Archive for the 'Geothermal' Category

Southern California Edison inks PPA with Calpine

Edison agreed to buy 225MW of geothermal power from Calpine today, which should help SCE meet the 20% RPS by 2010 along with large, recent wind purchases. The power purchase agreement still needs approval from the California Public Utilities Commission before it can go into effect.

UTC scores a big deal

280kw (225kw net) PureCycle Unit

In what must be the largest deal yet for the UTC PureCycle binary power unit, Raser Technologies has placed an order for 135 units for use in its developing projects.

Effectively, UTC is using its experience in the industrial chiller field to run the chiller backwards using the geothermal resource as input. What distinguishes the UTC approach from others is two fold: operating temperature range 74C (165F) to 150C (300F) and modularity. The units are designed to work individually or to be ganged up in pods as large as 40 units with 9MW net output. It’s really a nice product and Raser shows good business sense by heading this direction. And, it’s a really nice endorsement of the UTC product and approach.

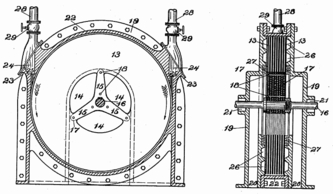

Illustration of how a binary unit works

As you can see from the diagram above, the binary unit is pretty straightforward. Hot fluid comes in, the heat is transferred to a working fluid through a heat exchanger, the working fluid vaporizes and drives a turbine, the working fluid is then cooled and returned to be reheated, the geothermal fluid is (typically) injected back into the reservoir.

Changing gears for the moment, this has had some business impact. Let’s look at what this impact has had on Raser’s stock.

Even though this constitutes movement for Raser, the reaction that is occurring in the stock is nothing less than irrational exuberance. The stock is up at the time of this writing over 30%, and that brings a one month run up of nearly 100% in the stock. While I appreciate that Raser is making very important strides in making their geothermal portfolio a reality, the valuation is wildly mismatched to the fundamentals.

Let’s do some math. Let’s assume that Raser can bring on all 30MW of power in 2008, possible, but it will be a push. Using generous assumptions of power sale at $0.07/kwh and a capacity factor of 95% that would yield around $17.5M in gross power sales per year. On the cost side, wheeling, transmission, and congestion costs will be around $0.015/kwh and plant operations costs will be in the $0.03/kwh range leading to a cost of $0.045/kwh. We haven’t factored in SG&A, depreciation, or debt, but my guess is that’s going to be in the $0.015-$0.025/kwh range. Yes, there will be the Production Tax Credit benefit of $0.02/kwh which will effectively make this tax free earnings, but, the net margin will be rather low, let’s say Raser pockets $2.5M/year on this set of assets. At standard power company valuation of 18.3 times net earnings, that would support a $45.75M market cap for this operation – at Ormat valuation (perhaps a closer comp) of 40x net earnings, that would support a $100M market cap.

This entry is not intended to slam Raser, I’m happy to see the company take these steps and roll out press releases every few days, but I think the valuation of the issue is wildly mismatched to reality. Raser sports a market cap of $464M at present (7:30am PDT April 12, 2007.)

Caveat emptor.

Update 4/16/2007: There have been some questions about whether or not this is an attempt to value Raser Technologies as a whole, it is not. The author has no detailed knowledge of the symetron technology that Raser has developed. The only information that the author has is that there is $400,000 of sales to date of the technology with opportunity for wider adoption. Rightly, that technology should not be valued at $0. However, in the author’s opinion, neither does that technology serve to bridge the valuation gap between the current market cap of $400M and the in operation geothermal plant valuation of $100M. So while we’re not attempting a detailed valuation, common sense dictates that a $400k revenue stream, however promising, does not justify $300M in market cap and thus the author sticks to the conclusion that Raser, at present prices, is overvalued. What is a fair value? That would require in-depth knowledge of the symetron technology to derive a valuation and then simple addition to the geothermal operations.

One other topic this initial post did not cover adequately was resource development cost. According to our research, geothermal resources cost between $1.2M on the low end of the range to $6.7M per megawatt. The average price for projects developed in the US over the past 10 years is $4.3M per megawatt. Drilling costs are the major variable in those figures running at around $1,300 per meter. The UTC unit cost (list price) alone is $1.4M per megawatt. Make no mistake, these are expensive projects to develop.

Finally, resource quality comes into play. The lower the temperature the lower the pressure is likely to be in the production wells. That implies pumping to get the resource to the surface for use in the generation units. This increases parasitic loads. The Stillwater plant in Nevada is a 19MW gross operation, but up to 50% of the output is dedicated to parasitic load. So when valuing the 30MW installation, it is likely overly optimistic until a resource review shows that the parasitic load will allow for that output.

There have also been some comments indicating that this source is anti-Raser. That’s simply not the case. Raser, like any other company in this space has a market valuation and an intrinsic valuation. When there is a difference between those two values, it’s interesting to explore. This has previously been pointed out with a Raser competitor, Ormat. Though the disparity between the two values is not so large in that case. The author would like to point out again, that Raser is making good public steps in development of its projects, management seems to be making shrewd choices, and that at the right valuation, Raser could be a good long term investment.

Disclosure: The author holds no shares in UTC or Raser Technologies

Raser gets more resource

Raser Technologies announced today that it has secured seven more geothermal leases in Utah, adding 13,887 acres to its portfolio. Investors seemed to like the news sending to stock up more than 3% on the news. However, investors should realize that development of geothermal resources take years; greenfield development is slow and fraught with difficulty. Nevertheless, it is encouraging to see a company approach the challenge with obvious passion and enthusiasm.

Comments are off for this post

Raser up 30% on private placement

Raser Technologies announced that they’ve completed a $12.5M private placement to help with drilling expenses. Traders were thrilled by this news causing the stock to climb 30%, though there has been a slight retreat since. What does this mean? In addition to the $5.5M AMP returned to Raser, there is at least $18M of cash available to Raser to funding drilling, which is phenomenally expensive.

Our unsolicited advice to the Raser team is, if you’re serious about the geothermal business (and by all indications you are,) consider buying a drill rig. With fully burdened geothermal well costs approaching $1,500/meter and the scarcity of drill rigs, this could be a solid capital acquisition that permanently reduces drilling costs by as much as 50% over the useful 30 year life of the rig.

So what did this extra money cost? The latest SEC filing indicates that Raser has 50.7M common shares outstanding. The private placement adds 2.7M shares to that total at a purchase price of $4.65 per share and grants 945,000 of warrants, essentially the right to by future shares, at a strike price of $6.05 per share. The combination of the shares and warrants (assuming they are excercised) will result in just over 7% dilution for shareholders of record at the time of the announcement.

As stated in prior entries, this is the latest in a series of deals of this type, which appears to be in vogue for geothermal developers.

Disclosure: The author holds no shares in Raser Technologies.

Tesla Turbines

Atlantic Geothermal posted a link to a video by Jeff Hayes discussing Tesla Turbines. This served to remind me about these turbine/pumps and other “dead” technologies like Stirling engines. This technology is relevant as many geothermal resources have extremely high total dissolved solids (like the Salton Sea) that are expensive to harvest with conventional turbine technology.

Conventional turbines consist of a shaft with blades mounted upon it. This looks very much like closely spaced propeller blades that are pushed by pressure exerted through gas or air which causes the shaft to rotate. Conventional steam turbines have inlets near the center of a shaft with the gas/steam expanding out toward the ends with the blades becoming progressively larger from the center to the end. See the photo below of a conventional steam turbine shaft and blade assembly, the far right of the photo is where the gas/steam enters on this model and it expands and exits on the left.

Image Credit: Christian Kuhna

These turbine shaft/blade assemblies can weigh as much as 40 tons and spin at 3,600 rpm. That’s alot of mass spinning very fast. When a steam resource with high total dissolved solids is pushed through conventional turbine systems, it results in scaling, friction, and loss of efficiency. The higher the TDS, the more frequently these devices require maintenance, expensive both in absolute terms and lost opportunity.

The Tesla turbine is a completely different animal. Rather than depending upon blades, it depends on centrifugal force created by adhesion of the steam/gas to large, smooth surface areas of closely spaced rotor disks. See the drawing below to get a sense of the difference between the Tesla system and conventional turbines.

Image Credit: Unknown

The figure on the left shows an end on view of the device with the shaft pointed toward the reader. One rotor is visible in this elevation with steam/gas entering on the top right of the device and exiting through the top left. Modern designs have only one inlet with the exhaust coming through the shaft region, this is important because as the rotors spin the gas is being pulled toward the shaft in a tight series of concentric circles.

The figure on the right is a side elevation of the device where the rotor assembly is the most interesting feature. These smooth disks are closely spaced (0.032″) and the adhesion of the gas/steam to the rotors cause the rotors and subsequently the shaft to rotate. The difference between conventional turbine design and the Tesla design is glaringly obvious, there is no good place for TDS to build up scaling. Another enormous difference between conventional turbines and Tesla’s design is operating speed, the Tesla, depending on rotor size, needs to operate in the 25,000 rpm realm and higher to effectively generate mechanical force. Operation at lower speeds doesn’t allow appreciable power to be harvested (which runs completely contrary to conventional turbines where power may be harvested throughout the range of rotational rpm.)

Today, Tesla turbines are used commonly as pumps for viscous materials (like crude oil) but have not found a place in turbine engine use as yet. The Department of Energy has dismissed Tesla turbines from consideration stating that “they don’t work” when compared against conventional turbines – although, this isn’t true when operated at high rpm which is the design center. So, will we see any Tesla turbines in operation? I wouldn’t bet on it in the near future, but longer term, it wouldn’t surprise me in the least to see a geothermal plant using this technology in the next 10 years.