Archive for February, 2008

Real Data on CFL Replacement

People are making all sorts of claims about energy efficient lighting, and we’re on that bandwagon too. Having systematically inventoried, evaluated, and replaced incandescent lighting with compact fluorescent lamps in June, 2007. In fact, one of the most popular entries ever to appear in this journal was titled “Want to get $3,500?” which talks about the inventory, method, and expected savings of replacing standard lighting with energy efficient lighting. With seven months of data available, I thought it was time to check expectations with reality.

Here are the headlines:

- Total kwH saved: 920

- Total $ saved (electricity bill): $299.18

- Total lightbulb burnout replacement $ avoided: $42.00

- Equivalent tree impact: 48 trees planted

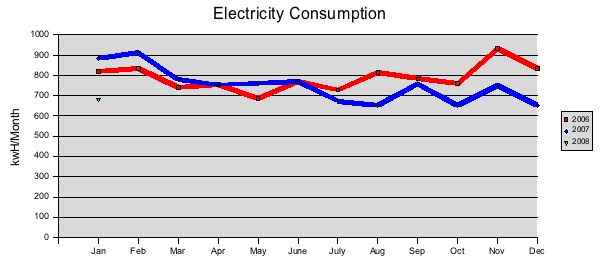

In seven months, we’ve recovered the “real $” investment in replacement lamps just with the savings in the monthly utility bill and lack of bulb replacement from burn outs. It was a great theory in June, it’s even better seeing it in reality in February. The chart below shows the actual electricity consumption change over time. We’ve got data from January of 2006 (so a full year of incandescent bulbs) and the first 6 months of 2007. The bulbs were replaced in the third week of June, 2007.

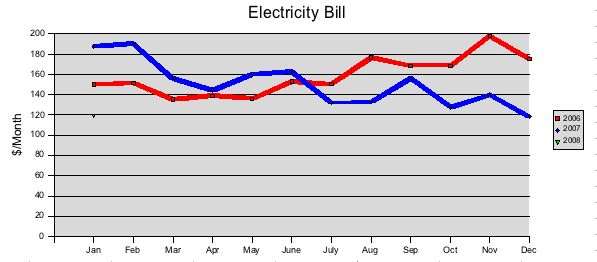

Now kwH reduction is interesting, but absolute cost reduction is king. Sure, we all want to to things that help the planet, but when you can combine that with a real measurable economic impact, that’s even better! The actual electricity charges are listed below for the same time period. One might notice that September was a funky month, it’s due to a large-scale data storage test that was conducted in this location and it almost accounted for the entire months savings. It’s easy to affect these numbers with activities like that.

One important thing to note about the cost savings on the monthly electrical bill, PG&E penalizes consumers rather stiffly for what it considers to be excessive use of power. Meaning the rates graduate from the base consumption of around $0.11/kwH to $0.32/kwH as the top tier rate. The lighting change is displacing kwH charged at the higher rate in our case, so if you choose to do this, make sure you understand how much you’re paying per kwH because it will affect your results.

Three other items of note: before the CFL bulbs, we were replacing about 1.5 incandescent lightbulbs per month (~$4 cost for the bulbs that would blow) – we’ve had zero replacements thus far in the CFL era. We haven’t had a break or replace situation, so cleanup and recycling hasn’t become an issue yet, this is still harder than it needs to be as we’ve had to dig to find places that will accept these bulbs post-use. It’s important to handle them properly as there is a small amount of mercury in the bulbs (with over 80 installed, it’s still far less than the amount of mercury in old of the old, small thermometers to put the risk in perspective.)

Finally, we have had one adjustment with respect to lighting, the 20 second or so “warm up” period. When the bulb is switched on, it goes to about 70% of illumination. Within 20 seconds, it’s up to 100%. At first, this is a little disconcerting, but it’s not noticed any more. The quality of the light is equivalent or better than the incandescent bulbs – it’s warm and full spectrum (choose your CFL’s carefully, we prefer the Philips brand for light quality and warmth.)

Convinced to make the switch yet? If you do, please leave a comment to let us know how it went. More data is better.

1 comment

Infinia scores some Green

Stirling engine manufacturer Infinia closed a $50M series B investment with a veritable who’s who of funders including: Vinod Khosla’s Khosla Ventures, Bill Gross’ Idealab and Paul Allen’s Vulcan Capital. The firm intends to use the funding to accelerate the productization of their stirling engines attached to generators for use in large scale solar thermal installations.

So what is a stirling engine anyway? It’s a loose piston setup that works on temperature differential between the two sides of the piston. Just like a regular piston engine, that reciprocating stroke can be transformed into rotation with torque. The novel approach in this case is to concentrate the sun’s heat and use that to generate the heat differential required to make the engine run. These engines have been around since the early 1800’s when Robert Stirling advanced the concept. See the illustration to the right from the Infinia website.

Each unit is rated at just over 3kw AC and are projected to list at around $20,000 per unit. It is believed that standard automotive parts manufacturing techniques can be used to fabricate the Infinia units. Operational costs associated with the units is believed to be low as stirling engines are low friction devices with relatively few moving parts and very loose tolerances used in design and assembly. As with all technologies, the cost should come down as the volume goes up.

Comments are off for this post

The Vulcan Vision

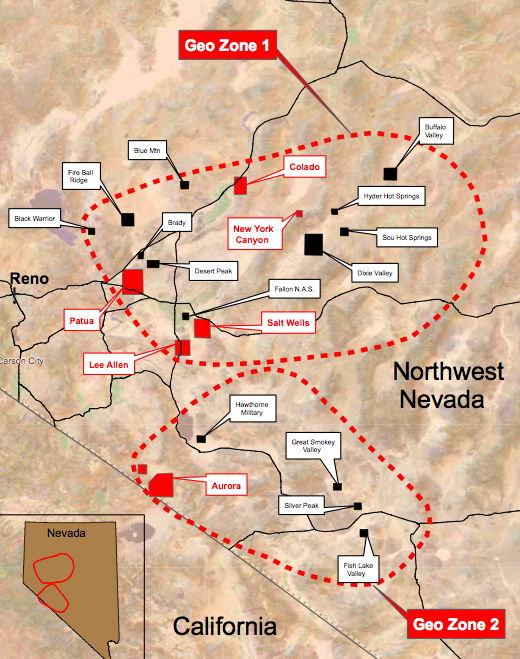

Vulcan Geothermal company has put forth its vision for a “green gigawatt” by tapping into the rich geothermal resource of the Basin and Range province largely located in north and central Nevada. What makes this different than any other approach? They’ve done a great job of characterizing resources across the range with most likely outputs, not only of their portfolio of geothermal prospects, but across the region. They’ve also taken the time to include other renewable sources like wind and solar thermal when considering transmission upgrades.

We applaud the bold vision that Vulcan has articulated at the G3 Plan site and look forward to seeing this vision moved toward reality as the multitude of developers with prospects in this general area work to bring their respective plans to fruition. Note to the Vulcan staff, it would be a good idea to have your website work with industry standard browsers like Firefox, this Internet Explorer only stuff is bush league, your vision deserves an open access professional touch. It might be worth a small investment to make that so…

Comments are off for this post

Corn Ethanol Economics

The Oil Drum did a great analysis of the economics of ethanol derived from corn as the feedstock yesterday. Read the article, it’s very well done. I’ll steal the punch line, on average at present ethanol prices (production and sale) there is a 7% margin on the product. That’s right, 7%. It’s awfully tough to make a living on 7% unless you’re moving massive volumes.

Does this mean ethanol is dead? No, not at all for a few reasons. First, the prices for ethanol sale move as do the corn feedstock prices. At $5/bushel of corn, that means the feedstock price for ethanol is $1.30/gallon (net of the $0.55/gal recovery from the resale of distillation byproducts.) In a certain sense, corn ethanol’s challenges today are a direct result of its early success – the more demand there is for the feedstock, the higher the price goes, corn has doubled in price the past couple of years.

Second, even with the current tough economics, the money spent in the production and consumption of ethanol is staying in the US vs. being shipped to OPEC countries, this is a net positive and it seems likely that government regulations will favor domestic ethanol production in upcoming energy policy decisions.

Finally, technology associated with alternate feedstocks, (i.e., cellulosic ethanol) is advancing at a pretty fast clip. When the science is able to be applied at scale against a feedstock like switchgrass where there is no competing food demand, the feedstock price should go down dramatically and perform more predictably (although there will be a premium paid in higher capital costs to build these plants it appears.)

It’s clear given the situation in Brazil that ethanol economics can work at scale, but the right approach must be employed. The biofuel market may be in a trough, but it’s likely a temporary situation.

Calpine Emerges

Earlier this week, Calpine emerged from bankruptcy protection after a prolonged struggle that saw multiple delays. The issue is now trading on the NYSE under symbol CPN-WI. The new issue will have 423 million shares outstanding meaning the market capitalization of the company at today’s values is nearly $7B. We’ve been a bit skeptical that Calpine could emerge, but have been proved wrong as they are now back in business and moving forward.

Let’s hope that the generator can stay in business and invests in the geothermal portion of its portfolio, after all, there are no ongoing fuel costs!