Blog Archives

Raser up 30% on private placement

Raser Technologies announced that they’ve completed a $12.5M private placement to help with drilling expenses. Traders were thrilled by this news causing the stock to climb 30%, though there has been a slight retreat since. What does this mean? In addition to the $5.5M AMP returned to Raser, there is at least $18M of cash available to Raser to funding drilling, which is phenomenally expensive.

Our unsolicited advice to the Raser team is, if you’re serious about the geothermal business (and by all indications you are,) consider buying a drill rig. With fully burdened geothermal well costs approaching $1,500/meter and the scarcity of drill rigs, this could be a solid capital acquisition that permanently reduces drilling costs by as much as 50% over the useful 30 year life of the rig.

So what did this extra money cost? The latest SEC filing indicates that Raser has 50.7M common shares outstanding. The private placement adds 2.7M shares to that total at a purchase price of $4.65 per share and grants 945,000 of warrants, essentially the right to by future shares, at a strike price of $6.05 per share. The combination of the shares and warrants (assuming they are excercised) will result in just over 7% dilution for shareholders of record at the time of the announcement.

As stated in prior entries, this is the latest in a series of deals of this type, which appears to be in vogue for geothermal developers.

Disclosure: The author holds no shares in Raser Technologies.

Consolidation time

We’ve seen a little of it already, but with hundreds of little renewable companies now operating and the bull run in the stock market showing signs of decline, consolidation should start to accelerate. It’s now time to figure out who will be acquiring and who will be targeted. The best acquirers will have a vision to fulfill and will have deep pockets (or access to deep pockets) to realize the consolidation. The targets will be predictable businesses that generate cash and carry large debt loads. Is anyone out there thinking Ormat? Calpine? Florida Power & Light?

Given the recent activity with KKR, Blackstone, and Goldman Sachs, it wouldn’t surprise me in the least if the private equity market leads this round of consolidation. Stay tuned, it’s going to be interesting.

Tesla Turbines

Atlantic Geothermal posted a link to a video by Jeff Hayes discussing Tesla Turbines. This served to remind me about these turbine/pumps and other “dead” technologies like Stirling engines. This technology is relevant as many geothermal resources have extremely high total dissolved solids (like the Salton Sea) that are expensive to harvest with conventional turbine technology.

Conventional turbines consist of a shaft with blades mounted upon it. This looks very much like closely spaced propeller blades that are pushed by pressure exerted through gas or air which causes the shaft to rotate. Conventional steam turbines have inlets near the center of a shaft with the gas/steam expanding out toward the ends with the blades becoming progressively larger from the center to the end. See the photo below of a conventional steam turbine shaft and blade assembly, the far right of the photo is where the gas/steam enters on this model and it expands and exits on the left.

Image Credit: Christian Kuhna

These turbine shaft/blade assemblies can weigh as much as 40 tons and spin at 3,600 rpm. That’s alot of mass spinning very fast. When a steam resource with high total dissolved solids is pushed through conventional turbine systems, it results in scaling, friction, and loss of efficiency. The higher the TDS, the more frequently these devices require maintenance, expensive both in absolute terms and lost opportunity.

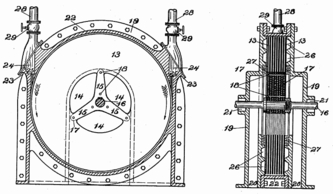

The Tesla turbine is a completely different animal. Rather than depending upon blades, it depends on centrifugal force created by adhesion of the steam/gas to large, smooth surface areas of closely spaced rotor disks. See the drawing below to get a sense of the difference between the Tesla system and conventional turbines.

Image Credit: Unknown

The figure on the left shows an end on view of the device with the shaft pointed toward the reader. One rotor is visible in this elevation with steam/gas entering on the top right of the device and exiting through the top left. Modern designs have only one inlet with the exhaust coming through the shaft region, this is important because as the rotors spin the gas is being pulled toward the shaft in a tight series of concentric circles.

The figure on the right is a side elevation of the device where the rotor assembly is the most interesting feature. These smooth disks are closely spaced (0.032″) and the adhesion of the gas/steam to the rotors cause the rotors and subsequently the shaft to rotate. The difference between conventional turbine design and the Tesla design is glaringly obvious, there is no good place for TDS to build up scaling. Another enormous difference between conventional turbines and Tesla’s design is operating speed, the Tesla, depending on rotor size, needs to operate in the 25,000 rpm realm and higher to effectively generate mechanical force. Operation at lower speeds doesn’t allow appreciable power to be harvested (which runs completely contrary to conventional turbines where power may be harvested throughout the range of rotational rpm.)

Today, Tesla turbines are used commonly as pumps for viscous materials (like crude oil) but have not found a place in turbine engine use as yet. The Department of Energy has dismissed Tesla turbines from consideration stating that “they don’t work” when compared against conventional turbines – although, this isn’t true when operated at high rpm which is the design center. So, will we see any Tesla turbines in operation? I wouldn’t bet on it in the near future, but longer term, it wouldn’t surprise me in the least to see a geothermal plant using this technology in the next 10 years.

90.5 million acres of corn planted

This constitutes a 15% increase from 2006 and the largest corn planting in over 60 years. The demand for corn is being driven largely by the use of corn to produce ethanol (though other types of plants have greater ethanol yields in other places, like sugar cane in Brazil.)

Since farming is something of a zero sum game, other species of crops will decrease as a natural consequence of the bull run on corn, notably soy beans which have decreased to 67.1M acres in 2007. The US Department of Agriculture released a report this morning detailing these shifts and more.

Federal Production Tax Credit increases

Renewable electricity producers got a cost of living increase as the Internal Revenue Service published the inflation adjustment factor for 2006. This increases the current PTC credit from $19 per megawatt hour to $20 per megawatt hour. This is an annual process of review and, if appropriate, adjustment of the credit. The credit is available to any qualified renewable electricity producer for a period of up to 10 years.

Comments are off for this post