Wherever you are and whatever you’re doing, I wish you happy thanksgiving and a turkey with no tan lines!

Each year, I take a moment to think about what I’m thankful for. Here’s a partial list: family, friends, dogs, technology, civil rights, business opportunities, the California coast, food, health, freedom of movement, economic choice, innovation, reason, great books and music.

Whatever you’re thankful for, make sure you appreciate it now. Have a great day.

Chart of Calpine’s Six Month Stock Price

Back in June when

Calpine unveiled their plan to emerge from bankruptcy, we weren’t too positive. In fact,

we were downright puzzled by the market reaction sending the stock over $3/share and market capitalization greater than $1.5B. The issue has been on a steady downswing since that time settling in around $1.20/share, around $600M in market cap. Yesterday the bottom dropped out when

the company announced a reduction in their enterprise value by $900M. The stock’s valuation now stands around $240M and closed yesterday at $0.495/share.

We wonder if it might not be a sensible thing for

Calpine to spinoff its geothermal unit into a separate entity and let the natural gas portion of its portfolio sort itself out with the mother company. With the current market for renewable energy running very hot, this could create a pure play competitor to Ormat with 2x the generation capacity (Ormat is producing about $200M/year from ~375MW – Calpine has 800MW, that should produce around $425M in revenue per year…)

At current valuation and with the geothermal assets, we see

Calpine as an interesting speculative buy. Caveat Emptor.

Disclosure: The author holds no position in Calpine stock. The author is considering a speculative, long-term position in the company.

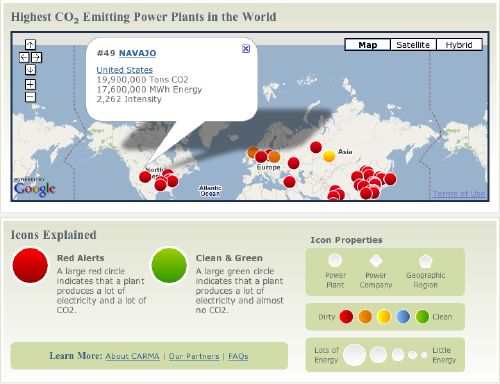

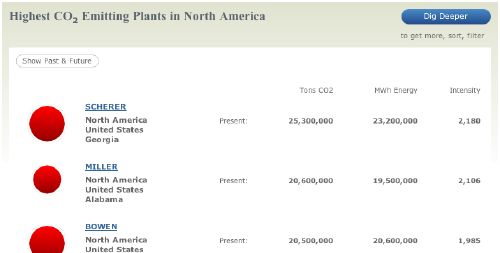

A few days ago the link for Carbon Monitoring for Action (CARMA) was forwarded along to us. This is a mashup of the global electric power plant database on a map with visual representation of the size of the plant, intensity, and carbon contribution plotted on the map, globally, by continent, by country, by region/state, etc. Take a look at a screen shot below:

CARMA Screenshot

As you can see, the top 50 carbon emitters are plotted at a global level and #49 Navajo Power Plant is selected showing it produces 17.6 GWh of power along with 19.9 M tons of CO

2 emissions per year. One of the more interesting things they track is intensity, or pounds of CO

2 emitted per megawatt-hour of electricity produced.

The data in CARMA are compiled from numerous sources. Emissions data for thousands of power plants in the U.S., Canada, the EU, and India come from official reports. Other data are derived from information provided by power sector analysts, the International Energy Agency, the U.S. Department of Energy, the Environmental Protection Agency, and a host of geographic databases. So while it might not be 100% accurate, it’s credible and trackable and certainly better than what existed before.

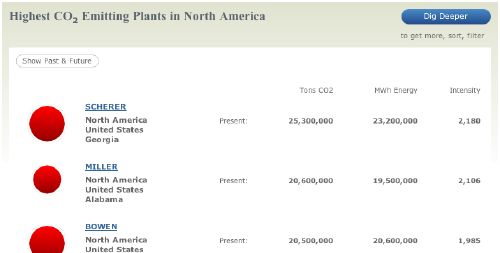

Zoom in on US Plant details

The aggregations and zooming are very useful and it enables a researcher to determine not only the largest contributors to CO

2 emissions, but also the most intense (or least efficient) as well as the lowest producers and most efficient power plants. One thing that may be surprising to people is that the largest electric power plants on the planet are also among the lowest CO

2 emitters – gravity hyrdo-generation facilities. For instance, the largest plant on the planet is ITAIPU in Brazil, an 8 GW hydo facility producing over 63 GWh of power per year and zero CO

2. In fact, of the 15 largest power plants globally (4 GW and over) – ten are zero CO

2 emission.

If you’re interested in knowing more about power plants, their emissions, and impact, we encourage you to

visit CARMA.

I love photos like these. This particular image is from the

High Speed projects by Andrew Davidhazy. There are some other great photos on their site. One of the most interesting of these sorts of collections I’ve seen is at the

Exploratorium in San Francisco.

As has been widely reported all season, Lloyd Carr made it official today retiring after 13 seasons and 121 wins, 5 Big 10 Championships, and one national title as the University of Michigan head football coach. It’s with mixed feelings that, I a Buckeye fan, say goodbye to Coach Carr. He owned John Cooper in the rivalry and it seemed that Tressel reversed the situation. It’s in the conference’s best interest (and the rivalry’s best interest) to have a strong Michigan football team year in and year out – so I wish them well in every game except against the Buckeyes.

Good luck in retirement Coach Carr; you’ve consistently produced at a high-level during your tenure.

Athletic Director Martin, I hope you do pursue a high profile, big money coach because that would make a good story. But if you’re smart, you’ll pursue a coach with a winning tradition, with or without a name, who can restore Michigan’s program to it’s rightful Top 10 position in the universe.