Archive for the 'Business' Category

Calpine Tanks

Back in June when Calpine unveiled their plan to emerge from bankruptcy, we weren’t too positive. In fact, we were downright puzzled by the market reaction sending the stock over $3/share and market capitalization greater than $1.5B. The issue has been on a steady downswing since that time settling in around $1.20/share, around $600M in market cap. Yesterday the bottom dropped out when the company announced a reduction in their enterprise value by $900M. The stock’s valuation now stands around $240M and closed yesterday at $0.495/share.

We wonder if it might not be a sensible thing for Calpine to spinoff its geothermal unit into a separate entity and let the natural gas portion of its portfolio sort itself out with the mother company. With the current market for renewable energy running very hot, this could create a pure play competitor to Ormat with 2x the generation capacity (Ormat is producing about $200M/year from ~375MW – Calpine has 800MW, that should produce around $425M in revenue per year…)

At current valuation and with the geothermal assets, we see Calpine as an interesting speculative buy. Caveat Emptor.

Disclosure: The author holds no position in Calpine stock. The author is considering a speculative, long-term position in the company. 2 comments

Ormat tops $2B

Today, despite the earlier dilution from a secondary offering on the public market, Ormat’s market capitalization has surged past $2B. That puts the P/E ratio at nearly 95 trailing twelve months. Ormat is a good company in a hot market. But, does the company’s performance justify this sort of premium? Caveat Emptor. 2 comments

Ormat announces secondary offering

Ormat, the largest “pure play” geothermal company in the US, yesterday announced that it would place 3 million shares on the public market. This will increase Ormat’s outstanding shares to 41.13M and effectively dilutes current shareholders by 7.8%. Unsurprisingly, the stock price dropped yesterday nearly that same percentage and seems to be creeping up incrementally today. This move should raise over $140M (less underwriter’s fees) to be used for general corporate purposes including paying down debt levels, exploration, and new geothermal plant development.

Comments are off for this post

Geothermal Finance & Development Summit

This event is upcoming November 14-16 in San Jose. Looking at the agenda, it is geared toward educating financial types about geothermal development and geothermal developers about financing options. The details of the event are available here. There is also a one day pre-session specifically on financing activities. If you’re in the Bay Area or planning to be in the Bay Area, this could be an interesting session to attend.

Turn this…

Into this…

Ormat up on takeover rumors

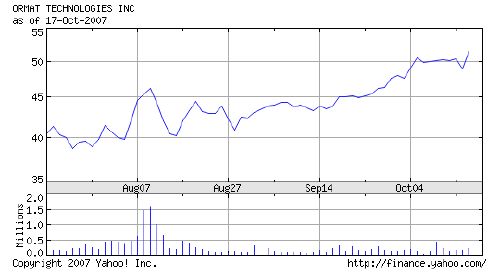

Over the past 3 months, Ormat (NYSE: ORA) market capitalization has increased to nearly $2B. The run up of the stock can be attributed to rumors that the company is considering some sort of takeover by private equity. The two names most closely connected to such potential deals are Goldman Sachs and Apax. Today, Apax has denied the rumors of such a deal.

What we do know is that a consolidation is underway in the renewable energy industry as established energy players rush to start or enhance their portfolios and renewable energy companies seek to cash-in on a liquidity event at near record market prices. This is a wise strategy, one only has to look at the ethanol segment today vs. two years ago to see how quickly and completely the bubble can pop. Caithness has provided a model for this, effectively exiting the operations of renewable power plants with the ArcLight Capital deal consummated earlier this year.

But what about valuation? Ormat is a $300M gross sales company split with 80% coming from electricity generation and 20% from equipment sales. Net income trailing 12 months is $21M and current market cap is $2B, 100x earnings value. Wow. The company carries nearly $500M in debt and has $73M in cash. The generation portfolio is around 370MW today and could double in the next 5-7 years, though it would be interesting to see how the company would choose to finance such aggressive expansion.

As a point of comparison, Calpine (OTC: CPNLQ.PK) has a geothermal portfolio of 800MW, development potential to increase that by 500MW over the next 5-7 years, and also has over 23,000MW of natural gas generation assets. Admittedly, Calpine is working to emerge from a painful and slow bankruptcy and does not have an equipment business as points of difference. Looking at the revenue, (though Calpine declines to segment revenues by gas fired and geothermal segments) we estimate that Calpine is capturing at least $400M per year in revenue from their geothermal portfolio and throwing off in excess of $100M per year in net income from the portfolio. Calpine’s market cap? $750M.

On the basis of this analysis, we would suggest that it would make more sense for large players looking to enter the renewable energy market in a big way to acquire Calpine, even at 100% premium of market price today, divest the natural gas resources and develop the other 500MW in Calpine’s pipeline. This would likely be more cost effective than taking on a smaller portfolio with an equipment business at a staggering premium. The bankruptcy proceedings definitely would complicate the matter, but it would be worth it to get such valuable assets without paying such a steep premium over intrinsic value.

Our analysis leads us to believe that Ormat is worth about $40/share presently, thus the current share price of $51.50 leads to substantial downside risk in the near to mid-term.

Disclosure: MeV holds no position in Ormat or Calpine. 2 comments