Archive for the 'Geothermal' Category

Seeking Alpha on Ormat

Photo Credit: Mike Harding

Via Seeking Alpha:

On December 17, Ormat Technologies Inc. (NYSE:ORA) announced a 20-year agreement with Southern California Edison for the sale of energy from ORA’s 30 megawatt plant at Imperial Valley, CA, that is expected to come on line by mid 2012. On December 18, Ormat announced the execution of agreements in the 340 MW Sarulla Geothermal Project in Indonesia where Ormat will design and supply the power generating units. These agreements indicate that ORA will not only remain as a leading geothermal power producer in US, but is also expanding its international presence.

…

The stock has been making good gains (almost 70%) since June ’07 lows. This gain has resulted in the stock breaking out of a prolonged consolidation that extended for almost a year and a half. The lofty PE (95 and 45 – Trailing and Forward respectively; Source: Yahoo Finance) makes the stock appears expensive at current levels. Nevertheless, considering the business opportunities available for ORA, any dip on the stock can be a buy opportunity for short and medium-term players. The Reno, NV based company’s policy of targeting an annual payout ratio of at least 20% of its net income (ORA has been distributing regular quarterly dividends for the last three years) makes the stock attractive for those who want a steady stream of income.

We agree that Ormat is an impressive player in the geothermal space, and the largest and most stable pure play. However, we believe the stock is tremendously expensive (even accounting for prospects and growth) at present levels.

One aspect of the company not covered in the article is the split between the equipment and electricity generation segments. We believe the equipment and electricity operations segments in the same company will prove to be problematic strategically as customers of the equipment segment increasingly see the electricity segment as a competitor. The equipment segment is about 20% of the company’s revenue and is “lumpy” from quarter to quarter. The electricity segment is where the growth is occurring. We wonder if it might not make more sense to spin out the equipment business as an “arms” dealer to all, including a separate Ormat run electricity generator.

All that being said, geothermal is the renewable that has yet to be discovered in the mainstream and it may be that there is substantial upside still possible in the stock given the overall heat of the segment. As an additional data point, traditional electricity generators trade at a PE of around 15 (Source: Yahoo Finance.)

Disclosure: The author holds no position in Ormat.

$130M market cap for Calpine

Things continue to look grim for Calpine, the independent power producer struggling to emerge from bankruptcy protection. Squeezed between declining margins (real terms, not necessarily GAAP terms with special charges coming off the books etc.) demanding creditors, one has to wonder if Calpine will emerge from the proceedings now.

Earlier this week the company announced a reduction of their credit facility by $400M (the entire facility was $8B) and a revaluation of the company when it emerges from bankruptcy of $18.95B. Creditors believe the valuation should be north of $24B leaving a significant gap. The bankruptcy court has approved the revised plan and the company should emerge in January. But, this was true in June too and didn’t happen.

Why do we care? Calpine’s portfolio is dominated by natural gas-fired power plants. But, a small and profitable segment of the company is comprised of the 19 plants located in The Geysers region of California producing about 750MW of clean power. We’re very interested in seeing those valuable assets protected and not have them sink with the Calpine ship.

Note: The issue is gaining today, but the market cap is still sub-$200M down from ~$2B in June.

Disclosure: The author holds no position in Calpine (though he did consider it as a speculative investment at one time.)

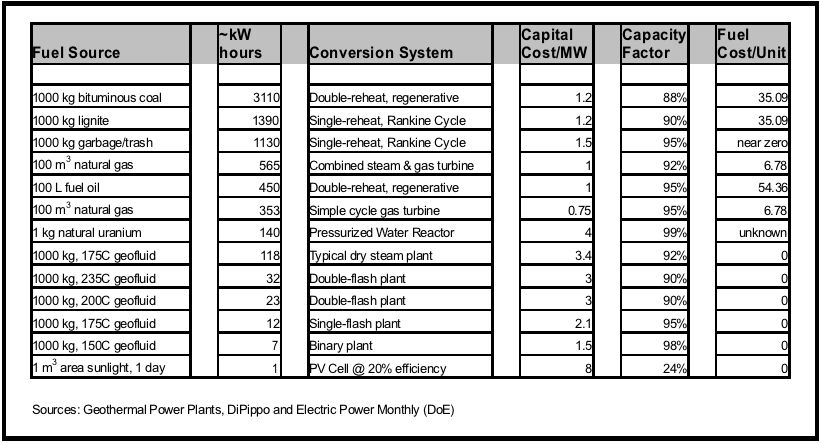

Instructive Chart

If ever you wanted to understand why the industry continues to develop coal plants, even though the negative impact is clear for all to understand, look at the chart above. You’ll notice that coal produces the most energy per unit, at a low cost per unit, and is relatively cheap from a capital cost perspective to build. With clean coal restrictions, the capital cost increases pretty radically (about 3x) but the energy output per unit and fuel cost still remain attractive.

A wind row ought to be added to this chart, but the standard unit was a little tricky to calculate. If anyone has good ideas about how to represent that aspect, please leave a comment. Comments are off for this post

One Redeeming Feature of Energy Bill

Last week we posted an entry excoriating Congress (the Senate in particular) for changes to the Energy Bill which among other things, ripped out production tax credits and renewable portfolio standards. But, credit where credit is due, there is a $95M line item for geothermal R&D which will be earmarked to do the following things:

- Geopressured and oil and gas field co-produced resource production: Clean, renewable geothermal energy can be produced with existing natural gas and oil and gas fields. These uses could revolutionize both the geothermal and the fossil fuel industry.

- Industry-coupled drilling: This program pairs the federal government with geothermal developers to reduce drilling risks and improve drilling precision. Exploration and drilling pose some of the most difficult risks for new geothermal projects and can add significantly to project costs.

- Enhanced geothermal systems (EGS): The MIT and NREL reports suggest that 100,000 megawatts (MW) or more of geothermal power could

be produced using advanced technology. A sustained research and development effort is needed to move towards this goal. - Center for geothermal technology transfer: Such a center, which currently does not exist, is critical to developers seeking information about geothermal prospects and technology advances.

- International Geothermal Collaboration: DOE and US AID are directed to support international geothermal development, particularly related to the African Rift Geothermal Development Facility, Australia, China, France, the Republic of Iceland, India, Japan, and the United Kingdom.

Karl Gawell from the Geothermal Energy Association has a nice write-up of the bill at the GEA website. So it’s not all bad news, but still, the PTC longterm extension and RPS omissions are glaring.

Comments are off for this post

New H3 Exploration Technique

Photo Credit: Roy Kaltschmidt

Via Renewable Energy Access:

In a survey of the northern Basin and Range province of the western United States, geochemists Mack Kennedy of the Department of Energy’s Lawrence Berkeley National Laboratory and Matthijs van Soest of Arizona State University have discovered a new tool for identifying potential geothermal energy resources with no drilling required.

…

Kennedy and van Soest made their discovery by comparing the ratios of helium isotopes in samples gathered from wells, surface springs, and vents across the northern Basin and Range. Helium-three, whose nucleus has just one neutron, is made only in stars, and Earth’s mantle retains a high proportion of primordial helium-three (compared to the minuscule amount found in air) left over from the formation of the solar system. Earth’s crust, on the other hand, is rich in radioactive elements like uranium and thorium that decay by emitting alpha particles, which are helium-four nuclei. Thus a high ratio of helium-three to helium-four in a fluid sample indicates that much of the fluid came from the mantle.

High helium ratios are common in active volcanic regions, where mantle fluids intrude through the ductile boundary of the lower crust. But when Kennedy and van Soest found high ratios in places far from volcanism, they knew that mantle fluids must be penetrating the ductile boundary by other means.

…

“We have never seen such a clear correlation of surface geochemical signals with tectonic activity, nor have we ever been able to quantify deep permeability from surface measurements of any kind,” says Kennedy. The samples they collected on the surface gave the researchers a window into the structure of the rocks far below, with no need to drill.

As a company with a vested interest in the Basin and Range province and in alternate methods of geothermal resource assessment, this is a welcome breakthrough. The research paper describing the technique and results published by van Soest and Kennedy appears in Science is available to subscribers for review. If this method proves reliable, it could open a whole new round of geothermal exploration (and certainly will be used as another tool to assess current geothermal prospects.)

2 comments