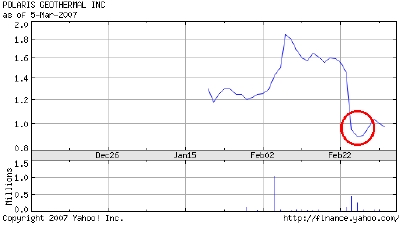

A picture is worth 1,000 words. In one day, Polaris Geothermal saw their market capitalization cut by more than 50%. Why? Because the government of Nicaragua is questioning the validity of their concession in the country. The company’s Nicaraguan subsidiary, PENSA, is already operating at 10MW facility in Jacinta and is actively pursuing plans to expand to 66MW over the next two years.

True or not, the action by the government has had a big impact on the company. If the concession claim is upheld, expect a big uptick in this issue. If not, I would expect further decline even with the bad news already reflected in the share price.

If you liked this entry, Digg It!

Tune: Tell Me Why by Los Lonely Boys

Technorati Tags: Energy | Geothermal | Stock | Mike Harding Blog

« Sierra Geothermal raising more cash

» Satire: The Apple iLaunch

Business, Energy

Bad news for Polaris Geothermal

03.06.07 | 2 Comments

2 Comments

« Sierra Geothermal raising more cash

» Satire: The Apple iLaunch

Obviously the threat to expropriate Polaris’ single asset is rather scary.

Notable is that Polaris is not the only one to receive such a notice. Ormat also received the same kind of notice but did not share the news with its shareholders. Of course Ormat has many other properties, is insured against expropriation and would not be devastated by loss of its Momotombo geothermal power plant. Ormat restored the productivity of the Momotombo plant after the geothermal resource had been misused for years by not replenishing the water extracted from the aquifer.

According to one poster, the real target was the Spanish company buying power from Polaris and others.

In any case Nicaragua would be doing terrific harm to itself by expropriating Polaris’ assets. Development of Nicaragua’s geothermal resources promises to make Nicaragua energy independent with the greenest of all alternative energies. Hardly impossible politicians would do such a thing but not terribly likely I think.

JMO.

Best, Terry

Polaris operates a third worls class facility. I perceive Polaris operation in Nicaragua as a method to increase market value in their stock, then he big share holders will cash it and run. The plant is very poorly done and do not show a potential. The company as an organization should be analyze very carefully.