Blog Archives

SunPower hits $1B

SunPower, the leading PV solar manufacturer, hit the big time with their latest financial results. Their run rate is now north of $1B (having turned in a $274M quarter) and the business model is now profitable (with earnings increasing 1,000% year over year.)

We here at MeV aren’t bullish on PV solar, yet it does have some undeniable appeal particularly as a massively distributed generation system which not only lends itself to scale, but solves problems like transmission and distribution. However, we still believe the economics don’t solve and ultimately, once the hype recedes, the PV industry will collapse unless the basic economics work.

Another intangible aspect of solar PV is momentum and this technology has it. People understand that the sun is hot and that ultimately, most energy we harvest is in some way powered by the sun (hundreds of millions of years ago for plants having transformed into hydrocarbons for instance.) In any case, congratulations SunPower, that’s a phenomenal quarter you’ve turned in and despite our outlook on PV overall, we hope you drive the economics to solve and prove our pessimistic view on PV very wrong in the end.

Public Policy, Subsidies, and Renewable Energy

The past few years have seen some rather dramatic events unfold in the area of public policy and subsidies with respect to renewable energy projects. It would be difficult to underestimate the impact of these policies and the resulting guarantees that really enable renewable projects to be developed. Ideally, renewable energy projects would be economically viable without such legislative intervention, but we’re not quite there yet.

In our view, the government could best serve the people, the interest of the nation, and renewable project developers by doing a few, simple things:

- Shift focus from fossil fuel generation to renewable generation. Slash funding and subsidies to nothing for fossil fuel generators. In reality, these industries are mature and do not need the government support to maintain profitable operation, and encouragement of continued development of new fossil powered projects is counter productive for energy security and greenhouse gas issues.

- Establish a long-term (10-15 year) production tax credit for renewable projects. When it expires, do not renew the credit. This longevity enables investors to take on renewable projects with reduced risk, reducing costs all along the financial supply chain. The fact that PTCs will likely expire in December of this year increases risk making project financing significantly more difficult to secure and more expensive. This fundamentally changes the economics of projects for the worse. The PTC however, should not be permanent. It’s a catalyzing measure to increase investment in the near-term in renewable projects.

- Provide loan guarantees. Particularly in the present credit crunch, it’s difficult to get project financing. Having the government as a co-signer reduces risk for lenders and cost for developers. To their credit, there is a program with $38.5B in loan guarantees out there, but more than half is earmarked for nuclear and fossil fuel projects, which misses the point of having the guarantees.

- Give regulatory preference and increase velocity of government interaction on renewable projects. Be it a lease from the BLM, and environmental impact review from the EPA, a power plant application to FERC, these projects need to be expedited. The long development times kill developers making it difficult to get a project in place and producing. The average renewable project takes 4 years to go from concept to commercial operations.

- Get out of the way. Once the pieces above are in place, simply let the industry move forward. Additional oversight and overhead are not particularly useful or necessary.

Until and unless a simple, coherent, and consistent energy policy exists that prefers renewable generation projects, we’re simply on a status quo course of action. As a new administration is selected and sworn in, we’ll see if that person has the vision and will to lead the nation to an outcome of energy independence and security.

Switchgrass Gas

Photo Credit: Ben Barnhart

The holy grail of biofuels has been to find a feedstock that doesn’t compete with food (i.e., corn), produce a product that is compatible with existing infrastructure and has great performance, and to discover a low-impact/energy process to produce the product.

University of Massachusetts (Amherst) BioChemist, Dr. George Huber and his graduate students, Torren Carlson and Tushar Vispute, may have grasped the grail with their switchgrass gas. A process that makes not ethanol, but actual gasoline compounds by combining the cellulose with certain catalysts in the presence of heat to produce the precursors to gasoline and then to run a series of steps that further refines these compounds into gasoline, effectively indistinguishable from the petroleum based fuel used today.

While many years from appearing at the pump, this breakthrough has the possibility of transforming the inefficient and increasingly controversial biofuels segment into something completely different.

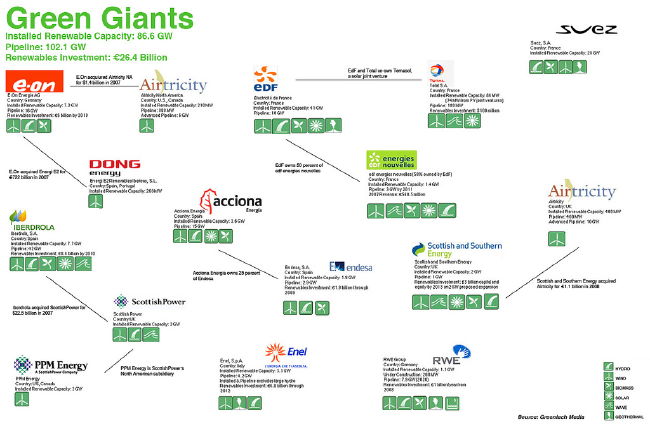

Euro Utility Renewable Map

Attribution: GreenTech Media

GreenTech Media put together a really nice visual representation of the European Utilities Renewable Portfolios and development pipelines indicating the country and types of renewables in the portfolio. It’s really nice work and helpful. We need to do one of these for the US as well.

Things that stick out, the overall European nameplate capacity of renewables is 86.6GW at a cost of 26.4B EUR and the total development pipeline is 102.1GW. That’s showing just how far ahead Europe is in considering and solving this problem. It also shows the room the US industry has to grow, we’re just scratching the surface of what’s possible.

Comments are off for this post

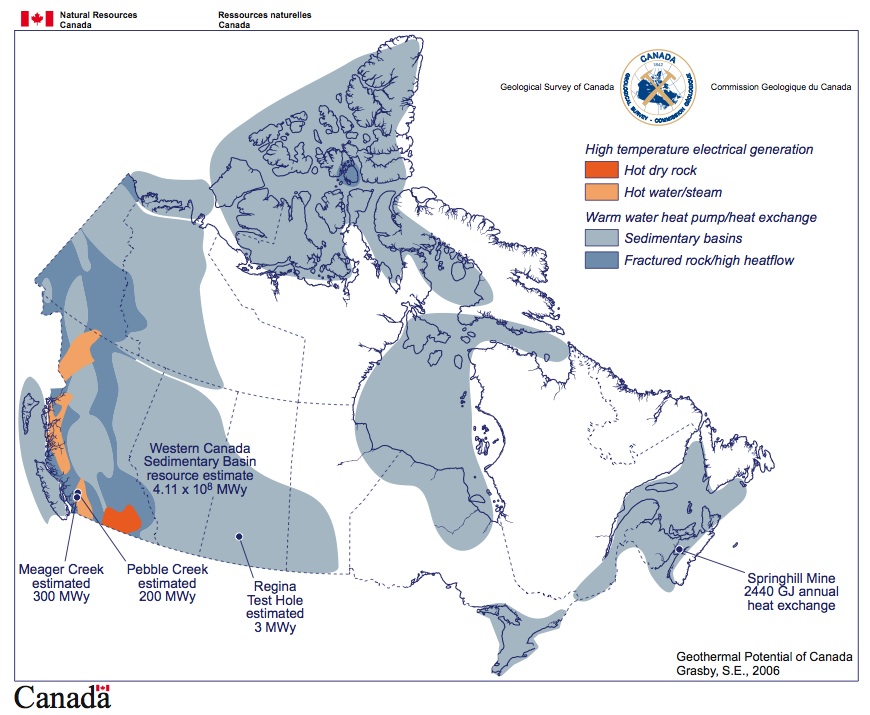

Canadian Geothermal Potential

If you’ve been around the geothermal world in the US, you’ve seen the heatmap of the US produced by the SMU crowd led by David Blackwell. But the Canadian heatmap isn’t too well known and we came across it recently and thought we’d share it. It’s one of the interesting tidbits available from Canadian Geothermal Resources Association (CanGEA).

Attribution: Geologic Survey of Canada

After analyzing the map, we have to wonder why Canada’s geothermal potential is largely untapped. There are a few projects happening in the country and perhaps, in a land mass this vast, there are more opportunities for development that are not yet identified or under development.

Whatever your perspective, Canadian geothermal resources are an underutilized resource.

HT: Craig

1 comment