Archive for the 'Business' Category

Ormat inks PPA with Sierra Pacific

Today, Ormat announced an agreement to sell power beginning in 2010 to Sierra Pacific’s Nevada Power Company for output targeted between 18 and 30MW. Between this news and an upgrade from RBC Capital Markets Tuesday, Ormat’s stock is enjoying a nice run up from lows experienced post-Q1 earnings miss warning.

As an investor, Ormat is attractive around $35 share provided the company meets its stated revenue and earnings projections.

Renewable power PPA’s often fail

Another great talk at the GEA Geothermal Financing workshop was given by Tom Fair of Sierra Pacific Resources. Tom reviewed what investor owned utilities (IOUs) were looking for when selecting independent power producers (specifically for renewable electricity, but there seemed to be nothing particular that would make it different for non-renewable IPPs either.)

One surprising fact Tom stated was that up to 40% of awarded power purchase agreements to renewable IPPs fail. As the power companies face renewable portfolio standards in their service areas, this failure rate exposes the IOUs to risks they’re not willing to accept. From the IOUs’ perspective, when they book megawatts to be delivered, they’re expecting that the megawatts will be there. In the renewable space, that has often not been the case.

In fact, Tom’s talk really could be labeled “get power purchase contracts by lowering the IOUs risk and delivering what you promise.” This is an important and basic lesson: don’t sign up if you can’t deliver.

How much does geothermal development cost?

In our series of continuing entries spawned from the GEA Financing Workshop last week, we’ll use Dan Schochet’s presentation as the basis to answer this question. Dan is the Vice President for Project Development at Ormat, a leading independent power producer which operates over 370MW of geothermal electricity generation and has developed over 1,000MW of geothermal projects. It’s clear Ormat and Dan have been around the block a few times…

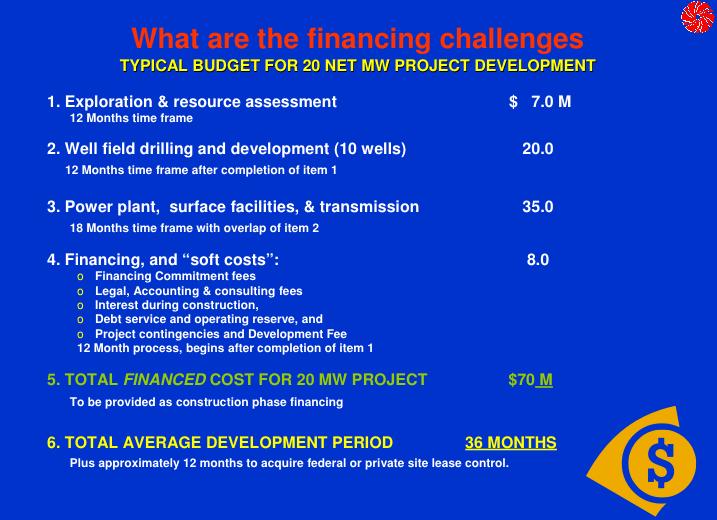

The screenshot below is from Dan’s presentation:

The information above is modeled using a hypothetical 20MW plant as the development target. Obviously, each project will deviate from the model based on the type of harvest technology employed, binary, flash, or dry steam. Also, the resource depth will factor greatly into field development costs. But, the good thing about this model, is it’s based upon real experience in developing geothermal projects and can provide a basis for modeling any specific resource taking into account resource quality and depth as well as transmission issues.

The other important thing this model provides is information in both the time and money dimensions. On the time front, once a project area has been secured (the cost is not noted on this model, the time is in point #6,) it takes an average of 36 months to move the project to a point where it is producing power for customers. On the money side, a 20MW plant in this model comes in at around $3.5M per developed megawatt of capacity (exclusive of resource acquisition) broken down into the categories of exploration/assessment at 10% of budget, well field development at 29% of budget, plant and transmission infrastructure at 50% of budget, and “soft expenses” accounting for the remaining 11% of the budget.

On the revenue side of the equation, assuming one can operate at 95% capacity factor, this asset can produce 166,440 megawatt hours of power per year (a little more in a leap year) yielding revenue of $11.6M per year in power sales (assuming $70/megawatt hour,) potentially $1.2M in renewable energy credits (this might not be available if the power is sold into an RPS state, in which case the power price may go up to compensate,) and generate Federal Production Tax Credit benefit of $3.3M for the first 10 years of operation. That would yield a maximum benefit from the plant of $16.1M per year, and a likely benefit $14.9M per year.

If the entire cost of the plant was financed at 7% interest over 20 years, that result in annual debt payments of $6.5M. Obviously, it’s not terribly conducive to finance 100% of geothermal projects (or you’d want to get much better terms.) Ormat shows the operating cost of geothermal plants as $35 per megawatt hour, setting aside SG&A burden, that would amount to cost of $5.8M. The plant operating expense plus the debt expense is $12.3M per year, or a deficit of $0.7M per year on this project in real dollar terms. Since the PTC is available, there are legal ways to pass the benefit to equity investors, so $2.6M per year could be used to make the economics work. It’s clear at least some of the plant development cost should be supplied by means other than debt (equity financing is common and may provide a legal way for equity investors to use the excess PTC.)

This is very interesting and instructive information for geothermal project developers to have. As we at MeV pursue our own development projects, it’s taken months to collect the information that is presented in this one slide from Ormat. Our own analysis of the available data provides numbers within 3% of the Ormat model (which is encouraging on the accuracy front, though daunting on the fund raising front.)

Polaris Geothermal inks MOU with Nicaragua

In February, the Nicaraguan government communicated that geothermal concessions granted in the country were suspended. In an update to that situation, Polaris Geothermal, which operates and develops geothermal plants in Nicaragua announced they’ve signed a memorandum of understanding (MOU) that should lead to the realization of their 66MW project by 2009.

The market likes this news and Polaris’ stock is up more than 20% today.

US Geothermal gets $15M

Renewable Energy Access reports today that US Geothermal has raised another $15M to aid in the development of their geothermal projects, notably the Raft River Project in Idaho. The deal is slated to close in June, 2007 pending regulatory approval.

Comments are off for this post