Archive for the 'Solar' Category

Triple Play: Sou Hills Project

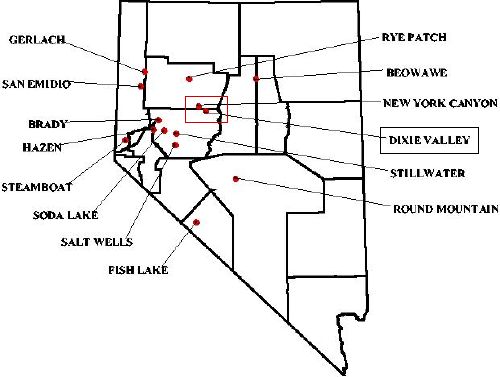

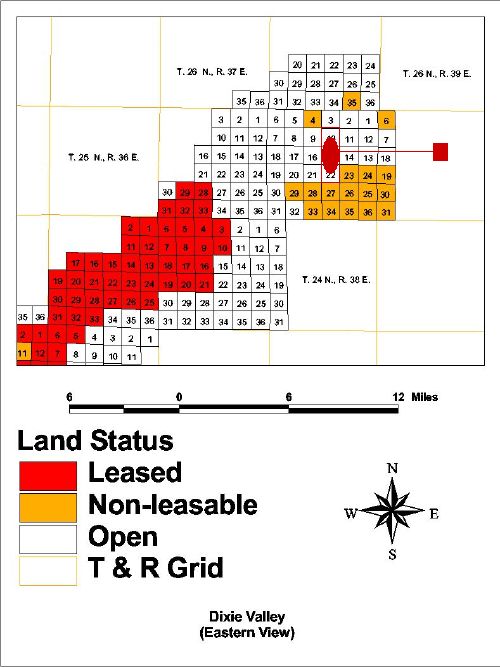

In August, 2007, MeV acquired a lease and development rights on ~1700 acres (~700 hectares) of land in Nevada’s East Dixie Valley. This area is a Known Geothermal Resources Area (KGRA) with a functioning plant, Ormat’s Dixie Valley 60MW facility, in the near vicinity. Given the parcel’s location in the Sou Hills, we now refer to this parcel as the Sou Hills Prospect. One other key aspect to the Sou Hills Prospect is its proximity to electricity transmission. A distribution line is located within 400m of the southern end of the parcel which connects to a 230kv transmission line owned and operated by Sierra Pacific Power Company. MeV has made one preliminary visit to the Sou Hills Prospect which is recorded here.

As with any geothermal prospect, exploration is paramount. Before the end of the year, MeV plans to complete aerial, self-potential, soil chemical, and magnetic surveys of the prospect. In addition, MeV plans a 2m shallow temperature survey with at least 100 measurement points (which can and will be adjusted in the field to accommodate the localization of any anomolies.) After collecting and analyzing this data, MeV may drill temperature gradient wells in locations suggested by the analysis of the prior surveys.

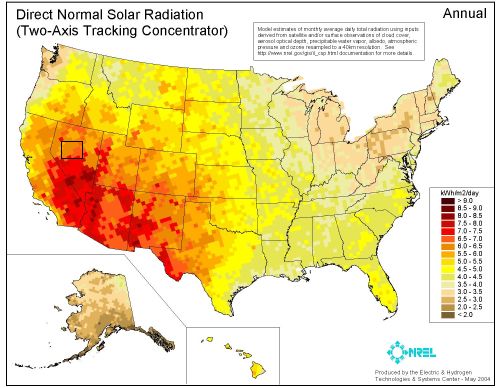

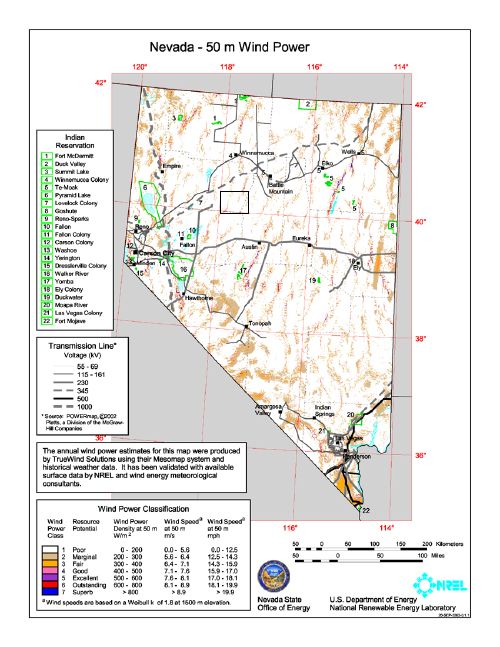

In addition to geothermal resource, MeV also observes that this location lies in the desert and is the recipient of copious amounts of sunshine year around. Given that benefit, solar surveys to characterize resource applicability for solar thermal electricity production will also be performed. Finally, there may be wind resource in the area and as such a wind resource analysis will be performed. This will help determine the feasibility of a “double” or “triple” play allowing multi-dimensional harvest of renewable resource below the surface level with geothermal, at surface level with solar thermal, and above surface level with wind all on the same physical property.

(Sou Hills Prospect in Rectangle Area >5 kwh/m2)

(Sou Hills Prospect in Rectangular Area – Detail in cutout below)

In concert, the wind, solar, and geothermal resources can share the same operations and transmission infrastructure. Solar thermal and geothermal can share the same physical generation resources. As solar resources become unavailable (darkness) wind resources in this area tend to increase and peak during night time hours. Of course, geothermal resources are not subject to sunlight and wind conditions and provide a constant baseload power output from the renewable energy park. Presently, the size and feasibility of this approach are unknown and will not be known until the resource assessment has been completed. However, the conditions are right for this approach to work in this specific property and perhaps others located around the world.

As results of resource surveys become available, we will share those results and the progress of our project in general. Comments are off for this post

$1.5B for Solar Thermal

Via Renewable Energy Access:

Comments are off for this postFPL Group Incorporated, a generator of renewable electric power, yesterday announced a $2.4 billion investment program aimed at increasing U.S. solar thermal energy output and reducing carbon dioxide emissions that contribute to global warming.

“These new investments, coupled with our recent announcement to invest an estimated $20 billion in new wind generation, demonstrate FPL Group’s continued commitment to improve the environment.”

–Lew Hay, Chairman and CEO, FPL Group.

The majority of the investment ($1.5 billion) will go in new solar thermal generating facilities in Florida and California over the next seven years, starting with a project at FPL. FPL is planning to build 300 megawatts (MW) of solar generating capacity in Florida using Ausra, Inc.’s solar thermal technology.

Caithness exits renewable energy business

As referenced earlier today, ArcLight Capital and Caithness Energy LLC have entered into a deal where ArcLight will take an interest in 824MW of power generation in geothermal, solar thermal, and wind projects.

Upon reviewing the remaining Caithness Energy LLC portfolio the company is left with one undisclosed hydro power project and the remainder of its portfolio is now fossil fuel based with the largest component being natural gas (one diesel and one coal project exist as well.)

With the transfer of the geothermal, solar thermal, and wind assets and their operation to ArcLight, Caithness has effectively exited the renewable energy business after 25 years. Once operating agreements with eneXco and Seapower West lapse in the wind projects, it is likely ArcLight will take over operation of those projects as well.

With renewable energy’s move toward the mainstream, it’s interesting that Caithness would take this opportunity to exit. Perhaps it is because of the current hot market the management team looked for a high dollar value exit, on asset value alone, this is a billion dollar deal. Does the Caithness management team believe that the sector valuation has peaked?

The flip side of that is ArcLight’s asset acquisition positions them to enter the renewable power business in a big way. The Caithness assets join CPV Wind Ventures in the portfolio. ArcLight has vast experience in the power industry and has extensive interest in coal and gas fired power plants, along with transmission and pipeline operations.

Caithness gets capital boost

COSO Geothermal Field

ArcLight Capital has invested an undisclosed amount in Caithness Energy, LLC in exchange for interest in 18 different renewable energy projects in the geothermal, wind, and solar thermal areas totally more than 800MW. In addition to securing an interest, ArcLight will assume operations and maintenance responsibilities for 10 of the 18 projects. Caithness benefits from this transaction by attracting capital to help complete their 350MW Long Island project. Subject to regulatory approval, the anticipated close of the deal should occur in the 3rd quarter of 2007.

The specific projects included in the deal are:

- Geothermal: Coso (240 MW), Dixie Valley (66 MW) and Beowawe (18 MW)

- Wind: Cameron Ridge (60 MW), Pacific Crest (47 MW), San Gorgonio (43 MW), Foote Creek II-IV (43 MW), Texas Big Spring (34 MW), Ridgetop (31 MW), Peetz (30 MW), Oak Creek (23 MW), 251 (18 MW), VG Repower (7 MW), and Chandler (2 MW)

- Solar: SEGS VIII (80 MW), SEGS IX (80 MW)

The full press release is available from the ArcLight Capital website.

1 comment

The View from REFF

Today we’re attending the Renewable Energy Financing Forum sponsored by ACORE in NY. Thus far, there have been two very interesting sessions on Biomass/biofuels and Solar (PV). The panels have been informative, a mix of executives from established companies in the segments and investors (mostly public market.)

In his opening remarks this morning, Michael Eckhart, the President of ACORE, walked through the various renewable resources and he singled out geothermal as being the ONLY renewable capable of displacing coal baseload generation. Curiously, there is not a geothermal session in this conference and we here from the Geothermal Energy Association, Geothermal Resources Council, or even a single geothermal industry attendee from the Geothermal Financing Workshops over the past year. This is a missed opportunity.

A few key points from this morning’s session were:

- 10% of venture capital investments in 2006 were in renewable energy

- 1.6B people do not have access to electricity (perhaps we ought to solve the power divide too…)

- 20% of US corn output is used to make ethanol, that is predicted to rise to 30% by 2010

- 2/3 of the cost of ethanol in the US is due to fuel stock (corn) prices

- Aggregate market capitalization for US solar companies has increased from $1B in 2004 to $67.3B now

- It takes between 2-4 years of electricity production of a solar cell to offset it’s electrical and environmental impact of manufacture

- Refined silicon costs on the spot market have increased from $50/kg two years ago to over $250/kg now. Long term contracts can be had for $70/kg. The cost of Si is forecast to decrease to $40/kg over the next 2 years.

Those are facts we found interesting, we’ll share more on the afternoon’s sessions in future entries.

Comments are off for this post