Archive for the 'Business' Category

Triple Play: Sou Hills Project

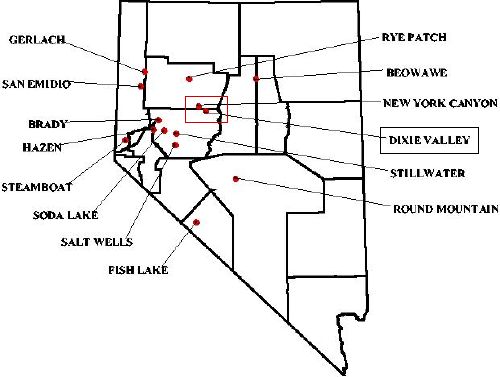

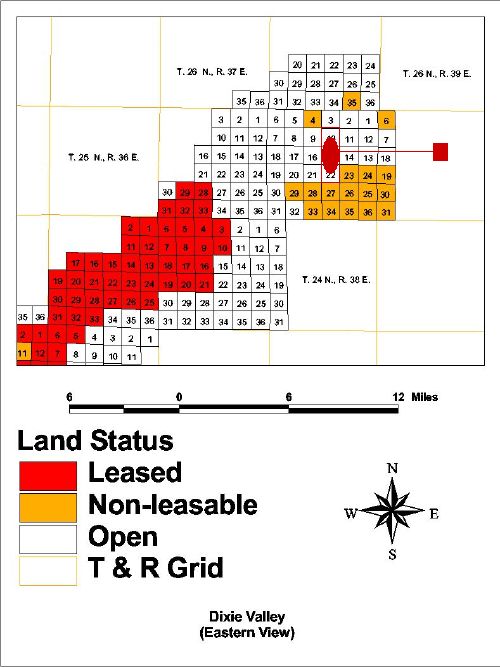

In August, 2007, MeV acquired a lease and development rights on ~1700 acres (~700 hectares) of land in Nevada’s East Dixie Valley. This area is a Known Geothermal Resources Area (KGRA) with a functioning plant, Ormat’s Dixie Valley 60MW facility, in the near vicinity. Given the parcel’s location in the Sou Hills, we now refer to this parcel as the Sou Hills Prospect. One other key aspect to the Sou Hills Prospect is its proximity to electricity transmission. A distribution line is located within 400m of the southern end of the parcel which connects to a 230kv transmission line owned and operated by Sierra Pacific Power Company. MeV has made one preliminary visit to the Sou Hills Prospect which is recorded here.

As with any geothermal prospect, exploration is paramount. Before the end of the year, MeV plans to complete aerial, self-potential, soil chemical, and magnetic surveys of the prospect. In addition, MeV plans a 2m shallow temperature survey with at least 100 measurement points (which can and will be adjusted in the field to accommodate the localization of any anomolies.) After collecting and analyzing this data, MeV may drill temperature gradient wells in locations suggested by the analysis of the prior surveys.

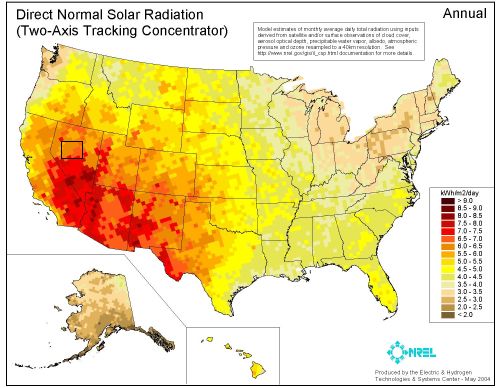

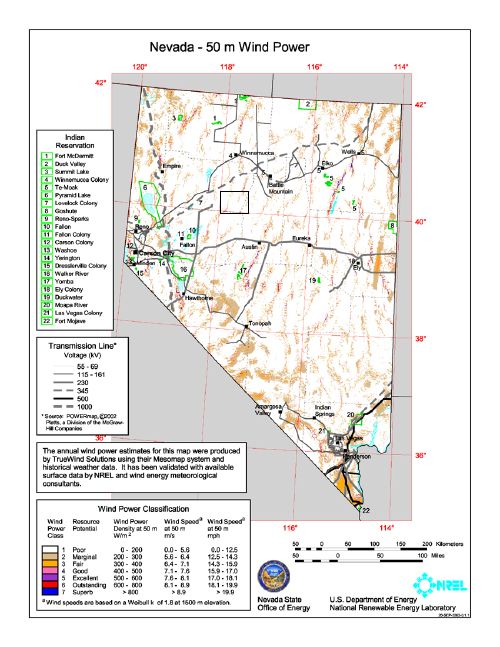

In addition to geothermal resource, MeV also observes that this location lies in the desert and is the recipient of copious amounts of sunshine year around. Given that benefit, solar surveys to characterize resource applicability for solar thermal electricity production will also be performed. Finally, there may be wind resource in the area and as such a wind resource analysis will be performed. This will help determine the feasibility of a “double” or “triple” play allowing multi-dimensional harvest of renewable resource below the surface level with geothermal, at surface level with solar thermal, and above surface level with wind all on the same physical property.

(Sou Hills Prospect in Rectangle Area >5 kwh/m2)

(Sou Hills Prospect in Rectangular Area – Detail in cutout below)

In concert, the wind, solar, and geothermal resources can share the same operations and transmission infrastructure. Solar thermal and geothermal can share the same physical generation resources. As solar resources become unavailable (darkness) wind resources in this area tend to increase and peak during night time hours. Of course, geothermal resources are not subject to sunlight and wind conditions and provide a constant baseload power output from the renewable energy park. Presently, the size and feasibility of this approach are unknown and will not be known until the resource assessment has been completed. However, the conditions are right for this approach to work in this specific property and perhaps others located around the world.

As results of resource surveys become available, we will share those results and the progress of our project in general. Comments are off for this post

US Geothermal ups PPA by 30%

Recently, US Geothermal renegotiated its power purchase agreement with the Idaho Power Company increasing it from 10MW to 13MW. Details are available in this press release. This constitutes the first segment in what is believed to be a 45.5MW project at Raft River, Idaho. This is good news for the company as it shows that the project will have greater net output than originally forecast. Comments are off for this post

Decision Time: Energy Investments

Recently, one of our partners brought an interesting situation to light. AMP-Ohio, a US electricity generation company, is working to build a new $2.7B, 1,000MW “clean coal” generation facility on the Ohio River. As part of the planning for this plant, the company is visiting the municipalities it serves and asking each for a 50 year commitment in the form of a power purchase agreement to aid in lining up the financing for the project. None of this is news, it’s happening every day across the country for every type of project.

The interesting bits of this story revolve around the tactics being employed by AMP to secure the commitments from the municipalities and ultimately, the choice these municipalities have in determining our energy future and policies.

A municipality involved in this is Yellow Springs, Ohio. A village of some 4,000 people located in southwestern Ohio. Historically, the village has been an independent where electricity is concerned, opting out of the large investor-owned utility Dayton Power and Light (now a subsidiary of DPLInc.) to maintain control over power production and distribution. AMP has created a sense of urgency around the project asking the municipalities to commit within a six month time frame or risk losing their AMP electrical supply when the current power purchase agreements expire in a few years. The leaders of the community are not experts on electricity generation and distribution (though there is expertise in the village staff and advisors) and are feeling the heat. In addition to the AMP proposal, the village is also struggling with issues around electricity distribution, but this is a separate issue from power supply.

As this topic heats up, there are editorials appearing and offers from groups like the National Resources Defense Council to come work with the village to understand its choices. This scene must be playing out in hundreds, if not thousands, of communities across the country. It comes down to a very real choice about how to proceed in the future: Why should communities invest in new fossil fuel projects with known negative impacts? Why not explore, and ultimately invest in, more reasonable and sustainable approaches? At $2.7M per megawatt of generation capacity in the proposed plant, why not look at resources like geothermal with the same baseload characteristics of a coal plant, and virtually none of the emissions? Averaged development cost per megawatt? $3M.

In a note written to the our partner who happens to reside in this village yesterday, some questions were posed that the village leadership should be considering:

- Has the village characterized its resource requirements/load? Has this been projected into the future?

- What is the net present value of the village’s aggregate power purchasing over a 50 year horizon?

- What conservation programs have been contemplated to affect the load over the longterm?

- What local renewable resources have been reviewed for feasibility of serving the electrical load?

Armed with this information, a community dialogue can then begin around the available choices and informed decisions based on information can be made. From a personal perspective, the simple act of installing compact fluorescent lamps in 87% of a home’s light fixtures has reduced electricity demand by 25%. That’s hard data, a story about it is available here. Small choices like this made across a community can have a large impact.

Regardless of where one stands on the environmental issues like global warming, green house gases, particulate air pollution, acid rain, etc. it is the country’s economic interest to not direct one more dollar toward development of new fossil fuel electricity generation. Now is the time, with each of these sorts of decisions at the local level, to assert our desire to responsibly and reasonably harvest renewable resources for our future power needs. This should be coupled with demand management and simple and effective conservation mechanisms that require minimal impact on end consumers. In this way, we can shape a better future for our families and minimize our negative impact on our environment.

Where does your community get electrical power? Are there decisions being taken by your local government? Now would be a good time to find out and make your voice heard. If people don’t speak out on these issues, the situation will not change.

OpenEco.org

A leading technology company, Sun Microsystems, has released a community-based carbon footprint tracker today called OpenEco.org. It’s clearly just a start, but it’s interesting in that the point is to have folks measure their activity, set goals for improvement, and track them on the website. The theory is, if you can see it, then you can do something about it. Since there is a community involved, best practices can be formed and shared across the community.

Sun has proved masterful at building communities throughout its 25 year history, but this is a slightly different animal. It’s encouraging to see a large company step up and sponsor this, but I have to wonder, who will participate? The price of participation is high – that being the entry of vast quantities of data into the system. Yes, the community participant can choose how much is private vs. public, but just the act of entry is a high price. And it’s not a one-time gig. If Sun and the community can find a way to ease this price, then there may be some community growth.

But, this much is true, if you can’t see it, you won’t do anything about it. We applaud the company for making the effort. Comments are off for this post

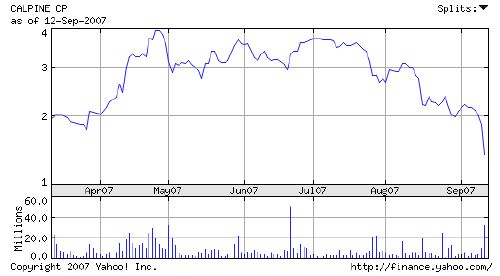

Calpine’s Market Cap Shrinks

Back in June when Calpine’s reorganization plan was announced, the stock traded at $2.93 per share. On that day, we predicted that the shares would slide (in the face of a post-announcement pop to $3.21/share) to a level that would more accurately reflect the value for shareholders.

Yesterday, the issue closed at $1.39/share. It has traded as high as $1.55/share today.

Does this mean Calpine is a bad company? No, not at all. It does mean that the reorganization plan and the company’s desire to “go it alone” leave investors with limited near-term upside. On the contrary, if Calpine invests in expansion of the geothermal portfolio and slims its fossil fuel portfolio to profitable plants, this is potentially a good long-term investment – particularly now that the shares are trading at a level closer to intrinsic value.

Where do the shares go from here? It depends on the execution of the reorganization plan, natural gas prices, and non-fossil fuel generation investment decisions. If these work out favorably, there should be a nice appreciation. If any of the 3 are out of line, expect the issue to stay flat or even fall a little further. Caveat Emptor.

The principals of MeV hold no position in Calpine. Comments are off for this post