Archive for the 'Geothermal' Category

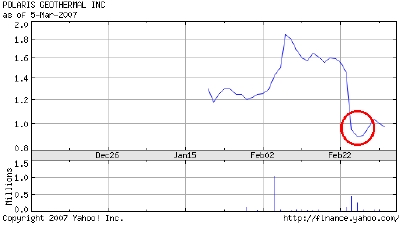

Bad news for Polaris Geothermal

A picture is worth 1,000 words. In one day, Polaris Geothermal saw their market capitalization cut by more than 50%. Why? Because the government of Nicaragua is questioning the validity of their concession in the country. The company’s Nicaraguan subsidiary, PENSA, is already operating at 10MW facility in Jacinta and is actively pursuing plans to expand to 66MW over the next two years.

True or not, the action by the government has had a big impact on the company. If the concession claim is upheld, expect a big uptick in this issue. If not, I would expect further decline even with the bad news already reflected in the share price.

If you liked this entry, Digg It!

Technorati Tags: Energy | Geothermal | Stock

Sierra Geothermal raising more cash

Through a private placement, Sierra Geothermal is selling 20,000,000 units (a unit is a share and a warrant to buy another share at a fixed price) for C$0.50 per unit yielding C$10,000,000. Net of the 8% fee charged by Jacob & Company Securities Inc. to raise the cash, Sierra should end up with just over $9M to help with projects like Reese River in Nevada.

If you liked this entry, Digg It!

Technorati Tags: Energy | Geothermal | Financing

Ormat shares take a beating

Geothermal equipment maker and electricity producer Ormat (ORA) announced 4th quarter and 2006 full year results. Based on the run up of the stock in the early week, investors were expecting big things from this report. On Tuesday Ormat was trading at a near 52 week high of $44 per share sporting a market capitalization of $1.5B.

After results were announced Wednesday morning, shares dipped into the $37 a share range shaving market cap to $1.3B. Friday, a modest rally ensued on an upgrade from HSBC securities sending shares back to the $39 range, pretty much where the shares have been trading for the last year. Interestingly, enterprise value for the company is pegged at $1.8B so even at $44 per share, the issue was trading at a discount of $6 per share from enterprise value.

Let’s take a look at the earnings to see what we can uncover about Ormat. For the 4th quarter, the company recorded revenue of $66.7M, up from $58.8 million a year ago. Net income was $4.2M up from a loss of $5.1M a year ago, that’s a $0.28 per share swing year over year. For the year, revenues were $268.9M up from $238M a year ago and net income was $34.4M up from $15.2M a year ago. The board of directors declared a $0.07 per share dividend as well. That’s pretty impressive performance, so why did the shares get hammered?

I think it comes back to two issues: debt levels and strategy implementation. The debt is pretty straight forward, Ormat has taken on $500M in debt to finance it’s electricity generation business. Geothermal plant construction is a capital intensive business that involves the expense and risk of petro-chemical like drilling with the infrastructure requirements of traditional power plant construction. Consequently, the debt tends to be more expensive than tradition power plant construction and there tends to be alot of it per megawatt of capacity. During 2006, Ormat added 51 MW of generation capacity, bringing its total output to 377 MW.

This is a nice segue into the second issue, strategy implementation. Ormat has traditionally been a product company producing the equipment necessary to harvest power from geothermal resources. In particular, Ormat has demonstrated leadership in organic rankine cycle or binary harvest in closed geothermal systems. A few years ago, Ormat decided to get into the geothermal electricity production business in addition to its equipment business. This decision had risk of alienating their equipment customers since Ormat was now a competitor as well as a supplier in the electricity generation business.

A look into the Q4 and full year results shows that Ormat recorded equipment revenues of $20.1M and $73.5M respectively. The electricity segment shows results for Q4 and full year of $46.6M and $195.5M respectively. In the forward looking statements management indicated that equipment sales were projected to drop in 2007 while electricity segment would continue to grow. The key question is will electricity grow faster than equipment shrinks? And can Ormat continue to take on debt to finance the growth of electricity segment to fuel that growth?

The beauty of this strategy is that electricity generation is a pretty predictable business. Ormat will enter into longterm power sale agreements with known pricing and will work to control and reduce operating costs to generate predictable results. The equipment business is and will continue to be “lumpy” – dictated by the number of projects underway at any given time and with Ormat’s entry into the generation business, new competitors will appear like United Technologies with their Pure Cycle organic rankine cycle generation units.

So, what’s Ormat worth? That’s a pretty good question. Taking their generation capacity of 377 MW with average sale price of $70 per megawatt hour multiplied by the industry average capacity factor of 90% multiplied by the number of hours in the year (8760,) I would predict revenues in the electricity segment of around $208M for the full year. Management projects that the equipment segment will produce around $68M for the year. This brings projected full year revenues to $276M without the benefit of new capacity impact brought online during the year and any upside in equipment sales. However, it also takes into account a 7.5% decrease year over year in the equipment segment which may not be sufficiently pessimistic given the competitive landscape.

Provided Ormat can sustain current expense levels commensurate with revenue levels, the revenue levels above would yield earnings in the $35.3M dollar range. With a valuation of 50x earnings, which is where Ormat has been trading, that would signal a price of $52.56 per share. However, the projected earnings growth rate of 3% won’t justify that multiple. I expect Ormat’s PE will be begin to fall back toward traditional power producer multiples in the 20x range as growth slows. At a 20x valuation, that indicates a price of $19.83 per share.

If Ormat can show growth in excess of 5%, then I would expect the shares to stay closer to the high side estimate. If Ormat delivers results with 3% or less growth, I would expect quick adjustment to the lower end of the range. My conclusion is that at $35 per share, Ormat is fairly valued given the projected growth rates, risks, debt level, and strategy implementation.

If you liked this entry, Digg It!

Technorati Tags: Energy | Geothermal | Ormat

Geothermal Co-production with Petroleum?

Here’s something interesting you may not know: when harvesting oil, there is often “waste water” mixed in the substance coming out of the hole, frequently the water is under pressure and hot. While at the Stanford Geothermal Conference last month, Mark Milliken covered this information during his talk.

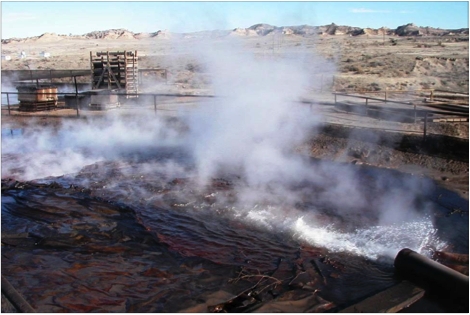

Waste Water Discharge at Naval Petroleum Reserve #3

The Naval Petroleum Reserve #3 is really part of the Department of Energy’s Rocky Mountain Oilfield Test Center. As such, it’s not bound by the economic realities of having to produce or else and can experiment a bit with new drilling techniques as well as ponder the question: “what should we do with all this hot water?”

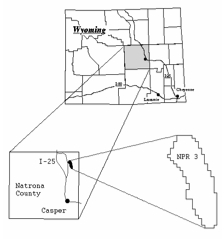

NPR #3’s location in Wyoming

At this particular site, some 6.4 million liters (1.7M gal) of 87°C (190°F) water is discharged per day as part of their oil production. This water is routed into a cooling pond and then released into Little Teapot Dome Creek when the water has cooled sufficiently. Curiously, the amount of oil produced from this activity is around 48,000 liters (12,600 gal) per day. As you can see, far more water is produced per day than oil! The raw power equivalent of this water is estimated to be 22MW, or enough to power some 25,000 homes per year. But, a small fraction of that raw power is available for harvest with existing technologies.

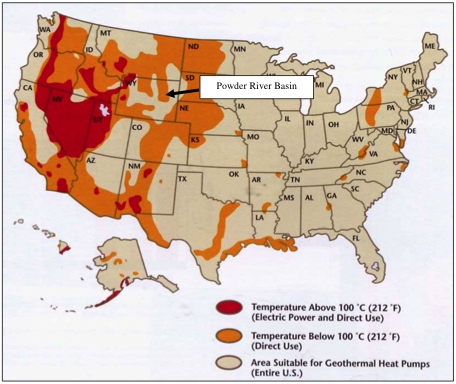

Where does all this hot water come from? The water is hypothesized to come from the Big Horn Mountain range where it soaks into the earth and descends to a series of hot rocks. It then migrates to the Powder River Basin and pours into fissures in Ten Sleep and Madison Limestone layers where it is extracted during petroleum operations. The heat map below will provide some context for how the NPR #3 site fits into the overall estimated heat flow at a 3km depth.

US Heat Map 3km depth

Using binary systems to extract the heat from this water could easily yield a couple of hundred kilowatts in a binary generation scheme. These units need around a 50°C (120°F) difference in temperature between the ambient temperature of production and the resource. It would seem likely that this could be established and maintained at this site and many others. It’s interesting to see this type of exploration underway and it could provide additional benefit (both ecologically and economically) to take advantage of this “free” by-product of an existing activity.

If you liked this entry, Digg It!

Technorati Tags: Energy | Geothermal | Oil

Sierra Geothermal begins Nevada drilling

The Reese River project is underway with a 1,200m slim hole for exploration. Sierra Geothermal expects to tap somewhere between 13 and 30 megawatts (MW) when the project enters production. At 30MW, that represents enough power to run around 26,000 households in the US for a year.

An interesting side note on this is that Sierra’s drilling program is receiving some $580,000 of Federal assistance throught the GRED program, a program that has been eliminated with the release of the FY2007 US Federal budget. See this entry for more detail on this subject.

Thanks to Jim for passing this along.

If you liked this entry, Digg It!

Technorati Tags: Energy | Geothermal | Drilling