i had the money to buy shares because its going to be worth so much more in the future. Everybody uses it

Jody, where in this post do I say I hate Facebook? The company has value, but what the value is is the core question. Everyone using the site is the chief value that has supported it to this point. But is that enough to sustain the company long-term?

I don’t think the price action has anything to do with valuation.

The original price range was 34-38 which MS priced at the top of the range last minute. GS and JPM were also part of the deal and rumor is dissatisfied with the way they were treated…

Given that I don’t think most retail trades on valuation or trade that nimbly I think this is much more about GS/JPM schooling MS by selling against the MS mandate to ‘stabilize’ around 38…

That FB is trading around $34 (original low-end of price range) is interesting. I wonder if MS pulled their perma-bid to find out where the buy orders were — which I suspect were placed just below the original IPO range…

Having said all that I think the IPO was priced perfectly for FB capital raise – and that was the point. Why should FB leave anything on the table by way of IPO pop?

The only people grumpy about a lack of pop have an agenda that isn’t aligned with FB’s goals.

Some random thoughts…

1) I frequently hear commentators on CNBC bemoan Amazon’s 178 PE while talking about retail valuation. Retail? I’ve heard that AWS moves %1 percent of all internet traffic… is Amazon a retail company? Or is Amazon becoming the Internet (“L’État, c’est moi”). How much traffic does FB move?

2) I’ve read that the market values Google users higher than FB users because G does a better job on minimization. If the market is forward-looking I think this thinking is incorrect and that FB users should be valued higher on a go-forward basis. Who agrees? Google – with their massive bet on G+ Google has showed that they think the richer social-graph information has over them is a weakness.

3) The WSJ has a bunch of stories today – 05/21 about how analysts are ‘cooling’ on FB (after it has dropped ~11%)… same ones will warm up FB if it rallied 50% (after the fact of course)

Disclosure: despite being ambivalent of holding anything over the weekend with the Euro/Greek mess I bought some FB at 38.8 on Friday. I don’t know what the long-term monitization plan will be but given the concentration of users and engineering fire-power at FB I’m interested in taking a flier

Yousef, thanks for the comment. Well reasoned. I hope you benefit from your FB long position. Good luck!

[…] that I’m a FaceBook bear; never having bought into the hype that built around the stock. I wrote that I wouldn’t touch it with a 10′ pole. Since that time, the valuation of the company is starting to come back to […]