Archive for the 'Business' Category

Ormat reports Q1 earnings

Ormat, a leading geothermal operator and equipment provider, reported earnings today consistent with the pre-announcement last month. The press release is available to read here at your convenience.

In what must be a disappointing quarter for management, expenses were up on unplanned maintenance and revenue in the electricity operations were flat due to delays in bringing new projects online. The lone bright spot in this report is the performance of the equipment segment which saw an increase in sales from $16.5M a year ago to $18M.

Ormat management reaffirmed guidance that the company will be profitable for the year and that this miss was an isolated incident, or “it is unusual for so many issues to converge in one quarter” from the earnings call. We’ll watch Ormat carefully over the next few quarters, margins are thin and the debt load and debt service is high.

Calpine down nearly 30%

Calpine’s stock has been all over the place this year. Rumors started circulating of a potential private equity buyout at the end of last year and have escalated through mid-April and now things have gone quiet. That could mean that negotiations are ongoing or it could be that negotiations have stopped. In any case, it seems there is some profit taking going on which has sent the issue on a nearly 30% slide since April 25th.

We’ll keep monitoring the situation and will provide updates as they occur.

Ormat expected to miss

There is news today that Ormat is expected to post a Q1 loss in its earnings report due May 9. Analysts expected to see revenue of $67M and net income of $0.23 per share, but the company indicated that a net loss of $5.5 – $6.5M should be expected instead due to lower revenue on a delayed project and higher than expected maintenance costs at three plants. The company does assert that it will be profitable for 2007 as a whole. As the market is not yet open, the effects of this announcement have not been observed. But, we predict that Ormat will fall to the $35/share range on the logic discussed in an earlier post on this subject valuing the company.

This was a miss Ormat can ill-afford. Q1 of last year, Ormat announced revenue of $60.3M and net income of $0.25 per share. Is this a one-time blip, or is the debt and operations load too heavy? Only time will tell. Expect the valuation to drop toward 18x vs. the rich 40x multiple seen over the past 12 months.

Disclosure: Our principals hold no position in Ormat.

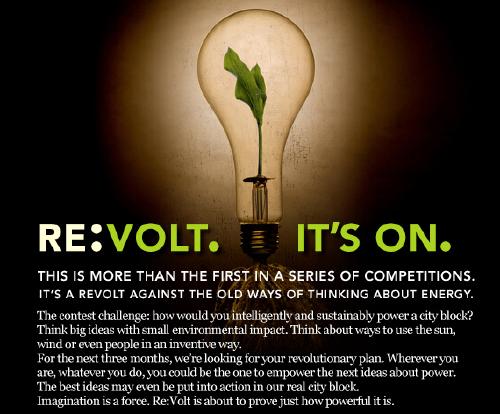

Re:Volt – An energy challenge

This is the latest in a series of contests aimed at sustainability by the folks at UrbanRevision. Submit your entry by May 1st.

Calpine up 15%, clears acquisition barriers

We’ve been watching Calpine with interest these past few months as it has become apparent that the company is for sale. Today the company announced that it reached an agreement with Cleco Corp over Acadia Power Holdings. This comes on the heels of the settlement with bond holders of $12B for $0.33 on the dollar last week.

It’s clear the Street likes the news as buyers sent the stock up another 15% today. In January, Calpine was trading for just over $1 per share and today’s closing price was $3.75 per share, nearly a 4 bagger.