Archive for October, 2007

Geothermal Finance & Development Summit

This event is upcoming November 14-16 in San Jose. Looking at the agenda, it is geared toward educating financial types about geothermal development and geothermal developers about financing options. The details of the event are available here. There is also a one day pre-session specifically on financing activities. If you’re in the Bay Area or planning to be in the Bay Area, this could be an interesting session to attend.

Turn this…

Into this…

7.5MW well for Blue Mountain

Last week, Nevada Geothermal Power announced the results of the flow test for their production well, 23-14, on the Blue Mountain property. The well tested out at 10MW gross power and 7.5MW net power when pump assisted and it produced from depths of around 1,000m (~3,300 feet) at temperature of 190C (375F). Armed with this information, the development of the site should now rapidly progress enabling a plant to be operational in the foreseeable future. The last remaining hurdle is transmission, a new line will need to be constructed to deliver the power to the grid. Comments are off for this post

High-Resolution Aerial Images

As we pursue our project, we’ve found that we needed high resolution aerial imaging to kick off the process. There are many companies out there that provide these services, but we chose GlobeXplorer due to instant delivery, product selection, price, and image quality. If you’re looking for aerial photographs, give them a try.

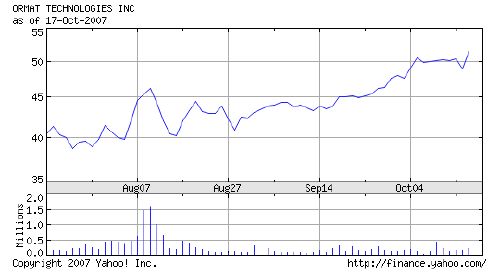

Ormat up on takeover rumors

Over the past 3 months, Ormat (NYSE: ORA) market capitalization has increased to nearly $2B. The run up of the stock can be attributed to rumors that the company is considering some sort of takeover by private equity. The two names most closely connected to such potential deals are Goldman Sachs and Apax. Today, Apax has denied the rumors of such a deal.

What we do know is that a consolidation is underway in the renewable energy industry as established energy players rush to start or enhance their portfolios and renewable energy companies seek to cash-in on a liquidity event at near record market prices. This is a wise strategy, one only has to look at the ethanol segment today vs. two years ago to see how quickly and completely the bubble can pop. Caithness has provided a model for this, effectively exiting the operations of renewable power plants with the ArcLight Capital deal consummated earlier this year.

But what about valuation? Ormat is a $300M gross sales company split with 80% coming from electricity generation and 20% from equipment sales. Net income trailing 12 months is $21M and current market cap is $2B, 100x earnings value. Wow. The company carries nearly $500M in debt and has $73M in cash. The generation portfolio is around 370MW today and could double in the next 5-7 years, though it would be interesting to see how the company would choose to finance such aggressive expansion.

As a point of comparison, Calpine (OTC: CPNLQ.PK) has a geothermal portfolio of 800MW, development potential to increase that by 500MW over the next 5-7 years, and also has over 23,000MW of natural gas generation assets. Admittedly, Calpine is working to emerge from a painful and slow bankruptcy and does not have an equipment business as points of difference. Looking at the revenue, (though Calpine declines to segment revenues by gas fired and geothermal segments) we estimate that Calpine is capturing at least $400M per year in revenue from their geothermal portfolio and throwing off in excess of $100M per year in net income from the portfolio. Calpine’s market cap? $750M.

On the basis of this analysis, we would suggest that it would make more sense for large players looking to enter the renewable energy market in a big way to acquire Calpine, even at 100% premium of market price today, divest the natural gas resources and develop the other 500MW in Calpine’s pipeline. This would likely be more cost effective than taking on a smaller portfolio with an equipment business at a staggering premium. The bankruptcy proceedings definitely would complicate the matter, but it would be worth it to get such valuable assets without paying such a steep premium over intrinsic value.

Our analysis leads us to believe that Ormat is worth about $40/share presently, thus the current share price of $51.50 leads to substantial downside risk in the near to mid-term.

Disclosure: MeV holds no position in Ormat or Calpine. 2 comments

Small-scale geothermal systems

At the GRC Annual Meeting earlier this month, the Chena Hot Springs project was discussed again. Chena is in central Alaska, about 65 miles northeast of Fairbanks and is home to a resort as well as a 400kw geothermal plant. At heart, the Chena geothermal power plant is no different than any other binary geothermal power plant. But in detail, there are some interesting aspects of the project that make it worthy of note:

- Low resource temperature – The production temperature from the wells at Chena is 165F (74C). Production from this low temperature is possible because of the ample supply of 40F (4C) cooling water that enables a consistent 120+F (49+C) difference in temperature at the harvest point. Location, location, and location matter in this instance.

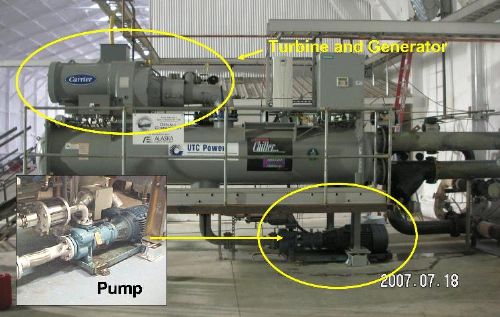

- Commercial chiller harvest – Chena elected to go with a commercial, off-the-shelf power conversion unit from UTC. These 280kw gross, 225kw net units are relatively cheap and are essentially industrial chillers being run in reverse. UTC has been producing these units for decades, their performance characteristics and failure modes are well known and understood. This is a departure from the Ormat approach which is to fit a custom harvest system to the resource which makes implementation much cheaper and faster.

- Shallow resource depth – The production and injection wells at Chena aren’t very deep by conventional geothermal harvest standards. This reduces the cost and complexity of implementing the systems. The wells at Chena range from 100 to 1000 feet (30-300m) deep.

- Time to production – Unlike most geothermal projects at utility scale, this project was implemented in less than a year real time, and less than 2 years elapsed time (due to the seasons – it’s tough to work in -40F weather.) The world land speed record for other plants appears to be 5 years elapsed time.

- Government sponsorship – The US Department of Energy and the State of Alaska worked with the project to support exploration, drilling, and development activities. This is not always the case, but in this instance, the public/private partnership seemed to work.

Before the geothermal power plant went live, Chena’s power was provided by diesel generators at a cost of around $0.30/kwh. Now, the cost has dropped to $0.07/kwh and the resort has less ambient noise and particulate matter in the near vicinity because the diesels aren’t running. That’s a real economic benefit coupled with a synergistic effect that is beneficial to the primary business of the resort, a clean, quiet environment. Not every project can be like this, but one has to wonder how many other small scale geothermal systems could be tapped and harvested. Over the lifetime of the plant (if it’s running at full capacity of 400kw for 30 years), the economic benefit just in difference of cost/kwh will be on the order of $23.7M – impressive.

3 comments