Archive for the 'Geothermal' Category

The Baseload Crunch

Last week, Thomas Blakeslee of the Clearlight Foundation wrote a piece for Renewable Energy World on the coming baseload crunch. It’s well worth your time to read the article in its entirety.

The core thesis to the piece is that adding wind and solar are great, but they’re both intermittent power sources and there is only so much intermittent supply that should be added to the grid. We’ve heard different levels, 20% being the most commonly accepted figure.

Blakeslee gives an impassioned argument on why we should be paying much more attention to geothermal power as an energy source – something that certainly resonates with us – due to resource availability, superior capacity factor, and the advances in harvest technologies that have appeared over the last 30 years.

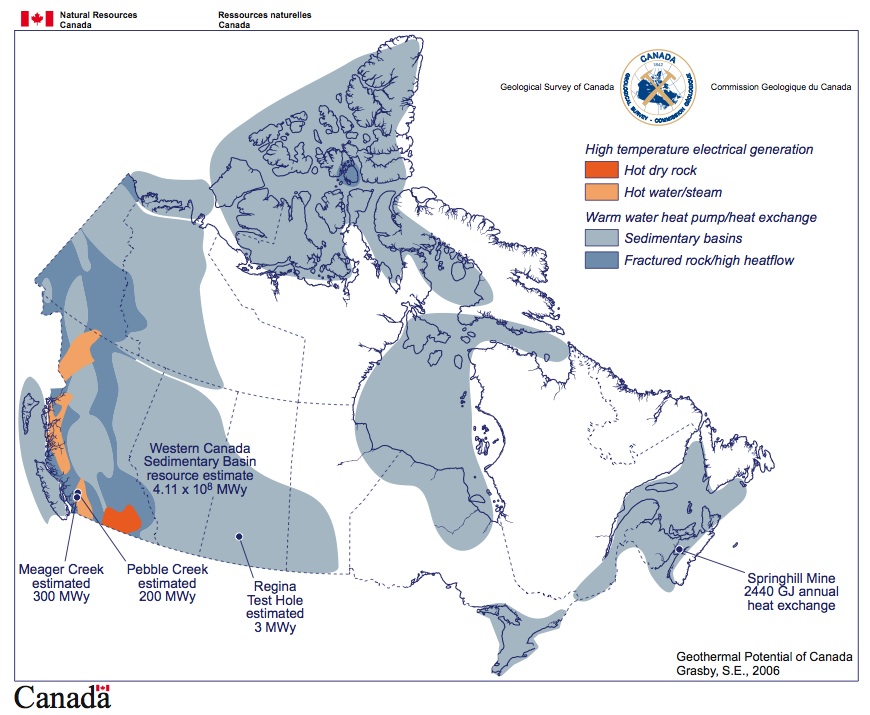

Canadian Geothermal Potential

If you’ve been around the geothermal world in the US, you’ve seen the heatmap of the US produced by the SMU crowd led by David Blackwell. But the Canadian heatmap isn’t too well known and we came across it recently and thought we’d share it. It’s one of the interesting tidbits available from Canadian Geothermal Resources Association (CanGEA).

Attribution: Geologic Survey of Canada

After analyzing the map, we have to wonder why Canada’s geothermal potential is largely untapped. There are a few projects happening in the country and perhaps, in a land mass this vast, there are more opportunities for development that are not yet identified or under development.

Whatever your perspective, Canadian geothermal resources are an underutilized resource.

HT: Craig

1 comment

Geothermal Industry Landscape

One of the more frustrating aspects of attempting to enter the geothermal industry is that it is small, fragmented, and insular. Most of the players have been in the business for more than 30 years, have seen the boom/bust cycle, and consequently are wary of newcomers during a boom cycle. The people who make up the core of the industry are the survivors from prior cycles and they can be difficult to reach.

Instead of focusing on the people, which would be counter-productive, a tour of the companies and organizations working in and around the geothermal industry might be useful for our readers. Roughly speaking, there are developers, operators, industry groups, and service providers. We’ll focus more on the developers and operators in this entry, but will list a few industry groups and service providers. This entry is North America focused, there are clearly well developed resources in Iceland, Italy, New Zealand, the Philippines, Mexico, and Indonesia. There are emerging projects in Africa, Asia Minor, and South America. This entry will not cover those areas explicitly.

Developers are the folks out there trying to create new projects from untapped and/or underutilized resources. Often times, developers are also operators, it’s just a function of where the team happens to be in the development cycle. There are private and public companies engaged, for the most part, it’s the public companies who are visible.

Developers

- Vulcan Power Company – Proponents of the “green gigawatt plan” with 7 properties in various stages of development.

- Nevada Geothermal – Developing four projects in Nevada and Oregon including the Blue Mountain project.

- Sierra Geothermal – Has a portfolio of 17 projects including the Reese River project in Nevada.

- Raser Technologies – Recent entry into the developer category with 12,000 acres and multiple projects in-flight.

- Western GeoPower – Longtime developer with two projects in-flight, a 35MW project at The Geysers and another in Canada.

- Many, many more small, under the radar shops (including MeV, publisher of this site.)

Operators

- Chevron – The world’s largest producer of geothermal power with 1,273MW in Indonesia and the Philippines.

- Calpine – The leading US geothermal producer with 750MW in 19 plants at The Geysers.

- Ormat – The largest “pure play” geothermal company. Ormat designs and develops geothermal harvest technology and operates nearly 400MW of power plants.

- Constellation – Operates the Mammoth and Soda Lake geothermal plants in California and Nevada.

- Cal Energy – Operates the Imperial Valley plants in California.

- Caithness/ArcLight – Operates 347MW across 5 plants in California and Nevada.

- US Geothermal – Operates the Raft River project in Idaho.

- Polaris Geothermal – Operates the San Jacinto Tizate plant in Nicaragua.

- US Navy – The Geothermal Program Office works in conjunction with Caithness in the operation of the Coso plants in California and may develop other resources on military lands in the Western US.

Industry Groups

- Geothermal Resources Council – The group focused on the geotechnical aspects of geothermal harvest and development.

- Geothermal Energy Association – The group focused on the political and financial aspects of geothermal harvest and development.

This service provider list is suggestive of the kinds of providers out there and some of the leaders, it is by no means complete. There are many, many service providers available to this nascent industry.

Service Providers

- Geothermex – A full-service geotechnical service provider well known for characterizing resources in advance of project financing.

- ThermaSource – An engineering company known for its drilling capabilities and execution at The Geysers.

- UTC Power – Subsidiary of United Technologies, producer of the first standard, modular, and scalable geothermal harvest systems.

- Stoel Rives – Law firm specializing in renewable energy deals, with specific expertise in geothermal projects.

- Jacob & Company – Canadian firm specializing in using the public markets (Toronto Venture Exchange) for project financing.

- US Renewables – Renewable energy venture funding source with geothermal projects and expertise.

- US Government – Has many agencies available to provide help and guidance (and regulation.) The Bureau of Land Manaement (BLM,) Environmental Protection Agency (EPA,) Federal Electricity Regulatory Commission (FERC,) Department of Forrestry (DoF,) and Department of Energy (DoE.)

We hope this has been an educational entry, we may do a deep dive on each company listed above over time. We certainly do comment periodically on the progress of projects as the news becomes public. If we’ve missed any developer/operator in the US (and it’s very possible we have) leave a comment and we’ll evaluate inclusion going forward.

Polaris Reports: Inside the Numbers

Photo Credit: Polaris Geothermal

Polaris Geothermal recently reported full results for the year 2007. A detailed press release about the earnings is available here. The high points: The company got a full year of production from the Phase I of its plant in San Jacinto-Tizate, Nicaragua at around 7MWe of average output, the drilling program continued to grow Phase I to its planned 34MW target, and the full 72MW of production appears to be on track for the 2010 timeframe.

The low lights involved a question about the validity of the concession from the Nicaraguan government which was resolved and accelerating losses, the net loss rate for the company increased nearly $2M to $6.7M on the year. Shareholder concerns about Polaris have to revolve around project finance where additional dilution and access to debt financing will present distinct challenges going forward.

Rather than making this a straight financial story, one of the things that struck us about this release was the transparency of the operational aspect of the SJC plant. We applaud Polaris for disclosing this information and believe since it is there, at least at this plant on this project, we can see some of the real cost and benefit of geothermal plant operations.

In 2007 the SJC plant produced 64,778 MWh of power accounting for $3.9M in power sales and $0.7M in carbon credit sales for a grand total of $4.6M of revenue for the project. Plant operations expenses totaled $2.2M yielding a gross margin of $2.4M for the project at an average output of 7.37MW per month. Hidden in these numbers are outages of over a week in June which cost the company approximately 1,000 MWh of sales.

We can reverse engineer that the company is being compensated $10.80 per MWh for carbon credits and $60.20 per MWh for power sales against operations cost of $34 per MWh. As the project grows to 34MW and finally tops out at its planned 72MW, these numbers should improve as the plant operations costs won’t scale in a linear fashion relative to output due to economies of scale (after all, the operations infrastructure is in place now, operations cost will increase but the slope should be pretty flat.)

NCPA, an operator at the Geysers, sees operations costs of about $19 per MWh at 132MW of output. It seems reasonable to believe that Polaris could achieve that level of efficiency over time, but even if the SJC project split the difference and only improved to $26.50/MWh, there would still be interesting impacts on the bottom line.

If nothing changes except capacity and output, at a 34MW and present availability and capacity factor, the company would bring in $13.2M in power sales and $2.4M in carbon credits balanced against $7.5M in plant operations producing a pre-tax, pre-corporate expense run rate net of $8.1M. If the company was able to hit the $26.50/MWh operational improvement, that would result in a $1.7M increase to $9.8M.

At 72MW and current operational levels and assumptions, the project is a real money machine producing $28M in power sales and $5M in carbon credits against operational expense of $15.8M. With numbers this attractive, why isn’t everyone building geothermal plants? The answer lies in the development expense. Effectively, the lifetime cost of production is incurred upfront and then amortized over the lifetime of the project. Therein lies the rub, the development cost per MW of output is in the $3.2M range presently meaning to reach 72MW Polaris will likely have spent $230M developing the plant.

It’s always nice to see real numbers, thank you for disclosing Polaris and we wish you well as you build your SJC project out to scale.

US Geothermal Acquires Empire Plant

Photo Credit: UNR

US Geothermal, developer and operator of the Raft River project in Idaho, announced their intent to acquire the assets of Empire Geothermal consisting of a 4.8MW (nameplate) binary plant and over 28,000 acres of land for $16.6M. The transaction details are complex, the press release goes into detail about how the deal is structured and the timing of the transaction.

The plant has been in operation since 1987 and consists of 4, 1.2MW binary units and a cooling tower arrangement. The average output of the plant has been in the 3MW range for sometime with the plant producing approximately 35,000 MWh gross and selling ~25,000 MWh in 2006. The difference in the gross and net loads are accounted for in the operation of the binary plant (pumping of fluids primarily for cooling and reinjection.)

The land in question consists of the San Emidio Desert (22k acres plus the plant) and Granite Creek near Gerlach, Nevada. USG estimates they can boost the output of the Empire plant to 10MW with the new technology available since 1987 and potentially develop up to a 40 MW plant across the other prospects.