Joint Venture of Silicon Valley publishes an annual report attempting to provide a holistic view of life and opportunity in the valley. To their credit, I’ve not seen a more complete view than what they’ve published – tip of the hat to Kevin for passing this along. The report for 2006 is available here. The report covers people, economy, society, place, and governance in the valley and is assembled by a diverse group of private and public agencies.

The general report is interesting enough, but I found a section on investment in clean tech to be very telling. Overall venture investment in the valley Quarters 1-3 in 2005 (Q4 2006 not yet available, so this will be a 3 quarter comparison) was $4.6B. The same period in 2006 saw the total rise to $5.2B, a healthy 13% increase year over year.

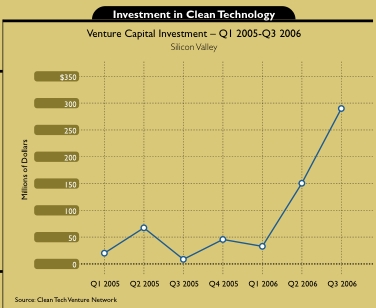

When we break out the clean tech segment, it’s even more interesting. Check the chart below:

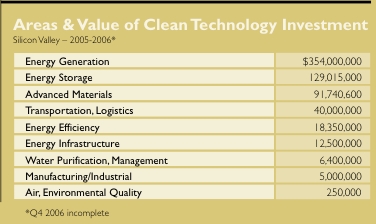

As you can see the 2005 Q1-3 total investment was on the order of $95M compared with $480M in the same period for 2006. A 505% increase year over year. Perhaps even more importantly, the total share of clean tech in the overall venture picture increased from 2% in 2005 to 9% in 2006. The chart below gives a breakout of the general areas of investment in clean tech and the dollar amount in each category:

It’s clear that we’re starting to see a shift in the way people are thinking about “green” from something that “is good for the planet” to something that “is good business.” And that’s exactly the shift that needs to happen, until these technologies and their attendant environmental benefits are profitable, we won’t see the magnitudes of change required to make a difference. However, venture capitalists as a rule seek out places their money can work at multiples, it’s encouraging to see the expectation of returns in this segment.

If you liked this entry, Digg It!

Tune: Laissez Faire by Bruce Daigrepont

Technorati Tags: Energy | Investment | Clean Tech | Mike Harding Blog

Business, Energy

Clean tech investments increase 500%

Commentary

Sushi fattening?

Like many people at the beginning of the year, I find myself on a diet. I’ve been doing pretty well this year shedding nearly 15 lbs (6.8 kg) thus far. Unfortunately, I’ve still got some work to do in that front. As a consequence, I’ve been watching what I eat and how it affects weight loss.

I’ve always believed that sushi is a pretty healthy meal, not much “bad” fat, one tends to feel a little hungry not long after the meal. But, I was shocked to discover the actual kcal in each morsel. Just in case you’re interested, here’s a listing of some sushi favorites with associated kcal:

- Nigiri Ebi (Shrimp 2 pcs.) – 72 kcal

- Nigiri Maguro (Tuna 2 pcs.) – 90 kcal

- Nigiri Sake (Salmon 2 pcs.) – 120 kcal

- Nigiri Hamachi (Yellowtail 2 pcs.) – 120 kcal

- Nigiri Hirami (Flounder 2 pcs.) – 78 kcal

- Nigiri Ika (Squid 2 pcs.) – 78 kcal

- Nigiri Kani (Crab 2 pcs.) – 90 kcal

- Nigiri Saba (Mackerel 2 pcs.) – 120 kcal

- Nigiri Unagi (Eel 2 pcs.) – 125 kcal

- Nigiri Tako (Octopus 2 pcs.) – 76 kcal (and who knows how many kcal are burned chewing it!)

- Kappa Maki (Cucumber roll 6 pcs) – 105 kcal

- Tekka Maki (Tuna roll 6 pcs) – 145 kcal

Individually, none of these are going to kill you. But if you order too many at one time (read, Mike last night at dinner) you’re sure to pay for it at the scale the next day. This doesn’t factor the ginger, soy sauce, and wasabi nor the impact of any adult beverages. No doubt, sushi tastes wonderful and is a good meal. But like anything else, it needs to be eaten in moderation (note to self: go easy on the nigiri next time.)

Want to eat at home? Copy Cat Cookbook has your favorite restaurant’s recipes.

If you liked this entry, Digg It!

Tune: Chain of Fools by Aretha Franklin

Technorati Tags: Sushi | Caloric Content | Weight Loss | Mike Harding Blog

Business, Innovation

Carbon Prize: Talk about putting your money where your mouth is…

Richard Branson today announced a $25M prize for the first viable means of “scrubbing the atmosphere of billions of tons of carbon gases from the atmosphere.”

It’s a big challenge, sort of the same spirit of the Ansari X Prize that gave $10M to the first non-government organization to reach space with manned flights twice within two weeks.

If you liked this entry, Digg It!

Tune: Like the 309 by Johnny Cash

Technorati Tags: Carbon Prize | 25 Million | Atmosphere Scrubber | Mike Harding Blog

Business, Energy

Deep sea geothermal?

Ormat Technologies (ORA) was granted an 11,000 acre geothermal lease off the coast of Texas. This is significant in it represents the first such lease in Texas, home of petroleum.

One has to wonder about the feasibility of tapping into such a resource in that area. By all indications it is a DEEP resource we’re talking about that will be technically difficult to tap – think ocean drilling rig expensive. We’ll watch development of this resource with interest. Thanks to Jim for passing this along yesterday.

If you liked this entry, Digg It!

Tune: Splish Splash by Bobby Darin

Technorati Tags: Energy | Geothermal | Texas | Mike Harding Blog

Business, Commentary

Lose $2M, gain your life

Yesterday, I had the chance to meet with an experienced Silicon Valley investor (who’s name will remain confidential.) We had a chat about an opportunity in the green energy space that was very productive. But the part of the conversation that really struck me and stuck with me, was the investor’s personal story of survival with cancer.

Not long ago, the investor was diagnosed with a particularly lethal type of cancer and medical professionals advised the investor to prepare personal effects, the investor would be dead in the not distant future. The investor initially bought into the diagnosis even while conferring with other medical professionals. However, the investor realized at some point that the medical profession were like “buggy whip manufacturers in 1905.” These folks would lovingly hand craft you the finest buggy whip ever made, but were ignoring the automobile revolution entirely.

This investor had made a $2M investment that didn’t pan out in a company sometime prior to all of this and in the process made some contacts with a physician that was working on new treatments for this disease with some success. The investor used the contacts and chose to undertake the new treatment which has resulted in a positive outcome. The combination of contacts and attitude made the difference between life and death for this person. It was an incredible story that I was grateful to be able to hear.

While losing $2M would be devestating to an overwhelming number of people, it’s well worth the price if your life is held in the balance. There is somehow a pleasing symmetry to this story about risk, reward, personal networks, and attitude. While raising funds for ventures can be a very stressful activity, it also has great ancilliary benefits in terms of contacts made and stories shared, like this one.

If you liked this entry, Digg It!

Tune: Don’t Fence Me In by Buck Howdy

Technorati Tags: Funding | Cancer | Survival | Mike Harding Blog

« Previous Entries

» Next Entries