Blog Archives

US Geothermal gets $15M

Renewable Energy Access reports today that US Geothermal has raised another $15M to aid in the development of their geothermal projects, notably the Raft River Project in Idaho. The deal is slated to close in June, 2007 pending regulatory approval.

Comments are off for this post

Geothermal Financing Workshop and RPS

Last Thursday, May 10, the Geothermal Energy Association hosted a Geothermal Financing Workshop. In a full day, the audience was exposed to policy, regulation, financing, and project development topics presented by industry experts. There are any number of highlights that could be selected to discuss in this entry, but the one we’ll focus on is the renewable portfolio standard.

The Union of Concerned Scientists have created a great resource in the form of the Electricity Standards Toolkit, a comprehensive listing of the renewable portfolio standards state by state in a handy online database. John Galloway, a Senior Energy Analyst, gave a very interesting talk about RPS and its impact.

One of the more interesting tidbits gleaned from the talk was that in California, the 20% RPS by 2010 standard is in reach. As of 2006, 14% of California’s energy is coming from renewable sources. This is the optimistic view of progress against RPS. The counter position is that renewable electricity generation and distribution needs to grow at 1.5% per year to meet the 20% goal by 2010, and much of the new power under contract or shortlist has yet to be constructed.

Of the 3 power providing entities in California, investor owned utilities (IOUs,) municipal utilities, and electricity service providers (ESPs,) the group with the most opportunity for improvement is the ESPs who presently provide only 1% of power to their customers from renewable resources as of 2006.

Over the next few entries, we’ll look at other portions of the conference as well. Overall, it was a good event that was well attended with a bunch of salient information. Comments are off for this post

Power purchase agreement day

Western Geothermal announced May 10th that PG&E has agreed to buy the output from their Geysers project amounting to 212,000 megawatt hours (MWh) per year. This constitutes a major step forward in the re-development of PG&E’s old Unit 15 that was previously in production at the site. There is potentially more capacity at the site and this contract allows for expansion to 261,000 MWh per year should that capacity become available.

In a separate series of power purchase agreements, Ormat has struck a deal with Basin Electric Power Cooperative who will purchase the output of 4 recovered heat binary units, each with an estimated capacity of 5.5MW. The heat will be provided by gas turbines from the Northern Border natural gas pipeline which runs through the area. The total output of the combined plants is estimated at over 180,000 MWh per year when all of the facilities are online in 2009.

Clean Energy Entreprenuer’s Forum

Earlier this week we attended the Clean Energy Entreprenuer’s Forum hosted by FountainBlue in Silicon Valley. For a journalist’s account of the event, we recommend reading InsideGreenTech’s article posted a couple of days ago. The event was a hosted in panel fashion with Mark Bauhaus, of Bauhaus Productions facilitating. The panel consisted of Mike Dorsey of JP Morgan’s Bay Area Equity Fund, Laurie Yoler of GrowthPoint Technology Partners, Justin Label of Bessemer Ventures, and Carol Sands of Angels Forum and Halo Fund.

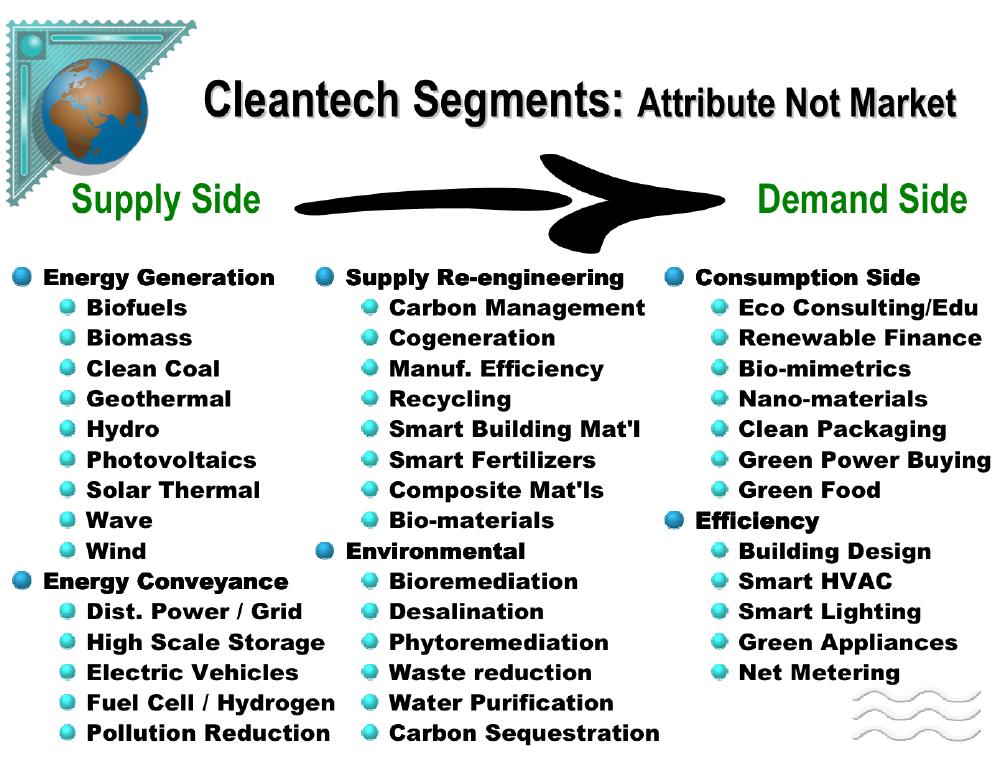

The panel discussed Clean Tech in the context of this very interesting slide – we’re really looking at a sector which touches many segments:

Attending in our dual role of geothermal project developer and clean tech investor, the session was very interesting in that it represented the intersection of the traditional technology venture capital community with the energy community – these communities are very different (now having been residents of both worlds, the differences are plain to see.) It’s clear that seeking the right “flavor of money” is key in getting projects funded and that there is a mismatch in expectations of traditional tech VCs vs. the requirements for most clean energy plays. Unless you’re working on the commercialization of breakthrough technology that was developed using other money, finding funding in the traditional technology dominated venture capital world is going to be tough.

A few key points made by the panelists are salient:

- Capital is king, this class of funder doesn’t want to see overall investment of more than say $30M over the lifetime of the investment. All of the panelists were adamant about that. Well, the implementation of utility scale clean energy production ranges from $1 to $8M per megawatt (technology dependent) so it’s pretty clear that traditional VCs won’t fund your power project.

- There were some surprises in what these investors were backing, the big surprise was solar installation. It turns out that presently, 60% of the revenue and nearly all of the margin in solar transactions is in the installation. Physical service providers are not a normal investment for this community.

- Speaking of solar, don’t bother trying to get your next incremental improvement on a photovoltaic cell funded, it’s too late unless you can demonstrate breakthrough numbers showing orders of magnitude difference in efficiency or production cost. A 23% efficiency silicon PV cell isn’t that interesting. A 23% CIGS cell probably would be interesting (given that 6% is the high end of efficiency now.)

The event was hosted by law firm DLA Piper in their beautiful new facilities in East Palo Alto and was sponsored by both DLA Piper and PeopleConnect, a recruiter specializing in finding expert talent who will work with your startup for the first few months without a check. Overall, this was a valuable event both for the content and for the networking opportunities. If you’re an entreprenuer in the clean tech space and will be in the SF Bay Area for a monthly event, it’s worth investing a few hours to attend.

Comments are off for this post

Calpine reports Q1 earnings

Calpine reported a net loss of $459M for the quarter on sales of $1.6B, this constitutes an improvement on the loss of $589M in the same period last year and a 31% increase in sales for the comparable period.

The company continues to prepare to emerge from bankruptcy in June by repositioning itself and it’s 25,000MW portfolio as a clean energy provider. Speculation remains rampant that a private equity player will acquire Calpine in the same manner as TXU earlier this year.

The major negative aspect of this report is that higher debt financing and operating costs offset the increase in sales.