When running a business, any business, there are many choices to be made. One of the big choices is how to handle core activities like vendor management, inventory management, stock analysis, the selling process, billing, etc.

Another decision revolves around automation of these core activities. Now for many of you reading this, you’re probably saying “what? why wouldn’t you automate?” Many retail businesses seem to start manually and then selectively automate. Since I’m a techie, the temptation is to automate everything. That could be a bad decision because automation can sometimes cause more work than it saves unless it supports a certain scale of operations.

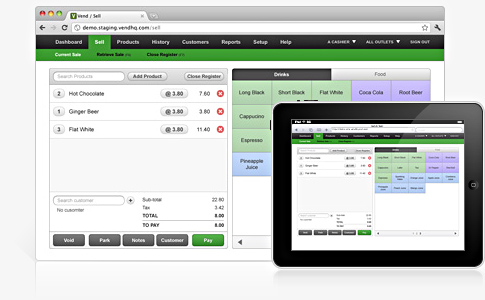

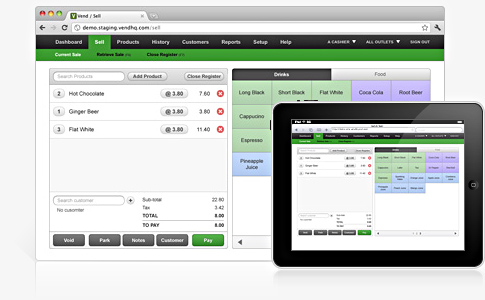

Things we know we want to automate are the selling process and inventory management. Ideally, a single software product would satisfy our needs (and make no mistake about it, there are hundreds of options to do just that at vastly different price points.) Our preferred solution needed to run across phones, tablets, and computers and run best on Apple. We wanted it to be cloud-based with the ability to take offline snapshots/backups. It needed to be easy enough to use that non-technical people could successfully sell products and manage inventory. Of course we needed to have confidence in the safety, security, and availability of our data in the cloud model. Note: we did briefly consider our own infrastructure, but the hassle and cost far outweigh the risks of the hosted model.

The hope we had was that Square would either develop or supplement their awesome payment application with inventory management. But alas, the inventory portion of Square is scaled toward a business with 10’s of products rather than 100’s and there appears to be no roadmap fill that gap. So we started a structured search to find the right solution for Oddyssea.

After messing about with many different options, we chose Vend as the Oddyssea store software. Initially Vend will be supplemented with Square for credit card processing but ultimately PayPal will supplant Square due to the tight integration with Vend.

One thing to note is that most of the candidates allowed for instant trial, this was extremely helpful in narrowing down the right choice. The first cut was “can I try this out?” If the answer was no, like it was for some of the different vendors, they were eliminated. Some of the vendors wanted to have people contact us and make it a high-touch sales activity. Not a good choice on their part. Of the software we could try, it turned out that most of these candidates simply did not work. Sad, but true.

Vend was easy to activate and use. It was moderately easy to import our inventory, vendors, and orders into the software, but not seamless. I had questions about the software over the holiday weekend and got an instantaneous, courteous, and high-content response from the Vend team. All of this BEFORE I decided to be a customer. To me, that interaction spoke volumes and reinforced that not only their software would do the job, but that they would value Oddyssea as a customer.

As we have more experience with the software, we’ll share more. But as it stands, we’re very happy to have Vend help to run our store.

Disclosure: No one from Vend solicited this content. I have no financial interest in Vend or their investors.

05.28.12 | Permalink | Comments Off on Memorial Day Musings

Well, it’s Memorial Day again and for many people that means it’s time to roll out the old grill, have some time with friends and family, and start summer.

That’s not what the holiday was intended to do, but I suppose it’s OK. If you read this blog with any regularity, you’ll know I’m not a flag waver. I speak my mind on a number of topics that at various times can rub conservatives and liberals the wrong way.

One thing I’ve become ever more thankful for as I grow older is freedom. And by that, I mean the ability to say what I want, when I want, with no fear of repercussion other than the anger of some group offended by my comments. That’s a privilege and it’s not accorded to all people on the earth. It’s a privilege that was established and secured with blood.

Thank you to everyone who has served in our Armed Forces for your gift to the rest of us. And a particularly solemn and heartfelt thank you to those who died while serving and to their families. Here’s a personal story written in 2008 to remind us of sacrifice from World War II.

05.22.12 | Permalink | Comments Off on The Business of Bones

Since some of our product was disclosed in a prior post, I thought I’d share a bit more about the business of bones.

It should be a pretty simple process: obtain animal carcass, disarticulate animal, remove skin and sticky bits, clean and dry bones, present in some attractive way (re-articulate, mount, etc.) and finally sell the bones. Turns out, cleaning and preparing the bones is the easy part.

There are international, Federal, and California State regulations about which animals are legal to trade and in what circumstances animals can be hunted and harvested. That was expected, but even animals that die of accidents or natural causes are regulated (to close the apparent loophole for poachers.)

The first set of rules is CITES (Convention on International Trade in Endangered Species) regulation; assuming the animal is sourced from outside the US. The way this set of regulations work is that species are tiered into 3 levels with varying degrees of protection for the roughly 5,000 animal and 30,000 plant species subject to the regulation. It was enacted in 1973 and roughly 80 countries including the US are party to the rules which are legally binding. Compliance is straight-forward: don’t trade in Tier 1 or 2, make sure you have the paperwork and pay the fees for Tier 3.

The second set of rules is the US Endangered and Threatened Species Act. Like CITES, it enumerates the species to be protected, in levels of Endangered, Threatened, and Proposed Protection. There are approximately 600 animal and 800 plant species on the US list. Compliance is simple for this set of rules too: don’t trade in the species that are Endangered or Threatened.

The final set of rules to understand are the California State regulations. Mirroring the US Federal regulations, there are Endangered and Threatened animal and plant species listed. In California, there are just over 100 animal and just under 200 plant species protected. Compliance works in the same way as the Federal regulations.

The big catch here is that the importer (read buyer) is responsible for compliance with the union of CITES, US Federal, and California State regulations and the consequences for running afoul of these laws can be severe.

If one wants to avoid all of this, one can choose to not have this sort of product in inventory or one can choose to carry cast replicas of the items in question. While we have chosen to carry real bones in so far as we are able to do so legally and ethically; we will complement the real bone inventory with cast replicas of some the protected species.

Now, this is one little portion of the inventory of Oddyssea, but an important one. The degree of complexity in obtaining some of our inventory is high, but ultimately, I believe the investment and learning will be worthwhile.

All you have to do is read the S-1 to see that Facebook is a viable and valuable company. The negative sentiment that surrounded the public offering of shares in the past few days is not because the company lacks value, but rather because the value at which the company is being offered does not reflect the risk levels or growth expectations of investors who might reasonably purchase those shares.

Which begs the question, what is a fair valuation for Facebook?

Using traditional measures, we can see what the underwriters and now the market think – it’s worth around $90B. But traditional measures tend to misstate value (above and below) in a case like Facebook. Investors generally are looking for high growth prospects when they take a company like Facebook into their portfolio.

With nearly one billion users, one could argue that Facebook’s user growth is for all intents and purposes complete. Could the user base double again? Perhaps it’s technically possible as more users become available globally, but would you rate it as likely? No. And will it will match the user land grab that has happened in the first decade of the company’s existence? Not likely. That means this measure of growth becomes far less interesting when thinking about value.

What about ARPU? (Average revenue per user) This is an area where Facebook can and will grow revenue. Which means that the metrics an investor should be looking to understand include users, active users, loyalty, churn, alternatives, and ARPU growth per user.

The company states that its active user base is 900 million users as of May, 2012. But does the company’s definition of active user really translate into a valuable and loyal user? For example, I have (and have had) a Facebook account since 2006. I was an active user until 2008. I will show up as an active user in Facebook’s metrics because I do login at least once in a 30 day time span, typically to check the status of a family member prompted by a nag email. An ad impression is generated that I don’t view or click. As a user, even a long standing user, what am I worth to Facebook?

That being said, the AOL-effect is in full swing right now and it wouldn’t surprise me if 100 million Facebook users are truly active, engaged, and for now, loyal users. If Facebook could move the ARPU for this subset of users up, and I believe the team can to some extent, then the company can realize the kind of revenue growth that investors covet. It’s an execution and timing task.

All this being said, subscription models are interesting to watch. Remember the go-go 1990’s and 2000’s where mobile phone companies were all the rage? That was because of the subscriber land rush. Once the rush is over, ARPU becomes predictable and it’s hard, barring some dislocation like the iPhone, to move the model once the subscriber (read Facebook user) rush subsides. This is normally where high valuations come back toward the mid-point.

So, what is a fair valuation for Facebook?

If you believe that the management team will find new ways to monetize the existing user base (hard) and goose revenue and earnings you’re probably pretty happy with the present valuation. You may wait for a dip like today to purchase shares and profit as Facebook executes and increases ARPU.

If you believe that expanding ARPU is a tough proposition and that the real value was created by the user (subscriber) land rush of the past few years, you’ll believe the company is over valued and will wait for it to drift back towards earth before considering it as an investment opportunity. Something more in the $20-$30B range vs. the roughly $90B valuation of this moment.

Personally, I’m a Facebook bear (I hold no position and do not plan to open one, long or short or derivative) in that I believe the earlier private investors have harvested the near- and mid-term value from the stock. Furthermore, I believe increasing ARPU is a tough road, particularly on a “free” product where fickle users can easily bolt to other “free” alternatives as popularity wanes. Already, the “cool” kids are not using Facebook and that’s a trend I see accelerating which will erode the active user base making it even more challenging to grow the company profitably.

But, I could be wrong. And there’s no doubt that there is value in the company and who knows what is possible given the law of large numbers?

What’s your take on Facebook valuation and why? Comments are open…

05.19.12 | Permalink | Comments Off on Maker Faire 2012

Here’s the thing, it’s possible to have too much love. Maker Faire is suffering from this phenomena.

We’ve been going to Maker Faire for a long time and this year it crossed over. The hassle, the crowd, and the crush over shadowed all the great stuff people were sharing. And that’s a shame.

Unless and until the Faire move to a venue that is more appropriate for its size and attendance, I can’t in good conscience continue to support the event. It’s a mob scene and it’s impossible to get value from the exhibits and interactions due to the conditions.

Even worse, it’s really gone commercial. That’s OK, these things need money to survive and thrive. But it’s now blatant.

To wit, GE had a Twitter exchange with me earlier this week inviting me to come to their garage area. When I showed up, I saw it and it looked kind of interesting. When I attempted to enter the tent, a security guard greeted me politely and indicated that I would not be allowed entry unless I registered at the front.

Sorry, if I want to share my information with you, that’s one thing. If you force me to share it to gain entrance, that’s quite another. No one would have thought to do such a thing at prior Faires and if they did, there would have been a revolt. Total Fail.

No giant mousetrap. No power tool drag races. Too many people to move freely. Ugh. Not a good experience.

Let’s hope O’Reilly Media recognize this and get it together for future events.

« Previous Entries