What a bunch of build up for so little content. Bickering, few facts, cheap shots, and half truths. Things that struck me as odd: “we are winning in Iraq” – hmmm, what does exactly the definition of winning?

The surge has reduced violence in Iraq and that is an improvement, but I still don’t see that we’ve got an exit strategy that leaves a strong, independent state – and hopefully a democracy.

A battle is being won? in Iraq with respect to reduced violence against US Soldiers, but the war is being lost in Afghanistan.

I’ll save you the 90 minutes of frustration in watching this content. McCain spends his time waving the flag and spreading fear, uncertainty, and doubt. Obama spends his time condemning Bush and attempting to link McCain to those policies. Neither candidate was particularly effective, perhaps they should have canceled the debate…..

Yesterday it was reported there was a deal on the bailout. Then there was a meeting with the candidates and the President and the deal was off. Overnight, Washington Mutual failed. Uh, this is going to get worse if action is not taken…What the heck happened in that meeting to undo the deal?

Mr. McCain and Mr. Obama, we know you want to help. The best way you can do that is get on with your campaigns and be ready to vote when it’s time. Since neither of you are on the Finance Committee, this Washington watch is pure HUMBUG. Suspending a campaign, PUH-LEEZE. Does anyone buy that steaming pile of lie?

It’s pretty clear the McCain campaign is sinking and a distraction from that reality is necessary.

The debates, oh the debates. Well, I hope Obama does show up. If McCain isn’t going to make it, he should send Palin. If neither of them make it, then Obama should give a 90 minute exclusive interview to the press there making his case.

Meanwhile, candidates, get back on the trail and let your colleagues do the deal – stay out of it. We can’t afford to wait much longer on this…I tell you, our government could screw up a two car parade!

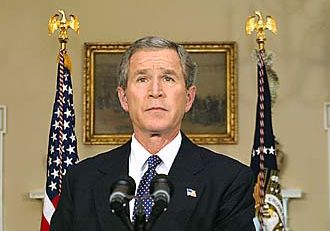

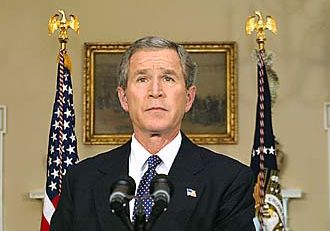

Yes, the title is intended to be clever. This is about President Bush’s speech last night. Those of you who read this blog often will know I don’t have much good to say about our current chief executive. Surprisingly, I listened to his speech last night and found it cogent and coherent – something that has not often been said about Mr. Bush and certainly not by me.

Does this mean I’m comfortable and supportive of the $1T bailout ($85B for AIG, $200B for Freddie/Fannie, and this latest $700B handout) – in a word, no. But I do understand the rationale and provided that basic protection, adult supervision, prevention of repeat measures, executive compensation limits, and transfer of assets actually occurs for us tax payers, I will reluctantly support the plan because I do believe it’s better than the alternative.

So, Mr. Bush, while we still have many, many differences, your 22nd attempt at addressing the nation was not painful to listen to and made a great deal of sense. I tip my hat to you sir for stepping up in an untenable situation. That being said, I will not be sorry when you leave office next year.

The more I think about this bailout, the more uncomfortable I become. Do we need to do something? Yes. Do we need to move with some pace? Yes. Do we need to do what the Bush Administration is pushing for? Not so fast my friend. Remember, this is the administration that has routinely screwed up two car parades. Perhaps a sober pause to consider options is in order?

First off, there’s the principle. We believe (and I certainly believe) in a market-based economy. So, we’re going to protect the financial institutions and home owners who made bad decisions from the market? How does this square with our system? What sort of precedent does it set? We’re simply going to raise a huge pile of money and hand it over to the very people who created this problem with their greed and bad judgment? Yeah, that sounds like a GREAT IDEA. Thank you sir, may I have another?

Here’s the key question: Why should we hand over a pile of cash to the same morons who created this crisis?

Perhaps there is another alternative we should consider? Let’s create a Resolution Trust Company-like entity and capitalize it with say $100B. Let’s put a trusted Financial expert in charge of the company with a Board of Directors representative of shareholders. Let’s have that company start buying the paper in a reverse auction like mechanism where other institutions can participate (if they’d like – and they won’t.) Let’s give each taxpayer stock in said company such that when the housing market does return from the brink, there is a possibility for recovering funds from the company (heck, put the returns in Social Security in trust for the public.) If $100B isn’t enough, authorize another capitalization round like any other company would.

Meanwhile, re-regulating some of the market activities might be a good idea since the industry has proven it is incapable of governing itself. While we’re at it, some accountability from the financial industry would be a good thing. The executives leading these companies shouldn’t profit from their malfeasance – perhaps even, criminal inquiries are in order. Golden parachutes shouldn’t be available to those who led the country into this mess. If we’re not going to help the individual home owner and we’re not going to help the employee who’s job is now gone, then those in charge should suffer the same consequences.

This preserves the transparency, accountability, and market economy we know and love. It doesn’t set any weird precedents. And it provides for some upside to the people who will fund this bailout, us. Let us not simply hand over another Trillion dollars to the idiots who got us into this mess in the first place, please!

Well, I did the math on the bailout. IF it only costs $700,000,000,000 (that’s $700 billion) and there are 303,000,000 (303 million citizens – current census estimate) then each person’s share, child, woman, and man, is just north of $2,300. That means for a family of three like ours, the bill is $6,900. Now, I don’t believe for a moment it’s going to be $700B, I think if we get off for a Trillion dollars – think about that for a moment – a Trillion dollars – we will have done well.

Now, do we have a choice? No, I don’t think so. Should we put some controls around the bailout mechanism? You bet. That doesn’t seem to be in the proposal. In a continuation of the largest movement of public funds (our money) to a small number of Bush beneficiaries, you can bet that we’re going to see every kind of bad decision security banks hold take advantage of this bailout. Who can blame them?

Meanwhile, back at the campaign, neither Senator Obama nor Senator McCain have any sort of credible answer about what specifically they would do, or we should do. That’s likely a winning strategy for Obama, but not what I expect from a leader. Mr. McCain continues to do his dance about how he’s a reformer. Oh yeah, I remember, in 1989 in the shadow of the savings and loan fiasco, he was a part of removing the regulation from the banks that caused this in the first place. Any ownership from him? No. His idea? Combine Federal agencies for better supervision. In other words, rearrange the deck chairs on the Titanic.

Now, when we’re spending more than we take in on an annual basis, we’re signing up to take on nearly a Trillion dollars more debt, does either candidate have a sound fiscal plan? Check the chart out below on the revenue side of the equation (courtesy of countryclubfirst.com):

Now, I’m not an economics expert, but I can add. If you continually spend more than you make, you have a problem. If you sign on to handle debts that you cannot pay, you have a problem. The problem has a solution, you spend less and try to make more. You don’t take on extra commitments when you can’t meet your current obligations. Our government is operating under the check theory of economics. “What do you mean I’m out of money, I still have checks?” And that’s bad for all of us.