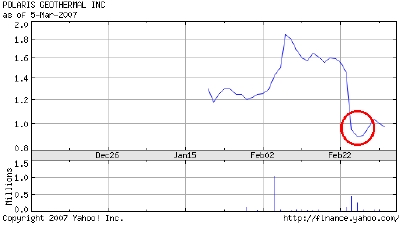

A picture is worth 1,000 words. In one day, Polaris Geothermal saw their market capitalization cut by more than 50%. Why? Because the government of Nicaragua is questioning the validity of their concession in the country. The company’s Nicaraguan subsidiary, PENSA, is already operating at 10MW facility in Jacinta and is actively pursuing plans to expand to 66MW over the next two years.

True or not, the action by the government has had a big impact on the company. If the concession claim is upheld, expect a big uptick in this issue. If not, I would expect further decline even with the bad news already reflected in the share price.

If you liked this entry, Digg It!

Tune: Tell Me Why by Los Lonely Boys

Technorati Tags: Energy | Geothermal | Stock | Mike Harding Blog

Business, Energy

Bad news for Polaris Geothermal

Energy

Sierra Geothermal raising more cash

Through a private placement, Sierra Geothermal is selling 20,000,000 units (a unit is a share and a warrant to buy another share at a fixed price) for C$0.50 per unit yielding C$10,000,000. Net of the 8% fee charged by Jacob & Company Securities Inc. to raise the cash, Sierra should end up with just over $9M to help with projects like Reese River in Nevada.

If you liked this entry, Digg It!

Tune: Boll Weevil by The Presidents of the United States of America

Technorati Tags: Energy | Geothermal | Financing | Mike Harding Blog

Humor

Random musing of the day

If you’re playing Black Jack with basic strategy and the dealer has a 5 showing, the dealer has a 42.89% chance of busting. This has been a community service announcement.

If you liked this entry, Digg It!

Tune: Bad Businessman by Squirrel Nut Zippers

Technorati Tags: Blackjack | Odds | Dealer Bust | Mike Harding Blog

Business, Energy

Ormat shares take a beating

Geothermal equipment maker and electricity producer Ormat (ORA) announced 4th quarter and 2006 full year results. Based on the run up of the stock in the early week, investors were expecting big things from this report. On Tuesday Ormat was trading at a near 52 week high of $44 per share sporting a market capitalization of $1.5B.

After results were announced Wednesday morning, shares dipped into the $37 a share range shaving market cap to $1.3B. Friday, a modest rally ensued on an upgrade from HSBC securities sending shares back to the $39 range, pretty much where the shares have been trading for the last year. Interestingly, enterprise value for the company is pegged at $1.8B so even at $44 per share, the issue was trading at a discount of $6 per share from enterprise value.

Let’s take a look at the earnings to see what we can uncover about Ormat. For the 4th quarter, the company recorded revenue of $66.7M, up from $58.8 million a year ago. Net income was $4.2M up from a loss of $5.1M a year ago, that’s a $0.28 per share swing year over year. For the year, revenues were $268.9M up from $238M a year ago and net income was $34.4M up from $15.2M a year ago. The board of directors declared a $0.07 per share dividend as well. That’s pretty impressive performance, so why did the shares get hammered?

I think it comes back to two issues: debt levels and strategy implementation. The debt is pretty straight forward, Ormat has taken on $500M in debt to finance it’s electricity generation business. Geothermal plant construction is a capital intensive business that involves the expense and risk of petro-chemical like drilling with the infrastructure requirements of traditional power plant construction. Consequently, the debt tends to be more expensive than tradition power plant construction and there tends to be alot of it per megawatt of capacity. During 2006, Ormat added 51 MW of generation capacity, bringing its total output to 377 MW.

This is a nice segue into the second issue, strategy implementation. Ormat has traditionally been a product company producing the equipment necessary to harvest power from geothermal resources. In particular, Ormat has demonstrated leadership in organic rankine cycle or binary harvest in closed geothermal systems. A few years ago, Ormat decided to get into the geothermal electricity production business in addition to its equipment business. This decision had risk of alienating their equipment customers since Ormat was now a competitor as well as a supplier in the electricity generation business.

A look into the Q4 and full year results shows that Ormat recorded equipment revenues of $20.1M and $73.5M respectively. The electricity segment shows results for Q4 and full year of $46.6M and $195.5M respectively. In the forward looking statements management indicated that equipment sales were projected to drop in 2007 while electricity segment would continue to grow. The key question is will electricity grow faster than equipment shrinks? And can Ormat continue to take on debt to finance the growth of electricity segment to fuel that growth?

The beauty of this strategy is that electricity generation is a pretty predictable business. Ormat will enter into longterm power sale agreements with known pricing and will work to control and reduce operating costs to generate predictable results. The equipment business is and will continue to be “lumpy” – dictated by the number of projects underway at any given time and with Ormat’s entry into the generation business, new competitors will appear like United Technologies with their Pure Cycle organic rankine cycle generation units.

So, what’s Ormat worth? That’s a pretty good question. Taking their generation capacity of 377 MW with average sale price of $70 per megawatt hour multiplied by the industry average capacity factor of 90% multiplied by the number of hours in the year (8760,) I would predict revenues in the electricity segment of around $208M for the full year. Management projects that the equipment segment will produce around $68M for the year. This brings projected full year revenues to $276M without the benefit of new capacity impact brought online during the year and any upside in equipment sales. However, it also takes into account a 7.5% decrease year over year in the equipment segment which may not be sufficiently pessimistic given the competitive landscape.

Provided Ormat can sustain current expense levels commensurate with revenue levels, the revenue levels above would yield earnings in the $35.3M dollar range. With a valuation of 50x earnings, which is where Ormat has been trading, that would signal a price of $52.56 per share. However, the projected earnings growth rate of 3% won’t justify that multiple. I expect Ormat’s PE will be begin to fall back toward traditional power producer multiples in the 20x range as growth slows. At a 20x valuation, that indicates a price of $19.83 per share.

If Ormat can show growth in excess of 5%, then I would expect the shares to stay closer to the high side estimate. If Ormat delivers results with 3% or less growth, I would expect quick adjustment to the lower end of the range. My conclusion is that at $35 per share, Ormat is fairly valued given the projected growth rates, risks, debt level, and strategy implementation.

If you liked this entry, Digg It!

Tune: Cold Feet by Albert King

Technorati Tags: Energy | Geothermal | Ormat | Mike Harding Blog

Energy

Coal backlash

With the announced acquisition of TXU earlier this week, Fortune magazine has published a story analyzing the future of coal.

Coal fired electric generation accounts for 48.8% of US electricity production. Of the fossil fuel choices, coal is the least expensive and most plentiful of fuels, costing just $1.67 per million BTUs, though the price is up from $1.20 per million BTUs in the year 2000. To bring the BTUs measurement home, 1,000,000 BTUs is equivalent to around 293 kilowatt hours, enough to power a small home in the US for a month. Experts claim there is a coal reserve in the US of around 1.3 million square kilometers (~500,000 square miles) that should last at current burn rates for around 250 years. At present, there are some 150 new coal fired plants in planning through construction phases in the US.

Every 1,000,000 watt/hours of power produced by coal results in 1,000 kg (2,200 lbs) of carbon dioxide and 15 kgs of sulphur and nitrogen oxides into the atmosphere. Coal mining happens in one of two ways, shaft mining and strip mining. Shaft mining is just what it sounds like, a shaft is sunk into the earth at some angle and the coal vein is followed underground with the coal being transported out of the mine for processing. Strip mining works for shallow veins where the non-coal material (overburden) is removed to access the coal vein which is removed and processed, and then the overburden is replaced and the land is reclaimed.

New research is underway to make coal cleaner and less damaging to the atmosphere including gassification and carbon sequestration technologies. Gassification is happening to some extent now and carbon sequestration may or may not work – the idea of capturing the carbon post burn and injecting it into the earth for storage sounds a little farfetched until one thinks about how natural gas is stored. There are several large salt domes that have been hollowed out by pumping in water to dissolve the salt then the resulting brine is pumped out leaving a chamber. Natural gas is then injected and stored in these reserviors. I don’t know if that’s exactly what researchers have in mind for carbon dioxide, but there is an existence proof of some sort.

These facts are important when considering the future of coal. Environmental objection is but one variable in the coal equation, and perhaps the least important when considering how to positively impact climate change. Another variable is cost, the most important and most influential variable. I believe cost is the key. Until and unless coal generated electricity becomes more expensive to produce other energy sources will not be sought with the vigor that is required to make a large impact.

The good news is, we can already see the cost factor coming into play. The TXU plants on the docket are slated to cost on the order of $1B a piece, or about $1M per megawatt of generation capability. Natural gas costs $0.75M per megawatt. Wind costs $1M per megawatt, but it’s not baseload power due to the fickle nature of wind. Solar is still a couple of technology generations away costing around $8M megawatt, it also suffers from capacity factor, it’s not generating power at night. Geothermal power is baseload, but with exploration costs included, it comes to $2.5M per megawatt. Geothermal exclusive of exploration is in the $1M per megawatt range. Coal gassification plants come in at around $2.5M per megawatt now and who knows what carbon sequestration will add in terms of cost. As you can see, coal plant construction prices are starting to encroach on renewable plant cost territory.

Operations costs are also creeping higher. The more stringent the emissions regulation, the more expensive it becomes to operate a coal fired plant. If we add in the cost of fuel over the 40 year lifetime of a plant, all of the sudden baseload renewable generation like geothermal looks pretty darned attractive.

That brings us to the most important variable, emissions regulation (which will be the largest single driver of coal electricity production cost.) A policy the new Congress could take on is to mandate new coal plants to have emissions no greater than a geothermal plant (I’ll accept 1980’s vintage Geysers plants as the benchmark even though new binary plants in a closed system would be better.) This would serve notice that investment must go into clean electricity generation and would have lasting impact over the next 20 years on climate change.

One thing is certain, market forces alone are not enough to tip the investment from coal to other clean technologies. The market needs a push in the form of strict emissions control which will cause the price of coal generation to rise sufficiently to cause alternate behaviors. Now is the time.

If you liked this entry, Digg It!

Tune: Comin’ Home Baby by Mel Torme

Technorati Tags: Energy | Coal | Emissions | Mike Harding Blog

« Previous Entries

» Next Entries