Joint Venture of Silicon Valley publishes an annual report attempting to provide a holistic view of life and opportunity in the valley. To their credit, I’ve not seen a more complete view than what they’ve published – tip of the hat to Kevin for passing this along. The report for 2006 is available here. The report covers people, economy, society, place, and governance in the valley and is assembled by a diverse group of private and public agencies.

The general report is interesting enough, but I found a section on investment in clean tech to be very telling. Overall venture investment in the valley Quarters 1-3 in 2005 (Q4 2006 not yet available, so this will be a 3 quarter comparison) was $4.6B. The same period in 2006 saw the total rise to $5.2B, a healthy 13% increase year over year.

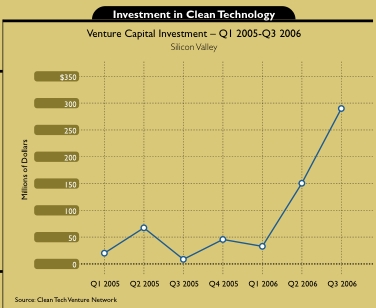

When we break out the clean tech segment, it’s even more interesting. Check the chart below:

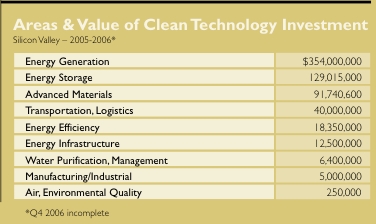

As you can see the 2005 Q1-3 total investment was on the order of $95M compared with $480M in the same period for 2006. A 505% increase year over year. Perhaps even more importantly, the total share of clean tech in the overall venture picture increased from 2% in 2005 to 9% in 2006. The chart below gives a breakout of the general areas of investment in clean tech and the dollar amount in each category:

It’s clear that we’re starting to see a shift in the way people are thinking about “green” from something that “is good for the planet” to something that “is good business.” And that’s exactly the shift that needs to happen, until these technologies and their attendant environmental benefits are profitable, we won’t see the magnitudes of change required to make a difference. However, venture capitalists as a rule seek out places their money can work at multiples, it’s encouraging to see the expectation of returns in this segment.

If you liked this entry, Digg It!

Tune: Laissez Faire by Bruce Daigrepont

Technorati Tags: Energy | Investment | Clean Tech | Mike Harding Blog

« Sushi fattening?

» Sierra Geothermal begins Nevada drilling

Business, Energy

Clean tech investments increase 500%

02.12.07 | Comment?

« Sushi fattening?

» Sierra Geothermal begins Nevada drilling