Archive for the 'Business' Category

Chrysler Challenge

Earlier this week there was news that Kirk Kerkorian made a $4.5B cash bid for Chrysler. Must be nice to have that much change lying around…

But to get to the point of this post, it is Easter weekend and for a couple of billion people around the globe, that means celebrating the resurrection of Jesus (or, something to do with rabbits laying colorful eggs and various chocolate treats.) But I digress. Let’s assume Kerkorian gets Chrysler from the good folks at Daimler, what should he do with it?

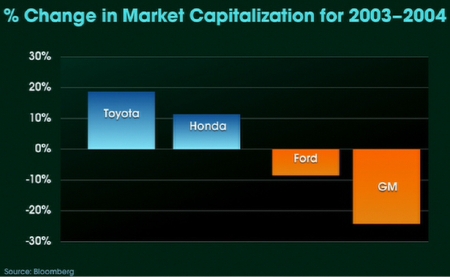

Like all American auto makers, it has a fleet of non-competitive vehicles, which coupled with rising fuel costs, is simply hammering sales. I snagged the graph below from the film An Inconvenient Truth, unfortunately, Chrysler’s market cap wasn’t on the slide since it is a subsidiary company.

It doesn’t take a Wall Street expert to interpret this chart. Fuel efficient vehicles are winning, and winning big. Last week, Toyota announced that it sold 28,453 hybrid vehicles in March. More than all of Saturn, GM’s fastest growing brand. This is not a temporary shift, it is permanent, inexorable, and accelerating.

As Easter suggests, sometimes things need to die before they can be resurrected and come back even stronger. I think that’s where the US Auto Industry is, it’s clearly dying because it is incapable of change.

Mr. Kerkorian, here’s the challenge: Don’t use half-measures, don’t compromise with hybrids. Crucify the gasoline and diesel engine. The 640hp Electric Mini project has already proved this is possible. Take the bold step forward to launch the following all electric vehicles from Chrysler:

- Full-sized pickup

- 4 door sedan

- Minivan

- Station wagon

- Coupe

Don’t get cute with this stuff, no distinctive designs, no hybrid systems, keep the range over 250 miles (400km,) and engineer the systems to use 4 motors, one on each wheel. Use your existing designs, rip the combustion engines, emissions equipment, and transmissions out and replace them with deep cycle batteries, 4 wheel mounted motors, and a 100 foot (30m) retractable extension cord. Engineer the power system to have the right performance characteristics: i.e., good low-end torque on the truck and fast acceleration on the passenger vehicles.

Get to market next year. It’s possible. What do you lose? The old market. The long haul market. But, do you care? Chrysler has lost, or is rapidly losing those markets anyway. Use your brand, your dealer network, and your manufacturing and distribution infrastructure to make this happen and to make it happen fast. And if Chrysler ultimately dies as a result of this decision? At least it went out swinging. And hey, you’re worth $15B now, you’ve still got $10B left.

This is not the time for half-measures, it’s the time for bold leadership. We’re closing factories and shipping work offshore, we’re sending billions into the middle east to fund terror each time we fill our gas tank, the temperature of the earth is quickly rising as a result of greenhouse gases. We’re facing a crisis on multiple dimensions.

Mr. Kerkorian, when you bought those surplus World War II bombers you took an enormous risk. When you built the original MGM Grand Casino, at the time, the world’s largest hotel, you took an enormous risk. You’ve got a track record, you’ve got the cash, you can do this.

The question is, will you?

Raser up 30% on private placement

Raser Technologies announced that they’ve completed a $12.5M private placement to help with drilling expenses. Traders were thrilled by this news causing the stock to climb 30%, though there has been a slight retreat since. What does this mean? In addition to the $5.5M AMP returned to Raser, there is at least $18M of cash available to Raser to funding drilling, which is phenomenally expensive.

Our unsolicited advice to the Raser team is, if you’re serious about the geothermal business (and by all indications you are,) consider buying a drill rig. With fully burdened geothermal well costs approaching $1,500/meter and the scarcity of drill rigs, this could be a solid capital acquisition that permanently reduces drilling costs by as much as 50% over the useful 30 year life of the rig.

So what did this extra money cost? The latest SEC filing indicates that Raser has 50.7M common shares outstanding. The private placement adds 2.7M shares to that total at a purchase price of $4.65 per share and grants 945,000 of warrants, essentially the right to by future shares, at a strike price of $6.05 per share. The combination of the shares and warrants (assuming they are excercised) will result in just over 7% dilution for shareholders of record at the time of the announcement.

As stated in prior entries, this is the latest in a series of deals of this type, which appears to be in vogue for geothermal developers.

Disclosure: The author holds no shares in Raser Technologies.

Consolidation time

We’ve seen a little of it already, but with hundreds of little renewable companies now operating and the bull run in the stock market showing signs of decline, consolidation should start to accelerate. It’s now time to figure out who will be acquiring and who will be targeted. The best acquirers will have a vision to fulfill and will have deep pockets (or access to deep pockets) to realize the consolidation. The targets will be predictable businesses that generate cash and carry large debt loads. Is anyone out there thinking Ormat? Calpine? Florida Power & Light?

Given the recent activity with KKR, Blackstone, and Goldman Sachs, it wouldn’t surprise me in the least if the private equity market leads this round of consolidation. Stay tuned, it’s going to be interesting.

Federal Production Tax Credit increases

Renewable electricity producers got a cost of living increase as the Internal Revenue Service published the inflation adjustment factor for 2006. This increases the current PTC credit from $19 per megawatt hour to $20 per megawatt hour. This is an annual process of review and, if appropriate, adjustment of the credit. The credit is available to any qualified renewable electricity producer for a period of up to 10 years.

Comments are off for this post

WFI, eco-* opportunity

While we mostly focus on electricity generation from renewable resources with something of a focus on geothermal technologies, I thought it was time to take a look at the home market.

WFI, A US company, listed on the Toronto Stock Exchange, presents a really interesting eco* (ecological and economic) opportunity: it has all the makings of a great investment and its products provide environmental benefit. In a nutshell, WFI uses geothermal heat exchange to heat or cool your home or office. WFI has two businesses, a product business consisting of the geothermal pumps (WaterFurnance) and an installation service that will install the heat exchange loops (LoopMaster.)

The DOE estimates that for each home installation of a geothermal heat pump it equates to taking two cars off the road for a year. These pumps have around 2.5 to 4 coefficient of performance, for every unit of energy that goes into the system 2.5 to 4 units of heat/cooling come out. The way these systems work is pretty simple, see the diagram below:

On the economic front, WFI earned $8.3M on sales of $91M and paid a dividend of $0.50/share, up from $6M, $72M, and $0.44/share last year. The company has been around for 25 years and is investing for expansion as green becomes the new red, white, and blue and fossil fuel prices continue to rise. WFI is trading around $22.80(C)/share currently.

This is one of those times that a company with a good product, in an expanding market, with a strong balance sheet, is poised to take off. Not only can investors benefit, but the customers, and the environment can benefit too. As always, do your own research before investing in any company, but I believe WFI presents an interesting opportunity below $21(C)/share.

Disclosure: The author holds no shares in WFI but is strongly considering an investment at the right price.