It was a big weekend for the Explore room at Oddyssea. The pods we ordered from Terra Amico showed up and were assembled (more on that in a later post) and I was inspired by The Brick House’s pipe shelving and decided to build a unit for the Explore room.

You can see how they turned out. Not bad for 24′ of 1″x12″ doug fir, ~45′ of 1/2″ steel pipe and accessories, a little stain, and some black spray paint. The prep work was really the effort in this project, getting the lumber conditioned and ready to stain, drilling holes in the right place, etc. The pipe was pretty easy even though a number of them needed to be specially sized to make the shelving work (thus I learned how to use a die to thread 1/2″ steel pipe.)

I’m happy with the result and the shelves are very solid. I might do a smaller version on another wall in the same room to keep things consistent – but not conforming. I’ll write another entry on the pods tomorrow as I’m still tweaking them from their natural state at the moment…..stay tuned.

I’ve written before that I’m a FaceBook bear; never having bought into the hype that built around the stock. I wrote that I wouldn’t touch it with a 10′ pole.

Since that time, the valuation of the company is starting to come back to levels that are at least in the realm of consideration for investment. I believe a fair price is around $15/share – but irrational exuberance is in play so if it even kissed $20, it could be an attractive investment opportunity – if not for some of the baggage the company is toting around.

Meanwhile, much has been made of Facebook’s “failed IPO.” This is missing the point entirely, the company went public to raise money. The company clearly maximized their opportunity to do so by offering more stock and at the high end of the offering price. So by that measure, it’s hard to call the IPO anything but a win because the maximum funds were realized from the IPO.

The trouble with the NASDAQ on day 1 of trading was certainly unexpected and unforgivable. The fact that FB management selectively notified potential investors before the IPO was probably legal, but definitely was unethical. That gives a clue to investors right there, if you weren’t notified, you’re the sucker at the poker table so to speak. And unfortunately, these are the investors who stand to take a loss, not the company or the investors who offered their shares during the IPO.

Even with the baggage, if you were an investor who liked Facebook at $38/share, you’ve got to love it at $26/share. I remain a FB bear. Where I hold an ownership interest in a company, however small, I expect and demand ethical and transparent behavior from company executives. FB management, in the IPO process, has proven lacking in that area.

Sometimes when things get tough, you need to remind yourself of the joy in what you’re doing. Things aren’t going as smoothly as we’d like at Oddyssea, but it’s going to be OK.

Now, I’ve been accused of being an overgrown kid many times and the great thing is, it’s true. I can still find happiness in very simple things. For example, I invested a little time yesterday between serious jobs (satisfying contracts and doing shop related activities) to build a desktop trebuchet – one of the items we’ll carry at Oddyssea.

If you click the image, you’ll be able to see a video of the test firing of that model. The whole episode made me smile and remember why we’re doing this – to have the freedom to share this sort of experience with others and have them enjoy it, learn from it, and take that spirit back home.

So, if you’re in the market for a trebuchet (or onager, or catapult, or other kinetic model) come visit us when we open our doors later this summer. You’ll have a blast. And we will too!

Well, it’s June. And Oddyssea is not yet open.

The front room of Oddyssea is not close to being completed and we’re now executing plan B. Unfortunately, the team we were working with to help get the right fixtures in place suffered a set back in the form of an injury and we’ll likely only see a fraction of the bits we’d hoped to install in the room.

So, I spent the weekend looking at our alternatives and have settled on doing a couple of projects myself, scavenging for other bits at going out of business sales for other stores, and looking around at commercial alternatives. Things are a bit behind schedule and a bit bumpy.

I’m reminded of the old saw “If it was easy, everyone would do it. It’s supposed to be hard.” That’s where we are right now in the Oddyssea odyssey.

When running a business, any business, there are many choices to be made. One of the big choices is how to handle core activities like vendor management, inventory management, stock analysis, the selling process, billing, etc.

Another decision revolves around automation of these core activities. Now for many of you reading this, you’re probably saying “what? why wouldn’t you automate?” Many retail businesses seem to start manually and then selectively automate. Since I’m a techie, the temptation is to automate everything. That could be a bad decision because automation can sometimes cause more work than it saves unless it supports a certain scale of operations.

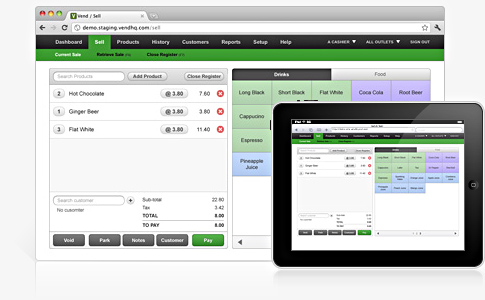

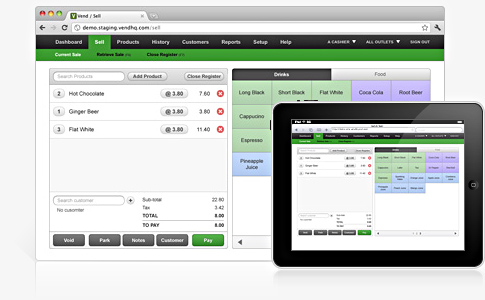

Things we know we want to automate are the selling process and inventory management. Ideally, a single software product would satisfy our needs (and make no mistake about it, there are hundreds of options to do just that at vastly different price points.) Our preferred solution needed to run across phones, tablets, and computers and run best on Apple. We wanted it to be cloud-based with the ability to take offline snapshots/backups. It needed to be easy enough to use that non-technical people could successfully sell products and manage inventory. Of course we needed to have confidence in the safety, security, and availability of our data in the cloud model. Note: we did briefly consider our own infrastructure, but the hassle and cost far outweigh the risks of the hosted model.

The hope we had was that Square would either develop or supplement their awesome payment application with inventory management. But alas, the inventory portion of Square is scaled toward a business with 10’s of products rather than 100’s and there appears to be no roadmap fill that gap. So we started a structured search to find the right solution for Oddyssea.

After messing about with many different options, we chose Vend as the Oddyssea store software. Initially Vend will be supplemented with Square for credit card processing but ultimately PayPal will supplant Square due to the tight integration with Vend.

One thing to note is that most of the candidates allowed for instant trial, this was extremely helpful in narrowing down the right choice. The first cut was “can I try this out?” If the answer was no, like it was for some of the different vendors, they were eliminated. Some of the vendors wanted to have people contact us and make it a high-touch sales activity. Not a good choice on their part. Of the software we could try, it turned out that most of these candidates simply did not work. Sad, but true.

Vend was easy to activate and use. It was moderately easy to import our inventory, vendors, and orders into the software, but not seamless. I had questions about the software over the holiday weekend and got an instantaneous, courteous, and high-content response from the Vend team. All of this BEFORE I decided to be a customer. To me, that interaction spoke volumes and reinforced that not only their software would do the job, but that they would value Oddyssea as a customer.

As we have more experience with the software, we’ll share more. But as it stands, we’re very happy to have Vend help to run our store.

Disclosure: No one from Vend solicited this content. I have no financial interest in Vend or their investors.