Blog Archives

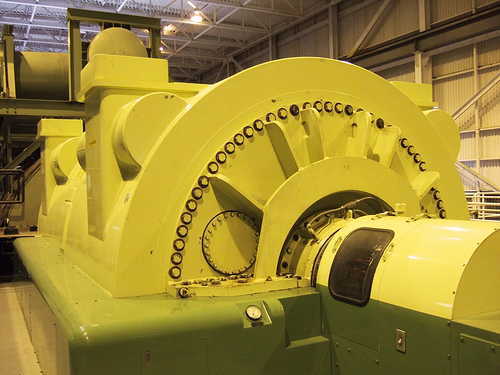

NRG bids for Calpine

Attribution: KQED

This morning there is news on the wire that New Jersey utility NRG has bid over $11B in an all stock deal to acquire Calpine. This is a 6% premium over the closing price of Calpine yesterday. With 26GW of generation capacity (a little less than 1GW geothermal, the rest natural gas) Calpine is a significant generator who only emerged from bankruptcy protection 4 months ago. Should the deal be consummated, the combined utility would have nearly 50GW of generation capacity in hydro, geothermal, petrochemical, coal, and nuclear powered generation.

The Calpine board is considering the offer at present. This is the latest in a wave of consolidate of the fossil fuel generators. Let’s hope the significant geothermal operation is not lost/damaged in the shuffle.

Links:

Calpine

NRG

AP Story on Bid

$98/MWh PPA

Western GeoPower scored a nice deal yesterday inking a 20 year PPA with the Northern California Power Association for around $26M/year and a purchase price of $98/MWh. We thought the $78/MWh + wheeling costs that was cut earlier this year between the City of Anaheim and Raser was lucrative. $98/MWh is great and reflects the new CPUC pricing model.

With the deal, WGP has a $500M+ revenue stream set against a ~$120M capital expenditure. With operating costs of $30/MWh, that leaves a whopping $68/MWh for debt service, other SG&A, taxes, and net income.

Links:

Western GeoPower

Raser Technologies

Northern California Power Association (NCPA)

California Public Utilities Commission (CPUC)

Another Electric Bike

Soon to be available in the US, providing zero-emission transport around Cannes, France now for less than $0.01/mile. The manufacturer claims a top speed of 100kph (~60mph) and a range of a little over 100 kilometers. With 2 hours of charging time, the batteries recover up to 90% of their charge. The bike also has regenerative braking and a reverse gear to assist in parking since this is a rather heavy (due to batteries) bike.

Links:

Vectrix

Comments are off for this post

Renewable Investments hitting Mainstream

CBS MarketWatch ran an interesting story last week on brokerage and investment banking concern Jesup & Lamont and their analysis of small cap stocks in the renewable space. The video above was recorded at a conference the company sponsored and Brian Yerger takes the viewers through the rationale of alternative energy (we prefer renewable, there’s nothing alternative about technologies that have been used for millennia) stocks moving into the mainstream for investors, particularly institutions. Geothermal player Ormat and solar PV installer Akeena are mentioned prominently in the clip.

Links:

CBS MarketWatch Article

Ormat (ORA)

Akeena (AKNS) 1 comment

Picken’s Green Gigawatt

It’s being widely reported that T. Boone Pickens and Mesa Wind have placed an order for 667, 1.5MWe wind turbines as the first 25% of what will be the largest wind farm on the planet. The order, worth $2B and awarded to GE, will result in a plant in the Texas Panhandle that can power some 300,000 homes. Curiously, if one were to invest in a geothermal complex that could power the same number of homes, it would be 300MWe and cost about $900M. Sounds like it’s time for more education!

Any way you cut it though, this is a great step to see an oil tycoon recognize the profit to made by supplying energy when the fuel is free. The only question we have is, what took so long?