Archive for June, 2007

What are the costs to produce ethanol?

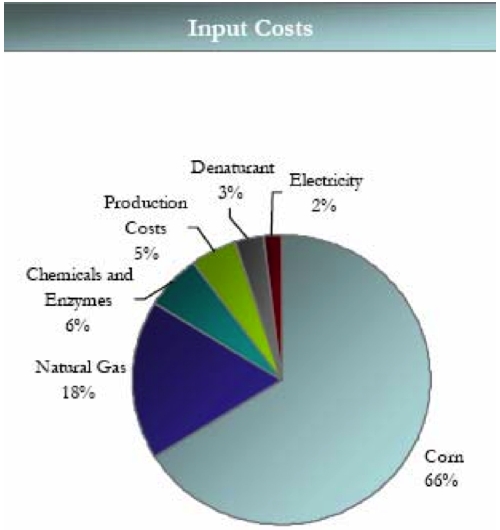

Another interesting tidbit picked up at REFF was what the requisite input costs are in the production of ethanol in the US. The pie chart above shows that the largest cost of input by far is the feedstock, corn at 66%. The cellulosic approach definitely makes sense as it attacks this major cost of production – one has to wonder if nations like Brazil, where 40% of their transport fuels are ethanol, experience a similar input cost percentage using sugar cane as the feedstock?

The next large cost is natural gas used in the distilling process. The natural gas and feedstock costs account for 84% of the production cost for ethanol! Unbelievable. Changing the equation of production costs will definitely have an impact on the future of the fuel. Corn prices have doubled as the demand for ethanol has increased. Natural gas prices have doubled in the past 6 years. Unless these trends moderate or the production methodology changes to break from the dependance on natural gas and corn, ethanol will become ever more expensive to produce. Comments are off for this post

Vacation Time

Due to vacation season, coverage will be spotty until July 11. This doesn’t mean zero new content, it does mean there will be a reduced information flow over the next 2 weeks.

Comments are off for this post

Biomass to go

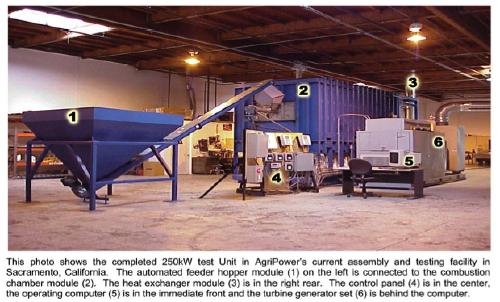

AgriPower, a biomass equipment provider, has created and tested a new transportable biomass power unit that outputs net 225kw. This is an interesting technology as it can be taken to where the fuel is located for distributed generation rather than causing the fuel to be transported to a large, central generation site. Comments are off for this post

CNNMoney.com discovers geothermal

In an article published today shows that the world is slowly waking up to geothermal:

NEW YORK (CNNMoney.com) — Old Faithful and expensive contraptions in the basement that never really worked – that’s what many people think of when they think geothermal energy.

But thanks to advances in technology, a better political climate and rising electricity prices, geothermal is quickly losing its status as renewable energy’s most unloved sector. In fact, investment in the sector jumped nearly fourfold over the last two years, to about $100 million last year.

“This resource is available, and it could develop to 30 times what is currently used,” said Curt Robinson, executive director of the Geothermal Resources Council, an educational and professional organization.

There are two issues with this article, one, there are enormous hydrothermal systems available to harvest (if only there was an exploration program to look for them) – HDR isn’t the only growth area. And two, utilities are falling over themselves to buy geothermal energy to meet RPS needs. Why? Because it’s baseload power friends and it’s the only renewable other than hydro-electric power that can claim to be baseload.

It is nice to see the world waking up a bit, solar and wind are great, but they can’t (and won’t) solve the problem on their own.

Investment in Clean Tech

Last week at the Renewable Energy Financing Forum there were some great data points given about the level of investment in renewable energy and clean tech. The rate of growth and the sheer amount of investment are overwhelming:

- 2006, the total venture investment was $2.4B – of that amount, $1B was invested for “steel in ground” projects

- 2007, Q1, the total venture investment was $0.9B – a run rate of $3.6B for the year

- 2006, mergers and acquisitions totaled $41B

- 2007, year-to-date, mergers and acquisitions totaled $43B

- 2006, initial public offerings raised $7.3B

- 2007, year-to-date, initial public offerings totaled $2.2B – it’s worth noting another $5.5B in value has filed for 2007 though has not yet been offered.

The numbers are staggering, particularly when one considers that the total venture investment in this space was a mere $400M in 2003. The source for this data generally is New Energy Finance.

Comments are off for this post