Archive for the 'Business' Category

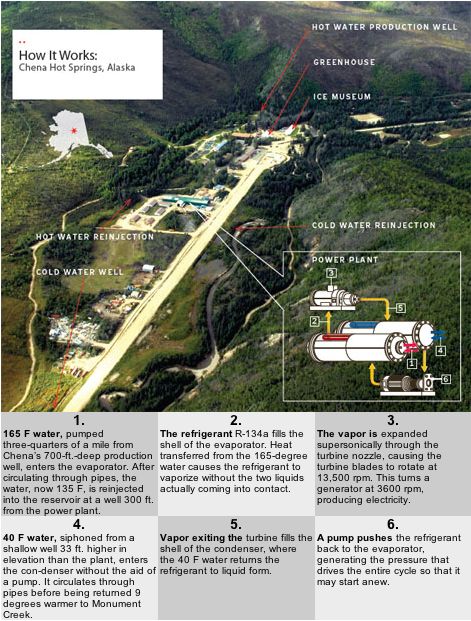

Innovation Ecosystem at Chena Hot Springs

We’ve written several times about Chena Hot Springs in Alaska and the small-scale (400kw) geothermal electricity project going on there. Recently, Popular Mechanics called on the resort and wrote a great article about how the geothermal system works for HVAC in extreme temperatures and is used in horticulture. Chena is not just a resort, it’s an innovation ecosystem around the uses of geothermal resource. The images below are part of the story, there’s much, much more content there, we encourage you to visit and read the whole story.

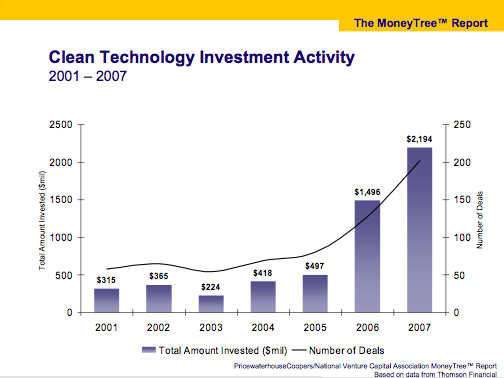

Cleantech Investment up 10x

As you can see from the chart above, since 2003 investment in Clean Technology has increased an order of magnitude since 2003. While the bloom seems to be off the biofuel flower, the rest of the segment continues to garner huge capital infusions from the private marketplace. When will the ride end? Your guess is as good as ours, but it’s clear this is a cyclical business and that the present growth rate is unlikely to be sustainable without substantial financial return in the foreseeable future. Comments are off for this post

Business Opportunity: CFL recycling?

Have you ever wondered what to do with those energy efficient compact fluorescent light bulbs when they burn out? One shouldn’t just toss them into the garbage due to the small amount of mercury (~5mg) in each bulb yet it’s not really apparent what to do with them. Presently, there are a number of pilot programs that collect and hopefully recycle the bulbs, but a sustainable and clear recycling stream has really yet to emerge.

One has to wonder if this is a business opportunity? The Wall Street Journal online has a good article discussing the pros and cons of the current state of electronics recycling including cfls (ignoring the pejorative title “The Dark Side of Green Bulbs”.)

Raser raises cash

Raser Technologies announced significant funding earlier this week from Merrill Lynch for their first 10.5MW power plant in Nevada due to come online in Q3 2008. The funding vehicle is what’s known in the business as a “flip” parternship, where an independent corporate entity (often a LLC) is formed with the funding partner so certain benefits can be distributed to partners as directed by the Managing Members.

C Corporations dictate the benefits are distributed according shareholder percentage. Limited Liability Corporations aren’t bound by that convention so tax benefits for instance, can be distributed as beneficial until some set of requirements are met, then the benefits can be redistributed as agreed. The first tranche appears to be $44M in debt financing over 15 years with tax benefits flowing to Merrill.

Interestingly, using this as a benchmark, the captial cost per MW for the Raser project is $4.2M – higher than the $3M average if all the funds were used for the project. Presumably, the first one will have more expenses than subsequent modules assembled in the same way and the capital cost will be lower over time. Merrill and Raser have an agreement for up to 100MW of projects with options to finance up to 55MW more.

Seeking Alpha on Ormat

Photo Credit: Mike Harding

Via Seeking Alpha:

On December 17, Ormat Technologies Inc. (NYSE:ORA) announced a 20-year agreement with Southern California Edison for the sale of energy from ORA’s 30 megawatt plant at Imperial Valley, CA, that is expected to come on line by mid 2012. On December 18, Ormat announced the execution of agreements in the 340 MW Sarulla Geothermal Project in Indonesia where Ormat will design and supply the power generating units. These agreements indicate that ORA will not only remain as a leading geothermal power producer in US, but is also expanding its international presence.

…

The stock has been making good gains (almost 70%) since June ’07 lows. This gain has resulted in the stock breaking out of a prolonged consolidation that extended for almost a year and a half. The lofty PE (95 and 45 – Trailing and Forward respectively; Source: Yahoo Finance) makes the stock appears expensive at current levels. Nevertheless, considering the business opportunities available for ORA, any dip on the stock can be a buy opportunity for short and medium-term players. The Reno, NV based company’s policy of targeting an annual payout ratio of at least 20% of its net income (ORA has been distributing regular quarterly dividends for the last three years) makes the stock attractive for those who want a steady stream of income.

We agree that Ormat is an impressive player in the geothermal space, and the largest and most stable pure play. However, we believe the stock is tremendously expensive (even accounting for prospects and growth) at present levels.

One aspect of the company not covered in the article is the split between the equipment and electricity generation segments. We believe the equipment and electricity operations segments in the same company will prove to be problematic strategically as customers of the equipment segment increasingly see the electricity segment as a competitor. The equipment segment is about 20% of the company’s revenue and is “lumpy” from quarter to quarter. The electricity segment is where the growth is occurring. We wonder if it might not make more sense to spin out the equipment business as an “arms” dealer to all, including a separate Ormat run electricity generator.

All that being said, geothermal is the renewable that has yet to be discovered in the mainstream and it may be that there is substantial upside still possible in the stock given the overall heat of the segment. As an additional data point, traditional electricity generators trade at a PE of around 15 (Source: Yahoo Finance.)

Disclosure: The author holds no position in Ormat.