Originally published at Montara Energy Ventures.

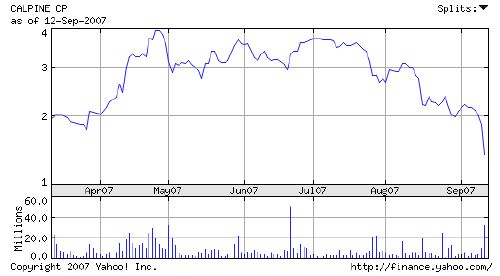

Back in June when Calpine’s reorganization plan was announced, the stock traded at $2.93 per share. On that day, we predicted that the shares would slide (in the face of a post-announcement pop to $3.21/share) to a level that would more accurately reflect the value for shareholders.

Yesterday, the issue closed at $1.39/share. It has traded as high as $1.55/share today.

Does this mean Calpine is a bad company? No, not at all. It does mean that the reorganization plan and the company’s desire to “go it alone” leave investors with limited near-term upside. On the contrary, if Calpine invests in expansion of the geothermal portfolio and slims its fossil fuel portfolio to profitable plants, this is potentially a good long-term investment – particularly now that the shares are trading at a level closer to intrinsic value.

Where do the shares go from here? It depends on the execution of the reorganization plan, natural gas prices, and non-fossil fuel generation investment decisions. If these work out favorably, there should be a nice appreciation. If any of the 3 are out of line, expect the issue to stay flat or even fall a little further. Caveat Emptor.

The principals of MeV hold no position in Calpine. Tweet