Archive for the 'Business' Category

Western GeoPower Raises $8.6M

Attribution: Geysir Green Energy

In a previously announced private placement, Geysir Green Energy has consummated the transaction to acquire 13.7% of Western GeoPower raising a $8.6M to continue development of the old Unit 15 project at the Geysers in Northern California. This comes on the heels of successful flow tests of the first production well on the site. Additionally, Geysir has warrants on 9.3M shares exercisable at $0.35/share – in total, Geysir controls 18.8% of WGP’s outstanding shares which could reach 25% if the warrants are exercised.

Links:

Western GeoPower

Geysir Green Energy

Comments are off for this post

Q1 Strong for Ormat

Pure play geothermal equipment and electricity generator Ormat (ORA) turned in a very strong Q1 earnings result today. The company increased the top line from $62M to $69M Y/Y despite the fact that the product segment revenue fell by 50% in the same period. This was offset by an increase in the generation segment due to greater MWh produced and higher prices being secured for that energy.

Even better for long-term shareholders, costs were controlled tightly and were down $9M overall. But the electricity segment was down $1.1M while net output from the unit increased making it significantly more profitable. Profits for the quarter were $10M after taxes compared to -$5.8M in the same period last year.

No matter how you cut it, this was a stellar quarter for Ormat.

Disclosure: The author holds no position in Ormat.

10MW well at The Geysers

Attribution: Western GeoPower

If they all produce like well #1, Western GeoPower will be able to save some money on drilling. The company announced today after an eight hour flow test that the well produced steam at 1,200 kg/minute flow rate – good for around 10MW/hr of electricity. Sustained production rates are predicted to be in the 7MW range. The reservoir is pressurized at 280 psia, higher than the predicted 250 psia; both the flow test and reservoir pressure may indicate that there is more resource in the leasehold than was previously predicted.

This is the site of PG&E’s old Unit 15, a 60+MW plant that was decommissioned in 1989 after reservoir pressures dropped dramatically due to over production. WGP’s original plan called for a 25MWe harvest unit, they’re now up to 35MWe, and perhaps we’ll see that boosted even higher. It would be a terrible waste to repeat the mistakes of 20 years ago and not manage the reservoir in a sustainable manner. We trust WGP is sensitive to this issue and will take steps to maximize production while keeping the resource viable.

Public Policy, Subsidies, and Renewable Energy

The past few years have seen some rather dramatic events unfold in the area of public policy and subsidies with respect to renewable energy projects. It would be difficult to underestimate the impact of these policies and the resulting guarantees that really enable renewable projects to be developed. Ideally, renewable energy projects would be economically viable without such legislative intervention, but we’re not quite there yet.

In our view, the government could best serve the people, the interest of the nation, and renewable project developers by doing a few, simple things:

- Shift focus from fossil fuel generation to renewable generation. Slash funding and subsidies to nothing for fossil fuel generators. In reality, these industries are mature and do not need the government support to maintain profitable operation, and encouragement of continued development of new fossil powered projects is counter productive for energy security and greenhouse gas issues.

- Establish a long-term (10-15 year) production tax credit for renewable projects. When it expires, do not renew the credit. This longevity enables investors to take on renewable projects with reduced risk, reducing costs all along the financial supply chain. The fact that PTCs will likely expire in December of this year increases risk making project financing significantly more difficult to secure and more expensive. This fundamentally changes the economics of projects for the worse. The PTC however, should not be permanent. It’s a catalyzing measure to increase investment in the near-term in renewable projects.

- Provide loan guarantees. Particularly in the present credit crunch, it’s difficult to get project financing. Having the government as a co-signer reduces risk for lenders and cost for developers. To their credit, there is a program with $38.5B in loan guarantees out there, but more than half is earmarked for nuclear and fossil fuel projects, which misses the point of having the guarantees.

- Give regulatory preference and increase velocity of government interaction on renewable projects. Be it a lease from the BLM, and environmental impact review from the EPA, a power plant application to FERC, these projects need to be expedited. The long development times kill developers making it difficult to get a project in place and producing. The average renewable project takes 4 years to go from concept to commercial operations.

- Get out of the way. Once the pieces above are in place, simply let the industry move forward. Additional oversight and overhead are not particularly useful or necessary.

Until and unless a simple, coherent, and consistent energy policy exists that prefers renewable generation projects, we’re simply on a status quo course of action. As a new administration is selected and sworn in, we’ll see if that person has the vision and will to lead the nation to an outcome of energy independence and security.

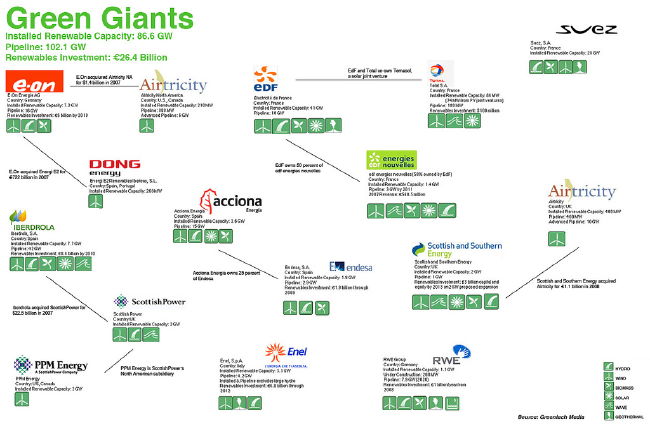

Euro Utility Renewable Map

Attribution: GreenTech Media

GreenTech Media put together a really nice visual representation of the European Utilities Renewable Portfolios and development pipelines indicating the country and types of renewables in the portfolio. It’s really nice work and helpful. We need to do one of these for the US as well.

Things that stick out, the overall European nameplate capacity of renewables is 86.6GW at a cost of 26.4B EUR and the total development pipeline is 102.1GW. That’s showing just how far ahead Europe is in considering and solving this problem. It also shows the room the US industry has to grow, we’re just scratching the surface of what’s possible.

Comments are off for this post