Blog Archives

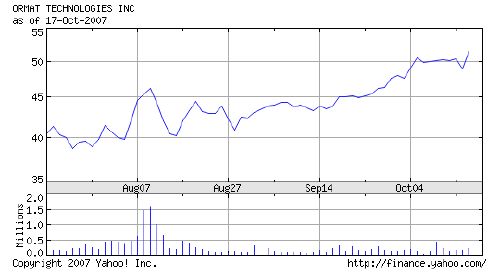

Ormat up on takeover rumors

Over the past 3 months, Ormat (NYSE: ORA) market capitalization has increased to nearly $2B. The run up of the stock can be attributed to rumors that the company is considering some sort of takeover by private equity. The two names most closely connected to such potential deals are Goldman Sachs and Apax. Today, Apax has denied the rumors of such a deal.

What we do know is that a consolidation is underway in the renewable energy industry as established energy players rush to start or enhance their portfolios and renewable energy companies seek to cash-in on a liquidity event at near record market prices. This is a wise strategy, one only has to look at the ethanol segment today vs. two years ago to see how quickly and completely the bubble can pop. Caithness has provided a model for this, effectively exiting the operations of renewable power plants with the ArcLight Capital deal consummated earlier this year.

But what about valuation? Ormat is a $300M gross sales company split with 80% coming from electricity generation and 20% from equipment sales. Net income trailing 12 months is $21M and current market cap is $2B, 100x earnings value. Wow. The company carries nearly $500M in debt and has $73M in cash. The generation portfolio is around 370MW today and could double in the next 5-7 years, though it would be interesting to see how the company would choose to finance such aggressive expansion.

As a point of comparison, Calpine (OTC: CPNLQ.PK) has a geothermal portfolio of 800MW, development potential to increase that by 500MW over the next 5-7 years, and also has over 23,000MW of natural gas generation assets. Admittedly, Calpine is working to emerge from a painful and slow bankruptcy and does not have an equipment business as points of difference. Looking at the revenue, (though Calpine declines to segment revenues by gas fired and geothermal segments) we estimate that Calpine is capturing at least $400M per year in revenue from their geothermal portfolio and throwing off in excess of $100M per year in net income from the portfolio. Calpine’s market cap? $750M.

On the basis of this analysis, we would suggest that it would make more sense for large players looking to enter the renewable energy market in a big way to acquire Calpine, even at 100% premium of market price today, divest the natural gas resources and develop the other 500MW in Calpine’s pipeline. This would likely be more cost effective than taking on a smaller portfolio with an equipment business at a staggering premium. The bankruptcy proceedings definitely would complicate the matter, but it would be worth it to get such valuable assets without paying such a steep premium over intrinsic value.

Our analysis leads us to believe that Ormat is worth about $40/share presently, thus the current share price of $51.50 leads to substantial downside risk in the near to mid-term.

Disclosure: MeV holds no position in Ormat or Calpine. 2 comments

Small-scale geothermal systems

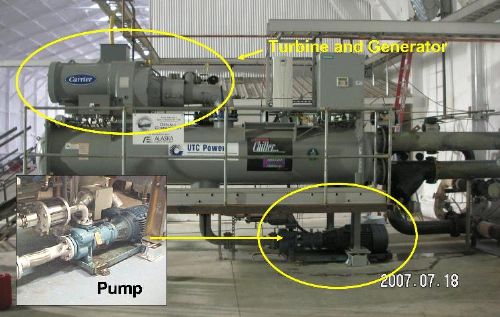

At the GRC Annual Meeting earlier this month, the Chena Hot Springs project was discussed again. Chena is in central Alaska, about 65 miles northeast of Fairbanks and is home to a resort as well as a 400kw geothermal plant. At heart, the Chena geothermal power plant is no different than any other binary geothermal power plant. But in detail, there are some interesting aspects of the project that make it worthy of note:

- Low resource temperature – The production temperature from the wells at Chena is 165F (74C). Production from this low temperature is possible because of the ample supply of 40F (4C) cooling water that enables a consistent 120+F (49+C) difference in temperature at the harvest point. Location, location, and location matter in this instance.

- Commercial chiller harvest – Chena elected to go with a commercial, off-the-shelf power conversion unit from UTC. These 280kw gross, 225kw net units are relatively cheap and are essentially industrial chillers being run in reverse. UTC has been producing these units for decades, their performance characteristics and failure modes are well known and understood. This is a departure from the Ormat approach which is to fit a custom harvest system to the resource which makes implementation much cheaper and faster.

- Shallow resource depth – The production and injection wells at Chena aren’t very deep by conventional geothermal harvest standards. This reduces the cost and complexity of implementing the systems. The wells at Chena range from 100 to 1000 feet (30-300m) deep.

- Time to production – Unlike most geothermal projects at utility scale, this project was implemented in less than a year real time, and less than 2 years elapsed time (due to the seasons – it’s tough to work in -40F weather.) The world land speed record for other plants appears to be 5 years elapsed time.

- Government sponsorship – The US Department of Energy and the State of Alaska worked with the project to support exploration, drilling, and development activities. This is not always the case, but in this instance, the public/private partnership seemed to work.

Before the geothermal power plant went live, Chena’s power was provided by diesel generators at a cost of around $0.30/kwh. Now, the cost has dropped to $0.07/kwh and the resort has less ambient noise and particulate matter in the near vicinity because the diesels aren’t running. That’s a real economic benefit coupled with a synergistic effect that is beneficial to the primary business of the resort, a clean, quiet environment. Not every project can be like this, but one has to wonder how many other small scale geothermal systems could be tapped and harvested. Over the lifetime of the plant (if it’s running at full capacity of 400kw for 30 years), the economic benefit just in difference of cost/kwh will be on the order of $23.7M – impressive.

3 comments

Galloping Gertie Wind Harvest

Using aeroelastic flutter, the same effect that resulted in the collapse of the Tacoma Narrows Bridge (aka Galloping Gertie), Shawn Frayne has created a wind harvest device that is small, cheap to produce, and simple. The 2:05 video below has details of the breakthrough.

Tip of the Hat: Popular Mechanics 2 comments

Another Conservation Game

This time, from Chevron. In July we wrote about My Abodo, a consumer-focused exercise that enabled one to make choices about how they live then to see the impact of those changes on the environment around them. In retrospect, it was a very cool exercise and you can still see our little MeV home we created – optimized for lowest level of impact.

Today, Chevron has gotten into the act with WillYouJoinUs.com, more a Sim City approach to the same problem where you, the Mayor and CFO make decisions about energy supply then watch the impacts on economics, environment, and security through a few simulation phases over time. A screen shot of MeV City is located below the jump.

It’s great to see Chevron get engaged in this area, their bread is obviously still buttered by fossil fuels, but in the last few months they seem to be getting on the green bandwagon. Would it surprise you to learn that Chevron is the world’s largest geothermal electricity provider? Interesting, I’d think that geothermal power would be an option on their game. Oh well…

Tip of the hat: Didn’t You Hear? Comments are off for this post

DoE: 30 years and $350B later

This month marks the 30th birthday of the US Department of Energy. Formed in the aftermath of the 1970’s energy crisis, the Department was created to catalyze the transformation of the US from a net-oil importer and net-pollution exporter into a nation with a secure energy supply and sustainable environmental footprint while keeping the economy humming along and keeping energy prices stable for consumers. The 2007 version of the Department’s mission is:

- Energy Security

- Nuclear Security

- Scientific Discovery and Research

- Environmental Responsibility

- Management Excellence

While it’s clear there have been many accomplishments that the DoE can claim, relative to their mission, these are the results of the 30 year history:

- Energy Security – 1977, 77% of our electricty generated from fossil fuels and 46.5% of oil imported. 2007, 70% of our electricity generated from fossil fuels and 65.9% of oil imported.

- Nuclear Security – 1977, The US, USSR, UK, France, and China were nuclear powers. In 2007, India, Pakistan, Israel, North Korea, and perhaps Iran have entered the fraternity. Security has proven lax at national labratories and military bases. Nuclear electric power production has increased from 9% in 1977 to nearly 21% in 2007. Nuclear waste management issues are still unresolved and the problem continues to grow. There have been no nuclear attacks.

- Scientific Discovery and Research – Many interesting discoveries have been made; but the percentage of fossil fuel electricity generation, the nuclear waste issues, and oil import growth indicate that the breakthroughs are not making it to commercial application at a fast enough rate to make a difference.

- Environmental Responsibility – Renewable electrcity production has decreased in share from 14.3% in 1977 to 9% in 2007. CO2 levels have grown from ~335 parts per million in 1977 to >380 ppm at present.

- Management Excellence – Though it’s not quite clear what this means, the budget of the DoE was $6.3B in 1977 and has grown to $23.5B in 2007. The cumulative spend on the DoE from 1977 to present is estimated to be in excess of $350B.

Many dedicated and talented people work for the DoE, we’ve met them in our travels. However, we have to question the overall direction of the agency and its resources since the mission has not been accomplished. Compared with the levels 30 years ago, the US is more dependent than ever on foreign oil to sustain the demand for transportation fuel, the electricity industry produces a smaller percentage of renewable power, the level of greenhouse gases has increased nearly 10%, and nuclear weapons technology and capability have proliferated. However, the DoE’s budget has increased 4-fold over that same time horizon.

It’s time to closely examine our national priorities and align resources in a whole-hearted manner to achieve the necessary impacts. It’s one thing to have a mission posted on a web site, it’s another to allocate resources toward that mission and measure progress each day, week, month, and year toward achieving those goals.