Clean Energy Entreprenuer’s Forum

Earlier this week we attended the Clean Energy Entreprenuer’s Forum hosted by FountainBlue in Silicon Valley. For a journalist’s account of the event, we recommend reading InsideGreenTech’s article posted a couple of days ago. The event was a hosted in panel fashion with Mark Bauhaus, of Bauhaus Productions facilitating. The panel consisted of Mike Dorsey of JP Morgan’s Bay Area Equity Fund, Laurie Yoler of GrowthPoint Technology Partners, Justin Label of Bessemer Ventures, and Carol Sands of Angels Forum and Halo Fund.

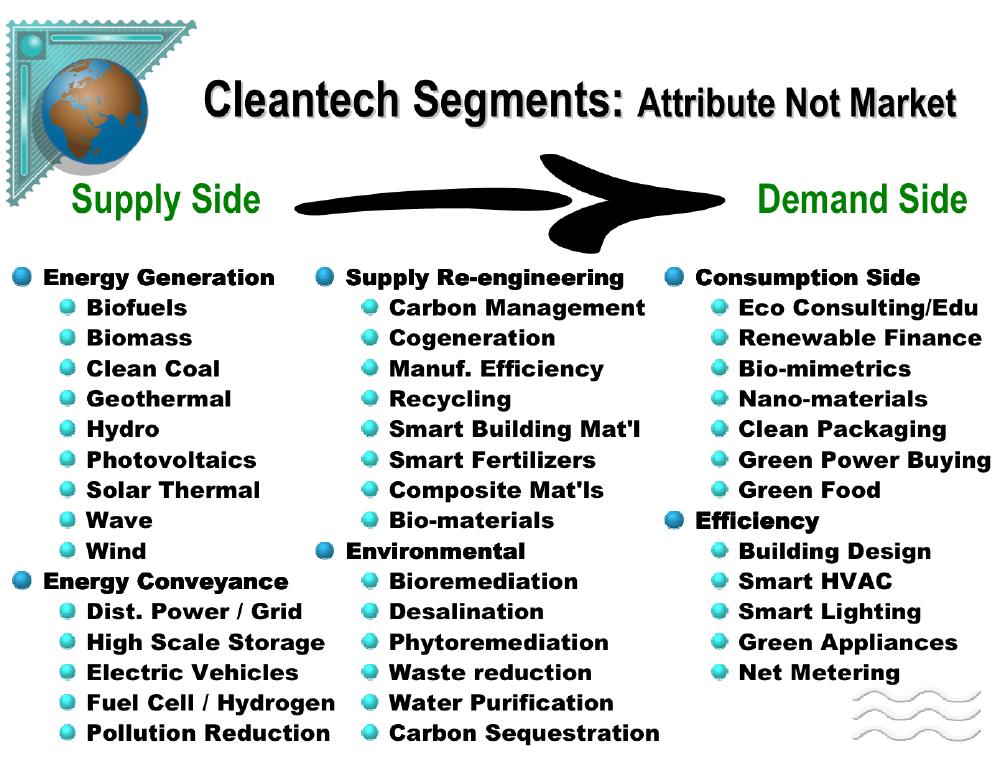

The panel discussed Clean Tech in the context of this very interesting slide – we’re really looking at a sector which touches many segments:

Attending in our dual role of geothermal project developer and clean tech investor, the session was very interesting in that it represented the intersection of the traditional technology venture capital community with the energy community – these communities are very different (now having been residents of both worlds, the differences are plain to see.) It’s clear that seeking the right “flavor of money” is key in getting projects funded and that there is a mismatch in expectations of traditional tech VCs vs. the requirements for most clean energy plays. Unless you’re working on the commercialization of breakthrough technology that was developed using other money, finding funding in the traditional technology dominated venture capital world is going to be tough.

A few key points made by the panelists are salient:

- Capital is king, this class of funder doesn’t want to see overall investment of more than say $30M over the lifetime of the investment. All of the panelists were adamant about that. Well, the implementation of utility scale clean energy production ranges from $1 to $8M per megawatt (technology dependent) so it’s pretty clear that traditional VCs won’t fund your power project.

- There were some surprises in what these investors were backing, the big surprise was solar installation. It turns out that presently, 60% of the revenue and nearly all of the margin in solar transactions is in the installation. Physical service providers are not a normal investment for this community.

- Speaking of solar, don’t bother trying to get your next incremental improvement on a photovoltaic cell funded, it’s too late unless you can demonstrate breakthrough numbers showing orders of magnitude difference in efficiency or production cost. A 23% efficiency silicon PV cell isn’t that interesting. A 23% CIGS cell probably would be interesting (given that 6% is the high end of efficiency now.)

The event was hosted by law firm DLA Piper in their beautiful new facilities in East Palo Alto and was sponsored by both DLA Piper and PeopleConnect, a recruiter specializing in finding expert talent who will work with your startup for the first few months without a check. Overall, this was a valuable event both for the content and for the networking opportunities. If you’re an entreprenuer in the clean tech space and will be in the SF Bay Area for a monthly event, it’s worth investing a few hours to attend.