10.18.07 | Permalink | Comments Off on Apple’s Bite of the Market

Top 5 Vendors, United States PC Shipments

Third Quarter 2007 (Preliminary)

(Units Shipments are in thousands)

|

Rank

|

Vendor

|

3Q07

Shipments

|

Market

Share

|

3Q06

Shipments

|

Market

Share

|

3Q07/3Q06

Growth

|

|

|

|

|

|

|

|

|

1

|

Dell

|

5,010

|

28.0%

|

5,260

|

30.9%

|

-4.8%

|

|

2

|

HP

|

4,346

|

24.3%

|

3,718

|

21.8%

|

16.9%

|

|

3

|

Apple

|

1,127

|

6.3%

|

973

|

5.7%

|

15.9%

|

|

4

|

Toshiba

|

940

|

5.2%

|

805

|

4.7%

|

16.7%

|

|

5

|

Gateway

|

865

|

4.8%

|

1,009

|

5.9%

|

-14.2%

|

|

|

|

|

|

|

|

|

Others

|

5,633

|

31.4%

|

5,272

|

30.9%

|

6.9%

|

|

|

|

|

|

|

|

|

All Vendors

|

17,922

|

100.0%

|

17,037

|

100.0%

|

5.2%

|

The table above was

published by IDC yesterday and shows US market share for the top 5 vendors (note: there was a global table as well, but Apple was not broken out in that table as it is not in the top 5 vendors globally.) I went looking for this information because I was struck by the photo posted below:

College Class at the Univeristy of Missouri (click to enlarge)

This is a non-random, small demographic, a single lecture hall with a single class at the University of Missouri, but, do you think the market share is greater than 6.3% in that classroom (note that the little white dots on the laptop lids indicate that the computer is an Apple.) Also, it’s interesting to observe that this is a very young crowd, I wonder what Apple marketshare is by age group? I’m tending to think it’s skewed toward youth. When I look at Apple’s market cap of $150B I tend to think “this stock is way over-valued” but then I see an image like this and think: if Apple is dominating the under 25-crowd and the total marketshare is only 6.3%, and the iPhone and iPod continue their growth path, isn’t it possible that Apple could double or triple it’s market footprint over the next few years? An interesting thought…

What do you think, is Apple fairly valued? Over-valued? Under-valued? What do you think the marketshare might look like in 5 years time?

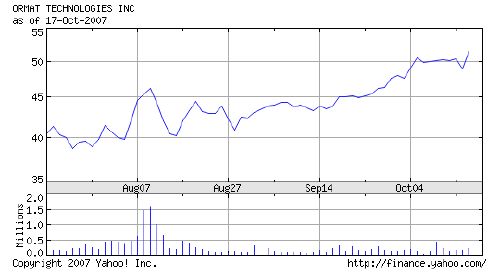

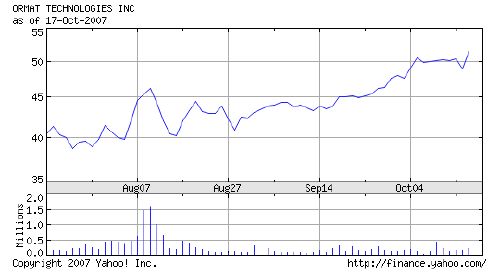

Ormat up over 25% in past 3 months

Over the past 3 months, Ormat (NYSE:

ORA) market capitalization has increased to nearly $2B. The run up of the stock can be attributed to rumors that the company is considering some sort of takeover by private equity. The two names most closely connected to such potential deals are Goldman Sachs and Apax. Today, Apax has denied the rumors of such a deal.

What we do know is that a consolidation is underway in the renewable energy industry as established energy players rush to start or enhance their portfolios and renewable energy companies seek to cash-in on a liquidity event at near record market prices. This is a wise strategy, one only has to look at the ethanol segment today vs. two years ago to see how quickly and completely the bubble can pop. Caithness has provided a model for this, effectively exiting the operations of renewable power plants with the

ArcLight Capital deal consummated earlier this year.

But what about valuation? Ormat is a $300M gross sales company split with 80% coming from electricity generation and 20% from equipment sales. Net income trailing 12 months is $21M and current market cap is $2B, 100x earnings value. Wow. The company carries nearly $500M in debt and has $73M in cash. The generation portfolio is around 370MW today and could double in the next 5-7 years, though it would be interesting to see how the company would choose to finance such aggressive expansion.

As a point of comparison, Calpine (OTC:

CPNLQ.PK) has a geothermal portfolio of 800MW, development potential to increase that by 500MW over the next 5-7 years, and also has over 23,000MW of natural gas generation assets. Admittedly, Calpine is working to emerge from a painful and slow bankruptcy and does not have an equipment business as points of difference. Looking at the revenue, (though Calpine declines to segment revenues by gas fired and geothermal segments) we estimate that Calpine is capturing at least $400M per year in revenue from their geothermal portfolio and throwing off in excess of $100M per year in net income from the portfolio. Calpine’s market cap? $750M.

On the basis of this analysis, we would suggest that it would make more sense for large players looking to enter the renewable energy market in a big way to acquire Calpine, even at 100% premium of market price today, divest the natural gas resources and develop the other 500MW in Calpine’s pipeline. This would likely be more cost effective than taking on a smaller portfolio with an equipment business at a staggering premium. The bankruptcy proceedings definitely would complicate the matter, but it would be worth it to get such valuable assets without paying such a steep premium over intrinsic value.

Our analysis leads us to believe that Ormat is worth about $40/share presently, thus the current share price of $51.50 leads to substantial downside risk in the near to mid-term.

Disclosure: MeV holds no position in Ormat or Calpine.

Via CNN.com on the latest Neilsen ratings:

There’s this little sobering fact to consider: The number of viewers, overall and with the ad-friendly 18-49 crowd, have declined sharply for each of these three networks. Oops.

Read the full article.

I’ve railed against the television networks, music distributors, radio networks, film distributors, and newspapers now for some time. The handwriting is on the wall: your audiences are shrinking and the trend is accelerating. The one traditional medium that might escape, is radio. That’s because it still has a captive audience in the car…other than that, these companies are screwed unless and until they learn how to function in a computer network-centric environment.

Here are some examples of the death of traditional media from my own life:

- Newspaper – 20 years ago, I had a daily subscription to the San Francisco Chronicle and a Sunday subscription to the NY Times and I would frequently buy other newspapers on a spot basis. Today, I maintain a weekly subscription to my local newspaper, the Half Moon Bay Review. Why that paper? It covers local events not available elsewhere (though Coastsider.com is coming on strong and may displace this last local news source.) What has taken the place of the papers for me? Live syndication of RSS feeds through a news reader. The reality is, by the time a paper can physically be produced and disseminated, it’s no longer news. My current newspaper is always available and always up-to-date, I can see any back issues I could ever want, and it’s free (I know, there are ads, but there are ads everywhere including the physical newspaper you pay to receive.) Outlook: Aside from an odd impulse purchase, I don’t see that I’ll ever consume/subscribe to another newspaper. Magazines may be an exception…more on that below.

- Radio – This is something of an odd one in that I do still listen to the radio in the car. And unfortunately, I spend a fair amount of time in the car. But what I listen to has changed dramatically. 20 years ago, I listened to FM radio almost exclusively with music and stupid drive-time shows dominating the content. Now, I listen to XM radio about 10% of the time for either sports or comedy, AM radio about 5% of the time for traffic, and the rest of the time is spent with music from my digital collection. I never listen to FM radio any more. If I’d purchased the realtime traffic adapter for my GPS system, I wouldn’t listen to AM radio period. If I collected comedy clips into my digital music collection, I wouldn’t listen to XM other than enroute to a destination hearing a game broadcast live. Outlook: It’s hard to beat radio for mobile updates on traffic, weather, and sports enroute while driving. But, look out for the 3G devices, they could displace radio from this niche.

- Movie Theaters – What an interesting market, NetFlix killed, and I mean killed, any desire I have to go to the movie theatre. Crowds, noise, cost, hassle, all of that to see the movie on a big screen and pay through the nose for bad snacks? No thank you. 20 years ago, I used to see a movie in a theater at least once per week. Now, it’s pretty much when an interesting children’s movie comes out as an event with my daughter, maybe once every three months. Between digital cable, our DVD collection, YouTube, Google Video, and NetFlix, we have no shortage of interesting content to choose from, all of which is cheaper, more convenient, and available on my schedule, not the theater’s. Outlook: Even the quarterly trip to the movie is at risk, my daughter doesn’t seem to enjoy them as much as when they’re at home. It’s hard to see that aside from an impluse trip to the cinema that I’ll see many more movies there. At home, however, we still consume movies on a regular basis, just on our terms.

- Music media – 20 years ago I was replacing my tapes and albums with compact discs. The music industry was happy as I was paying top dollar to get a physical artifact that contained media, 90% of which I didn’t like. Now, unless I’m sure I like a particular collection of music, I exclusively buy single tracks (without copy protection) from online music vendors. The thing that is interesting about this is, I probably buy as much music now as I did 20 years ago, the money is just transiting a different supply chain. The other difference is, my musical taste has expanded dramatically meaning I search for more obscure artists in genres I like vs. sticking to “known brand name artists” making my spending more diffuse. Outlook: Online distribution, purchase, and management of non-copy protected media has won and there’s no going back. Where possible, I buy directly from the artist online. If not possible, I fall back to an aggregator. It’s hard to see buying another CD ever.

- Television – The CNN article that prompted this entry is right, only is not extreme enough in its analysis. 20 years ago, I watched pretty much the network programming live. I did watch the odd cable channel, but mostly for special event type programming. Now, I haven’t watched network programming (aside from sports events) in at least 5 years. That’s not live network programming, that network programming period. My daughter, to my knowledge, has never seen one minute of network programmed TV. She’s an interesting case in that she expects that programming that she’s interested in is available when she wants it and that boring advertisements can be skipped. When that’s not the experience available, she opts out. Outlook: Grim. Not only have the networks “lost” some of their measurable audience, the digital natives won’t ever become their audience. Think about that for a minute if you’re considering investing in one of these stocks. There is no future. The only exception to this is sports events, I will watch network programming to get those events, I tend to DVR them to skip through the ads. Other than that, it’s movies and specialty programming. In our household, the Cartoon Channel, The Disney Channel, the History Channel, HBO, and Showtime – all timeshifted viewing has completely displaced network programming.

If you’re in traditional media, you should take away two things from this example: Content matters and delivery matters. Consumers (people like me) want quality content, aren’t afraid to pay a little something for it, want it in a portable format, want it on our own schedule, and want it to be convenient. The content providers pushing out quality stuff will migrate to the distribution mechanisms that meet these consumer desires – it’s not a matter of if, it’s a matter of when. Doing silly, counter-productive things like suing your customers and your new media distributors may temporarily stem the tide, but ultimately are doomed to failure. People will simply omit you from the supply chain. That’s what’s happening with the mediums described in the examples above. The trends are not a large mystery.

Two exceptions in the traditional media world I’d like to touch on are magazines and books. For whatever reason, I haven’t entirely displaced either of these content delivery vehicles. I think it comes down to content and depth in both cases. I have little desire to attempt to read a 1,000 page book on my computer screen. It just doesn’t work, you can’t really curl up with a computer screen as yet on the book side. On magazines, I think they’ve now migrated toward a depth of coverage that isn’t common in the news. So rather than competing with online media from a freshness perspective, they’re working quality and depth that aren’t seen as regularly in the online outlets, yet. It will be worthwhile to see in 20 years if magazines and books are displaced the way other traditional media and mediums have been displaced to date.

What’s your experience? Do you still watch network programming? Go to the movies? Listen to the radio? Buy newspapers? Buy physical CDs? How has your media consumption changed over time? Leave a comment if you’d like to share.

MSU’s RB, Javon Ringer

It’s Wednesday again, that must mean it’s time for the weekly game preview, this time between the Michigan State Spartans and the Ohio State Buckeyes at Ohio Stadium, 12:30 PT on Saturday, October 20th. As usual, Bucknuts has a good game data article available for this game.

The Spartans and Buckeyes have a long history of competitive play with MSU ruining OSU’s chances to play for the national championship in 1998, attempting to derail their hopes in 2006, and coming for the rubber game this weekend. What’s different? The attitude and the coaching staff. Former Ohio State defensive coordinator Mark Dantonio is now the head coach at MSU (notice what’s happening with his former University of Cincinnati team? It’s not an accident.) If this game were played two years from now, I would be really, really worried. But the reality is, these players are still learning Dantonio’s system and still seem to be affected by incomprehensible lapses in concentration and focus that defined the John L. Smith era.

Michigan State is a powerful offensive team, the average 37 points, 243 yards rushing and 224 yards passing per game. They have a big, strong offensive line and skilled ball handlers in RBs Javon Ringer and Jehuu Caulcrick. QB Brian Hoyer is efficient and the receivers and tightends are above average. After a tough loss to Wisconsin, 37-34 and a heart-breaking hangover loss to Northwestern in overtime, 48-41, the Spartans bounced back with a strong performance on the road thumping Indiana 52-27 to enter this contest with a respectable 5-2 record.

As you can see from these numbers, offense isn’t the challenge with MSU, it’s the defense. Which defense will show up? The one that surrendered 48 points to Northwestern? Or the one that held Pittsburgh to 13? Despite the Jeckyl and Hyde nature of this defense, it does sport one national star in defensive end Jonal Saint-Dic who has amassed 8 sacks and 11 tackles for loss on the season. Point totals surrendered thus far, 174 through 7 games, or nearly 25 points per game.

Ohio State conversely has averaged nearly 36 on offense and given up nearly 7 points per game on defense this season. If you split the difference between the teams averages you’d get a score of Ohio State 30, Michigan State 22. That’s not an unbelievable score as MSU will get some rushing yards and will score some points. The wild card here is turnovers and penalties. I have to give OSU the edge in those phases of the game. If MSU manages to win the turnover battle and OSU has stupid penalties, either stopping their own or prolonging the Spartan’s drives, it’s going to be a close game. If the turnover game is even and we see a typical Tressel-field position game, Ohio State will win comfortably.

What’s going to happen? We’re going to see a physical slugfest between two similar sized teams. But in the end, superior talent, mental toughness, and execution will create a separation in the second half leading to a 34-16 Ohio State win. As usual, we’ll check back on this after the game to see just how wrong this preview was. Enjoy the game and GO BUCKS!

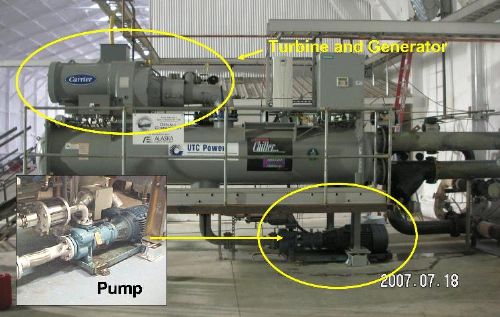

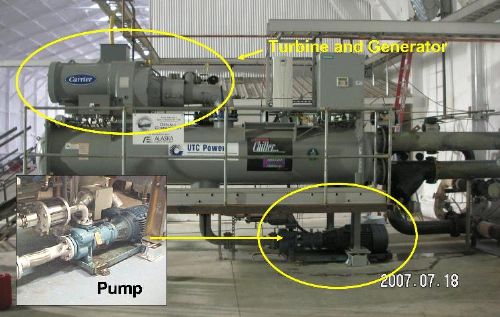

At the GRC Annual Meeting earlier this month, the Chena Hot Springs project was discussed again. Chena is in central Alaska, about 65 miles northeast of Fairbanks and is home to

a resort as well as a

400kw geothermal plant. At heart, the Chena geothermal power plant is no different than any other binary geothermal power plant. But in detail, there are some interesting aspects of the project that make it worthy of note:

- Low resource temperature – The production temperature from the wells at Chena is 165F (74C). Production from this low temperature is possible because of the ample supply of 40F (4C) cooling water that enables a consistent 120+F (49+C) difference in temperature at the harvest point. Location, location, and location matter in this instance.

- Commercial chiller harvest – Chena elected to go with a commercial, off-the-shelf power conversion unit from UTC. These 280kw gross, 225kw net units are relatively cheap and are essentially industrial chillers being run in reverse. UTC has been producing these units for decades, their performance characteristics and failure modes are well known and understood. This is a departure from the Ormat approach which is to fit a custom harvest system to the resource which makes implementation much cheaper and faster.

- Shallow resource depth – The production and injection wells at Chena aren’t very deep by conventional geothermal harvest standards. This reduces the cost and complexity of implementing the systems. The wells at Chena range from 100 to 1000 feet (30-300m) deep.

- Time to production – Unlike most geothermal projects at utility scale, this project was implemented in less than a year real time, and less than 2 years elapsed time (due to the seasons – it’s tough to work in -40F weather.) The world land speed record for other plants appears to be 5 years elapsed time.

- Government sponsorship – The US Department of Energy and the State of Alaska worked with the project to support exploration, drilling, and development activities. This is not always the case, but in this instance, the public/private partnership seemed to work.

Before the geothermal power plant went live, Chena’s power was provided by diesel generators at a cost of around $0.30/kwh. Now, the cost has dropped to $0.07/kwh and the resort has less ambient noise and particulate matter in the near vicinity because the diesels aren’t running. That’s a real economic benefit coupled with a synergistic effect that is beneficial to the primary business of the resort, a clean, quiet environment. Not every project can be like this, but one has to wonder how many other small scale geothermal systems could be tapped and harvested. Over the lifetime of the plant (if it’s running at full capacity of 400kw for 30 years), the economic benefit just in difference of cost/kwh will be on the order of $23.7M – impressive.

« Previous Entries

» Next Entries