Calpine Tanks

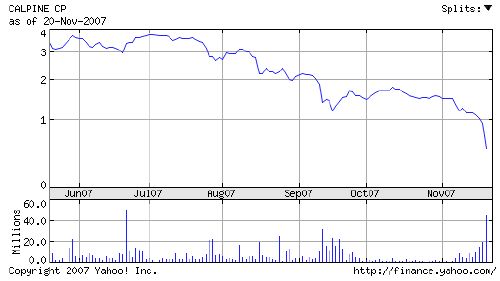

Back in June when Calpine unveiled their plan to emerge from bankruptcy, we weren’t too positive. In fact, we were downright puzzled by the market reaction sending the stock over $3/share and market capitalization greater than $1.5B. The issue has been on a steady downswing since that time settling in around $1.20/share, around $600M in market cap. Yesterday the bottom dropped out when the company announced a reduction in their enterprise value by $900M. The stock’s valuation now stands around $240M and closed yesterday at $0.495/share.

We wonder if it might not be a sensible thing for Calpine to spinoff its geothermal unit into a separate entity and let the natural gas portion of its portfolio sort itself out with the mother company. With the current market for renewable energy running very hot, this could create a pure play competitor to Ormat with 2x the generation capacity (Ormat is producing about $200M/year from ~375MW – Calpine has 800MW, that should produce around $425M in revenue per year…)

At current valuation and with the geothermal assets, we see Calpine as an interesting speculative buy. Caveat Emptor.

Disclosure: The author holds no position in Calpine stock. The author is considering a speculative, long-term position in the company.

Team

Quick question

And try to be nice to me, because I’m new here.

What do you think about the following:

1) buying a leap for Calpine

2) If i were just to buy stock outright as a speculative play – how much would you say is too much? I know it’s hard to say how much is too much.. but I’ll tell you this. I”M A WORKING STIFF — So feel free. But I need a number in terms of dollars…

Thanks

Kelly

Kelly,

We’re not investment advisors, so our opinion is simply that, an opinion. The rule I personally use when investing in speculative plays is not to put $1 more into the play than I can afford to lose. In other words, you have to be comfortable with losing it all in a speculative play – consequently, I don’t engage in them very often.

For good investment advice, we recommend the Motley Fool community at http://www.fool.com to discuss investment strategies and to get widely diverse opinions. http://www.seekingalpha.com is also a strong community.

Good luck with making whatever investment decisions you feel comfortable with.

Cheers,

Mike