Archive for the 'Solar' Category

$1 per watt solar

Photo Credit: Nanosolar Blog

Last week, much ink (pun intended) was spilled regarding Nanosolar’s announcements regarding their new printed solar cell technology. The first 3 panels were presented one to stay at company HQ, one to the San Jose tech museum, and one to be auctioned by eBay (not!, read the blog on that story…)

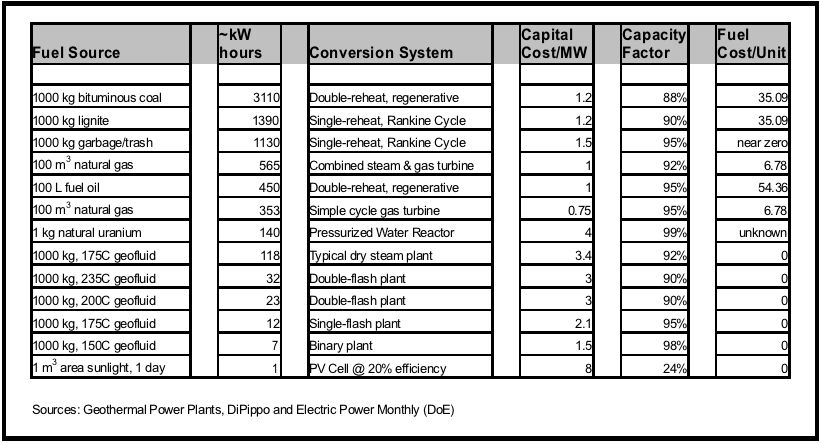

We’ve been a bit bearish on photovoltaic solar for two primary reasons: cost and capacity. If the breakthroughs claimed by Nanosolar prove out in practice (there is precious little technical information available about the printed solar cells performance) then it’s possible the cost aspect of our bearish outlook has been cracked. The pricing places these panels in the capital cost class of plain coal (as opposed to “clean coal”) and natural gas fired technologies. That is significant.

The capacity aspect is still problematic, here in North America around 40 degrees north, one can expect an average capacity factor in a good solar location to come out at 24%; peaking at ~36% in the summer and bottoming out at ~12% in the winter. When looking at solar relative to fossil fuels, hydro, nuclear, and geothermal, all baseload technologies, this aspect is still a barrier. However, at the new price point, the major advantage solar pv has is in small, distributed installations which are impractical for the baseload technologies and that advantage can now be maximized.

The missing link is the technical details. State-of-the-art pv loses around 1% efficiency per year of use, is that true of Nanosolar? What is the conversion efficiency? Silicon-based pv cells have gone north of 40% in the lab and are commercially available around ~20%. Thin film cells check in around 10%. Based on what has been disclosed about the technology it’s likely to be closer to thin film than silicon in efficiency. Until these details become clear and the breakthrough can be judged publicly against known technology, it’s exciting potential. We’ll be anxiously waiting to see the details.

Instructive Chart

If ever you wanted to understand why the industry continues to develop coal plants, even though the negative impact is clear for all to understand, look at the chart above. You’ll notice that coal produces the most energy per unit, at a low cost per unit, and is relatively cheap from a capital cost perspective to build. With clean coal restrictions, the capital cost increases pretty radically (about 3x) but the energy output per unit and fuel cost still remain attractive.

A wind row ought to be added to this chart, but the standard unit was a little tricky to calculate. If anyone has good ideas about how to represent that aspect, please leave a comment. Comments are off for this post

Multi-dimensional harvest experiment

Northern California Power Agency (NCPA) and SPG Solar, announced that they will together to build a 1 megawatt (MW) single-axis solar tracking system that will provide renewable energy to an existing pump station that supplies the NCPA Geysers Geothermal Energy Plant.

The array will be used to collect solar power to pump wastewater into the geysers, which is in turn used to generate geothermal power. The photovoltaic array will start generating clean renewable power beginning in September 2008.

The $8.2 million installation consists of 6,300 solar modules that will produce 2.2 million kilowatt hours of electricity annually. The solar plant will supplant PG&E-provided grid power that had been powering the pumps.

NCPA operates two geothermal plants at the Geysers producing approximately 132MW gross, and 120MW net of electricity. In the late 1990’s, in an attempt to regain pressure in the rapidly declining Geysers field, NCPA and other operators at the Geysers entered into an agreement with Lake County to reclaim the treated waste water, pipe it to the Geysers, and reinject it into the reservoir. This is necessary because nearly 70% of the mass extracted from the reservoir is released into the atmosphere during operations of the power plants and natural recharge was not matching the pace of extraction.

The good news is this scheme to replace mined mass has worked; so much so, that Calpine followed suit and created a similar agreement with Santa Rosa. The bad news is, it takes power to move the millions of gallons of water from Lake County to the injection wells. The pipeline is about 30 miles (50 km) and gains nearly 2,000 feet (600 m) in elevation over the course of its run. The load to run the pipeline operations is about 8MW, or two-thirds of the parasitic load borne by the NCPA plants.

So, in practical terms, the application of solar energy to power some of the pumping operations should be characterized as an experiment in multi-dimensional harvest. The other opportunities NCPA and the other Geysers operators have (given the location and transmission infrastructure) are straight-forward bottom cycling using the new generation units from UTC power further harvesting heat from the steam exhaust from the turbines and wind turbine installation. This is the approach Montara Energy Ventures is taking with its Sou Hills Prospect.

Geothermal: Stealth Renewable

Have you ever wondered why geothermal goes so incognito when the renewable electricity market is so visible? There could be a number of reasons, but we believe it has to do with accessibility to the public and ease of identifying resources.

Photo Credit The Pennine Way

When a lay-person sees the tree above, they can easily posit that wind contributed to the unique shape of the tree. And, since we know generally how trees grow, it’s easy to deduce that there is strong, consistent wind current present in that area. Thus, when people think about wind as a renewable resource, it’s accessible. There is no magic: wind exists and like a child’s pinwheel, it can cause things to move which is sufficient to make the connection.

Photo Credit The Safari Company

When a lay-person sees the photo above, they can reason that it is dry and that it’s likely that the sun shines there on a routine basis and rain/cloud cover aren’t the norm for the region. The connection between a strong sun presence and the potential for energy is very clear to humans, it’s accessible.

Photo Credit: UNR

Now contrast the image above with the tree and desert. What do you observe about the physical characteristics of this land? Does it look like this might be a place one could harness natural resources to generate renewable electricity? This photo happens to be from Nevada’s Dixie Valley, a known geothermal resource area. There is a functioning 60MW geothermal plant in close proximity. The only surface manifestations of the energy potential are hot springs. It’s much less accessible to a lay-person thinking about hot, fractured rocks with super-critical heated water trapped under a cap rock waiting to escape. Can you visualize it? Unless you’ve been around the industry or have a geology background, the chances are that it’s tough to comprehend.

The journal Live Science took a page from VH1’s “Where are they now?” publishing an article on “Whatever happened to Geothermal?” It’s an interesting article and covers many of the issues. Given that geothermal is the only baseload renewable power source (yes gravity hydro is close, but until droughts are solved, it’s not quite baseload) it seems inevitable that geothermal will be “rediscovered” as an energy source. 4 comments

Impressive Cleantech Business

Generally, other than solar thermal, we have been less than impressed with the “businesses” in the solar (pv/thin film) segment. The products are expensive, the business models opportunistic, and the conversation revolves around which technology is best while other harvest methods leave the segment in the dust. It looks like a bubble, smells like a bubble, and ultimately will be proven to be a bubble.

As with every bubble, there are likely to be a few winners and many losers over the long term. Despite our distaste for the segment, it will over the long-term prosper we believe which means that identifying those likely winners to emerge from the down-cycle of the bubble when it pops is important. While at the Renewable Energy Finance Forum in New York last summer, we believed that we identified one of those companies, First Solar. Lately, the company has been on a tear: currently trading at 10x their January, 2007 IPO price, 3rd quarter revenue tripled Y/Y, and 3rd quarter earnings are up 10.7x Y/Y. The company’s market capitalization now stands at $14.5B and the shares trade at a P/E ratio of 216 trailing twelve months. It’s clear the market has discovered First Solar.

That’s all great information, First Solar is clearly benefiting from stellar performance and also the meta market conditions, why is it a long-term winner? Mike Ahern, the CEO for First Solar won us over with his clarity of vision, simple plan, and aligning the fundamental metrics of execution with compensation. Notice, we said nothing about technology – it is adequate to achieve their aims and future breakthroughs can be applied to the business First Solar is building. The vision is clear: Profitably make commercial concerns energy independent using First Solar products. The market is clear, target commercial entities with access to solar resource where a payback is possible. The execution plan revolves around reducing the price of First Solar’s products by increasing volume and refining the process with specific improvement targets over time. Hint: They’ve already reduced their cost of manufacturing 3x.

Shifting a bit to technology only to highlight a business process, First Solar uses 2’x4′ glass panels coated with a thin chemical film (cadmium-telluride or CdTe) to create their product. They’ve invented a continuous process that enables a single panel to be produced in a 2 hour window as it traverses the manufacturing process. They fully understand the throughput and are continuously monitoring and refining the manufacturing process. In order to produce more product, they start new lines and/or establish new facilities (like Germany and an upcoming Asian location.)

Back to business, Ahern stated that the company executives and staff have goals and are compensated on three key metrics: revenue growth rate, product cost reduction rate, and product volume. The goals and the company’s execution against them to date coupled with pursuing a focused market strategy lead us to believe that First Solar is likely to be a winner in the long-term (though perhaps not at this market capitalization) and will be in a position to lead a consolidation in the solar space when the bubble bursts.

Disclosure: The author maintains a long position in First Solar shares.