Blog Archives

Real Data about Conservation

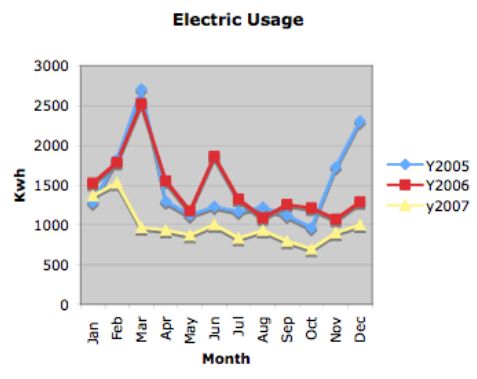

The chart above is from a family member’s home with data over the last 3 years. Of interest about this home, is that it is relatively new (<10 years old) and all-electric (water heating, cooking, clothes dryer, heating/cooling, etc.) Other interesting things to know is that the home has, relatively speaking, many windows and is located in an area where it is very warm in the summer and can get very cold in the winter.

Over the past 3 years this household has made a point of attempting to reduce their energy consumption and ultimately, energy efficient lighting has made a big difference as have solar shades to help with temperature control. One of the things that is striking about this chart is how the peaks have been reduced. Notice in March for 2005/2006 that the peak consumption was around 2,500 KWh. In 2007 that was reduced to about 1,000 KWh. Overall, the 2007 consumption is about 1/3 less than for comparable periods in the prior years.

Conservation does matter and when real data like this is exposed, it shows you what is possible by just by doing the simple things. 5 comments

Nuclear Battery

From the Santa Fe Reporter via StephenYears.com:

4 commentsThe portable nuclear reactor is the size of a hot tub. It’s shaped like a sake cup, filled with a uranium hydride core and surrounded by a hydrogen atmosphere. Encase it in concrete, truck it to a site, bury it underground, hook it up to a steam turbine and, voila, one would generate enough electricity to power a 25,000-home community for at least five years.

The company Hyperion Power Generation was formed last month to develop the nuclear fission reactor at Los Alamos National Laboratory and take it into the private sector. If all goes according to plan, Hyperion could have a factory in New Mexico by late 2012, and begin producing 4,000 of these

reactors.Though it would produce 27 megawatts worth of thermal energy, Hyperion doesn’t like to think of its product as a “reactor.†It’s self-contained, involves no moving parts and, therefore, doesn’t require a human operator.

“In fact, we prefer to call it a ‘drive’ or a ‘battery’ or a ‘module’ in that it’s so safe,†Hyperion spokeswoman Deborah Blackwell says. “Like you don’t open a double-A battery, you just plug [the reactor] in and it does its chemical thing inside of it. You don’t ever open it or mess with it.â€

Calpine Tanks

Back in June when Calpine unveiled their plan to emerge from bankruptcy, we weren’t too positive. In fact, we were downright puzzled by the market reaction sending the stock over $3/share and market capitalization greater than $1.5B. The issue has been on a steady downswing since that time settling in around $1.20/share, around $600M in market cap. Yesterday the bottom dropped out when the company announced a reduction in their enterprise value by $900M. The stock’s valuation now stands around $240M and closed yesterday at $0.495/share.

We wonder if it might not be a sensible thing for Calpine to spinoff its geothermal unit into a separate entity and let the natural gas portion of its portfolio sort itself out with the mother company. With the current market for renewable energy running very hot, this could create a pure play competitor to Ormat with 2x the generation capacity (Ormat is producing about $200M/year from ~375MW – Calpine has 800MW, that should produce around $425M in revenue per year…)

At current valuation and with the geothermal assets, we see Calpine as an interesting speculative buy. Caveat Emptor.

Disclosure: The author holds no position in Calpine stock. The author is considering a speculative, long-term position in the company. 2 comments

ITAIPU: 63.3 GWh and zero emissions

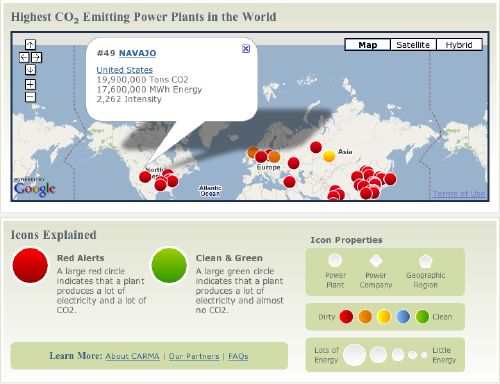

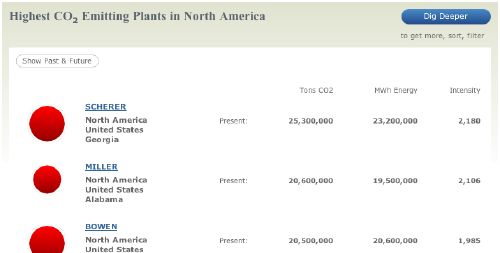

A few days ago the link for Carbon Monitoring for Action (CARMA) was forwarded along to us. This is a mashup of the global electric power plant database on a map with visual representation of the size of the plant, intensity, and carbon contribution plotted on the map, globally, by continent, by country, by region/state, etc. Take a look at a screen shot below:

As you can see, the top 50 carbon emitters are plotted at a global level and #49 Navajo Power Plant is selected showing it produces 17.6 GWh of power along with 19.9 M tons of CO2 emissions per year. One of the more interesting things they track is intensity, or pounds of CO2 emitted per megawatt-hour of electricity produced.

The data in CARMA are compiled from numerous sources. Emissions data for thousands of power plants in the U.S., Canada, the EU, and India come from official reports. Other data are derived from information provided by power sector analysts, the International Energy Agency, the U.S. Department of Energy, the Environmental Protection Agency, and a host of geographic databases. So while it might not be 100% accurate, it’s credible and trackable and certainly better than what existed before.

The aggregations and zooming are very useful and it enables a researcher to determine not only the largest contributors to CO2 emissions, but also the most intense (or least efficient) as well as the lowest producers and most efficient power plants. One thing that may be surprising to people is that the largest electric power plants on the planet are also among the lowest CO2 emitters – gravity hyrdo-generation facilities. For instance, the largest plant on the planet is ITAIPU in Brazil, an 8 GW hydo facility producing over 63 GWh of power per year and zero CO2. In fact, of the 15 largest power plants globally (4 GW and over) – ten are zero CO2 emission.

If you’re interested in knowing more about power plants, their emissions, and impact, we encourage you to visit CARMA. Comments are off for this post

Impressive Cleantech Business

Generally, other than solar thermal, we have been less than impressed with the “businesses” in the solar (pv/thin film) segment. The products are expensive, the business models opportunistic, and the conversation revolves around which technology is best while other harvest methods leave the segment in the dust. It looks like a bubble, smells like a bubble, and ultimately will be proven to be a bubble.

As with every bubble, there are likely to be a few winners and many losers over the long term. Despite our distaste for the segment, it will over the long-term prosper we believe which means that identifying those likely winners to emerge from the down-cycle of the bubble when it pops is important. While at the Renewable Energy Finance Forum in New York last summer, we believed that we identified one of those companies, First Solar. Lately, the company has been on a tear: currently trading at 10x their January, 2007 IPO price, 3rd quarter revenue tripled Y/Y, and 3rd quarter earnings are up 10.7x Y/Y. The company’s market capitalization now stands at $14.5B and the shares trade at a P/E ratio of 216 trailing twelve months. It’s clear the market has discovered First Solar.

That’s all great information, First Solar is clearly benefiting from stellar performance and also the meta market conditions, why is it a long-term winner? Mike Ahern, the CEO for First Solar won us over with his clarity of vision, simple plan, and aligning the fundamental metrics of execution with compensation. Notice, we said nothing about technology – it is adequate to achieve their aims and future breakthroughs can be applied to the business First Solar is building. The vision is clear: Profitably make commercial concerns energy independent using First Solar products. The market is clear, target commercial entities with access to solar resource where a payback is possible. The execution plan revolves around reducing the price of First Solar’s products by increasing volume and refining the process with specific improvement targets over time. Hint: They’ve already reduced their cost of manufacturing 3x.

Shifting a bit to technology only to highlight a business process, First Solar uses 2’x4′ glass panels coated with a thin chemical film (cadmium-telluride or CdTe) to create their product. They’ve invented a continuous process that enables a single panel to be produced in a 2 hour window as it traverses the manufacturing process. They fully understand the throughput and are continuously monitoring and refining the manufacturing process. In order to produce more product, they start new lines and/or establish new facilities (like Germany and an upcoming Asian location.)

Back to business, Ahern stated that the company executives and staff have goals and are compensated on three key metrics: revenue growth rate, product cost reduction rate, and product volume. The goals and the company’s execution against them to date coupled with pursuing a focused market strategy lead us to believe that First Solar is likely to be a winner in the long-term (though perhaps not at this market capitalization) and will be in a position to lead a consolidation in the solar space when the bubble bursts.

Disclosure: The author maintains a long position in First Solar shares.