Archive for June, 2007

Move over Tesla…

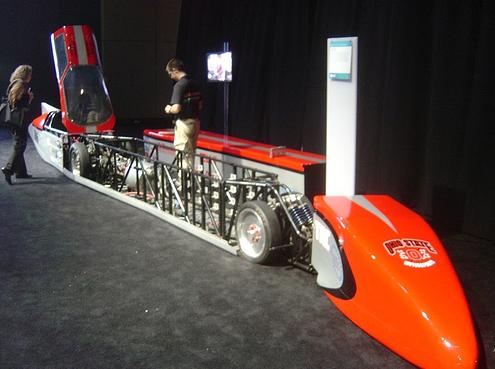

Here comes the Buckeye Bullet.

OK, it’s not a fair comparison, Tesla is a road worthy electric vehicle and the Buckeye Bullet is a single purpose speed machine. Back in 2004, the Buckeye Bullet 1 set and still holds the land speed record for electric vehicles at 315 mph (506 kph) at Bonneville Salt Flats. The Ohio State University College of Engineering is at it again this time attempting to build a hydrogen powered vehicle, the Buckeye Bullet 2, to attempt to set more records in August, 2007.

Who says clean can’t be fast? Comments are off for this post

Polaris Geothermal resolves Nicaraguan Concession Dispute

In what can only be described as good news for Polaris Geothermal, the dispute that began in February of this year over the legality of their Nicaraguan geothermal concession has been resolved. Polaris’ Nicaraguan operation, PENSA, retains full control over the concession and plans to continue development on the site in August. This will lead to the eventual operation of a gross 75MW, net 66MW facility.

Based on this news, a nice pop in the share price is in the cards for today. Polaris was most recently trading at $1.15/share.

Ormat Monetizes Production Tax Credits

In a deal announced this morning, Ormat has formed a new subsidiary, OPC LLC, with Morgan Stanley and Lehman Brothers. Under the terms of the deal, Ormat will transfer the Desert Peak 2, Steamboat Hills, and Galena 2 geothermal facilities to the subsidiary and upon completion, Galena 3. The equity investors will receive the benefits of the production tax credits at the geothermal plants and Ormat will gain cash proceeds from plant operations and will continue to operate the facilities.

Under the terms of the deal, Ormat will gain $118.4M from the asset transfer in two tranches, $71.2M now and $46.6 when Galena 3 is operational and transferred into the new entity. Upon reaching ROI thresholds for the equity investors, Ormat will have the option of repurchasing the assets from the subsidiary and will continue to harvest operating income until the capital investment of plant development is repaid in any case.

This is a smart use of excess production tax credits that benefits shareholders over the long term. At prices under $35/share, we continue to believe that Ormat presents an attractive investment opportunity.

Undersea turbine demonstrator, 1.2MW

Marine Current Turbines has today confirmed that installation of its SeaGen commercial tidal energy system will commence during the week of August 20th in Northern Ireland’s Strangford Lough. At 1.2MW capacity, SeaGen will be the world’s largest ever tidal current device by a significant margin, and will generate clean and sustainable electricity for approximately 1000 homes. It is also a world first in being a prototype for commercial technology to be replicated on a large scale over the next few years….

Having now seen a number of different undersea rotors it’s clear that most are inspired by wind designs. However, given the different density and velocity of the resource (water vs. air) it’s curious that there aren’t more water specific designs. For instance, you might expect the most efficient rotors to mimic the screws seen on ships vs. propellers seen on airplanes. Perhaps one of our readers could offer an explanation for the design center choices around sea harvest rotor design.

6 comments

Calpine ready to go it alone

Despite persistent rumors of various groups working to take Calpine private, it looks as though the company will try to make a go of it alone. The June 20 target to emerge from bankruptcy is fast approaching meaning one window for this decision is about to close, of course, another will open thereafter but the terms and situation will be vastly different.

One has to wonder if the run up in the stock price will be sustained with the changing view point on going private? Will investors be patient enough to see what the impact of Calpine’s relatively clean power can bring on the market? Given that the company has some 25,000MW of generation (700MW geothermal the balance natural gas) it is positioned as a clean energy provider in a time that coal generation is under attack. The company has made progress on restructuring its debt and streamlining its portfolio. But it’s unclear if the resulting company will be consistently profitable.

But is that enough? Prices of natural gas continue to rise squeezing margins. The geothermal bit of the portfolio is very interesting and productive, but is less than 1/25th the entire company’s generation capability. Yes, the fuel is “free”, but the cost of accessing the fuel over the lifetime of the plant is paid up front with exploration and drilling costs. Clean energy will command a premium price, that’s clear. How much of their portfolio can take advantage of that market trend? We shall see.

It’s unclear what Calpine is really worth at this point and we can’t tell if the issue provides good value or not. But, we’ll watch with interest as Calpine emerges from bankruptcy and as we can determine a fair valuation for the company, we’ll share it. Right now, it’s chock full of unknowns and potential upside.