Archive for the 'Geothermal' Category

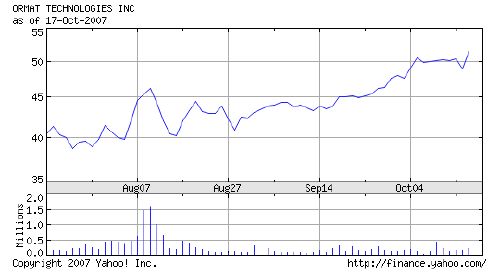

Ormat up on takeover rumors

Over the past 3 months, Ormat (NYSE: ORA) market capitalization has increased to nearly $2B. The run up of the stock can be attributed to rumors that the company is considering some sort of takeover by private equity. The two names most closely connected to such potential deals are Goldman Sachs and Apax. Today, Apax has denied the rumors of such a deal.

What we do know is that a consolidation is underway in the renewable energy industry as established energy players rush to start or enhance their portfolios and renewable energy companies seek to cash-in on a liquidity event at near record market prices. This is a wise strategy, one only has to look at the ethanol segment today vs. two years ago to see how quickly and completely the bubble can pop. Caithness has provided a model for this, effectively exiting the operations of renewable power plants with the ArcLight Capital deal consummated earlier this year.

But what about valuation? Ormat is a $300M gross sales company split with 80% coming from electricity generation and 20% from equipment sales. Net income trailing 12 months is $21M and current market cap is $2B, 100x earnings value. Wow. The company carries nearly $500M in debt and has $73M in cash. The generation portfolio is around 370MW today and could double in the next 5-7 years, though it would be interesting to see how the company would choose to finance such aggressive expansion.

As a point of comparison, Calpine (OTC: CPNLQ.PK) has a geothermal portfolio of 800MW, development potential to increase that by 500MW over the next 5-7 years, and also has over 23,000MW of natural gas generation assets. Admittedly, Calpine is working to emerge from a painful and slow bankruptcy and does not have an equipment business as points of difference. Looking at the revenue, (though Calpine declines to segment revenues by gas fired and geothermal segments) we estimate that Calpine is capturing at least $400M per year in revenue from their geothermal portfolio and throwing off in excess of $100M per year in net income from the portfolio. Calpine’s market cap? $750M.

On the basis of this analysis, we would suggest that it would make more sense for large players looking to enter the renewable energy market in a big way to acquire Calpine, even at 100% premium of market price today, divest the natural gas resources and develop the other 500MW in Calpine’s pipeline. This would likely be more cost effective than taking on a smaller portfolio with an equipment business at a staggering premium. The bankruptcy proceedings definitely would complicate the matter, but it would be worth it to get such valuable assets without paying such a steep premium over intrinsic value.

Our analysis leads us to believe that Ormat is worth about $40/share presently, thus the current share price of $51.50 leads to substantial downside risk in the near to mid-term.

Disclosure: MeV holds no position in Ormat or Calpine. 2 comments

Small-scale geothermal systems

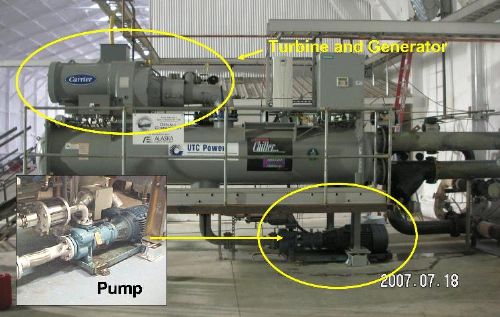

At the GRC Annual Meeting earlier this month, the Chena Hot Springs project was discussed again. Chena is in central Alaska, about 65 miles northeast of Fairbanks and is home to a resort as well as a 400kw geothermal plant. At heart, the Chena geothermal power plant is no different than any other binary geothermal power plant. But in detail, there are some interesting aspects of the project that make it worthy of note:

- Low resource temperature – The production temperature from the wells at Chena is 165F (74C). Production from this low temperature is possible because of the ample supply of 40F (4C) cooling water that enables a consistent 120+F (49+C) difference in temperature at the harvest point. Location, location, and location matter in this instance.

- Commercial chiller harvest – Chena elected to go with a commercial, off-the-shelf power conversion unit from UTC. These 280kw gross, 225kw net units are relatively cheap and are essentially industrial chillers being run in reverse. UTC has been producing these units for decades, their performance characteristics and failure modes are well known and understood. This is a departure from the Ormat approach which is to fit a custom harvest system to the resource which makes implementation much cheaper and faster.

- Shallow resource depth – The production and injection wells at Chena aren’t very deep by conventional geothermal harvest standards. This reduces the cost and complexity of implementing the systems. The wells at Chena range from 100 to 1000 feet (30-300m) deep.

- Time to production – Unlike most geothermal projects at utility scale, this project was implemented in less than a year real time, and less than 2 years elapsed time (due to the seasons – it’s tough to work in -40F weather.) The world land speed record for other plants appears to be 5 years elapsed time.

- Government sponsorship – The US Department of Energy and the State of Alaska worked with the project to support exploration, drilling, and development activities. This is not always the case, but in this instance, the public/private partnership seemed to work.

Before the geothermal power plant went live, Chena’s power was provided by diesel generators at a cost of around $0.30/kwh. Now, the cost has dropped to $0.07/kwh and the resort has less ambient noise and particulate matter in the near vicinity because the diesels aren’t running. That’s a real economic benefit coupled with a synergistic effect that is beneficial to the primary business of the resort, a clean, quiet environment. Not every project can be like this, but one has to wonder how many other small scale geothermal systems could be tapped and harvested. Over the lifetime of the plant (if it’s running at full capacity of 400kw for 30 years), the economic benefit just in difference of cost/kwh will be on the order of $23.7M – impressive.

3 comments

Another Conservation Game

This time, from Chevron. In July we wrote about My Abodo, a consumer-focused exercise that enabled one to make choices about how they live then to see the impact of those changes on the environment around them. In retrospect, it was a very cool exercise and you can still see our little MeV home we created – optimized for lowest level of impact.

Today, Chevron has gotten into the act with WillYouJoinUs.com, more a Sim City approach to the same problem where you, the Mayor and CFO make decisions about energy supply then watch the impacts on economics, environment, and security through a few simulation phases over time. A screen shot of MeV City is located below the jump.

It’s great to see Chevron get engaged in this area, their bread is obviously still buttered by fossil fuels, but in the last few months they seem to be getting on the green bandwagon. Would it surprise you to learn that Chevron is the world’s largest geothermal electricity provider? Interesting, I’d think that geothermal power would be an option on their game. Oh well…

Tip of the hat: Didn’t You Hear? Comments are off for this post

Triple Play: Sou Hills Project

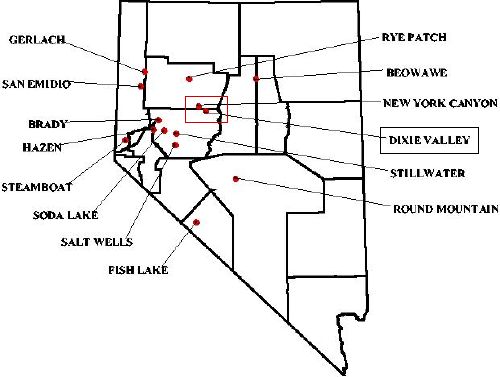

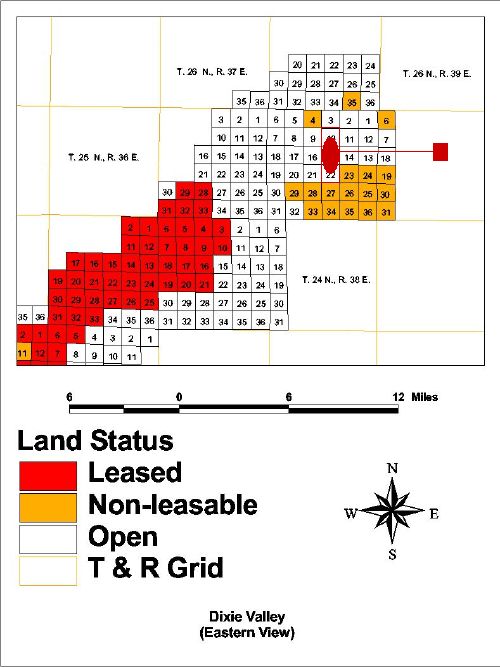

In August, 2007, MeV acquired a lease and development rights on ~1700 acres (~700 hectares) of land in Nevada’s East Dixie Valley. This area is a Known Geothermal Resources Area (KGRA) with a functioning plant, Ormat’s Dixie Valley 60MW facility, in the near vicinity. Given the parcel’s location in the Sou Hills, we now refer to this parcel as the Sou Hills Prospect. One other key aspect to the Sou Hills Prospect is its proximity to electricity transmission. A distribution line is located within 400m of the southern end of the parcel which connects to a 230kv transmission line owned and operated by Sierra Pacific Power Company. MeV has made one preliminary visit to the Sou Hills Prospect which is recorded here.

As with any geothermal prospect, exploration is paramount. Before the end of the year, MeV plans to complete aerial, self-potential, soil chemical, and magnetic surveys of the prospect. In addition, MeV plans a 2m shallow temperature survey with at least 100 measurement points (which can and will be adjusted in the field to accommodate the localization of any anomolies.) After collecting and analyzing this data, MeV may drill temperature gradient wells in locations suggested by the analysis of the prior surveys.

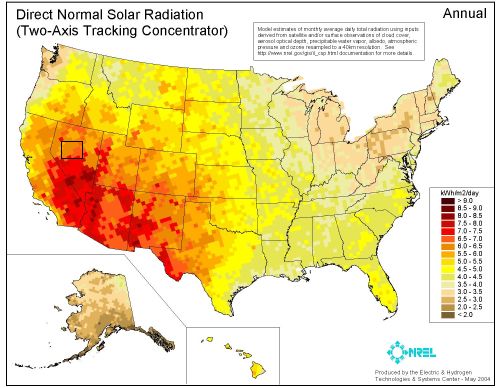

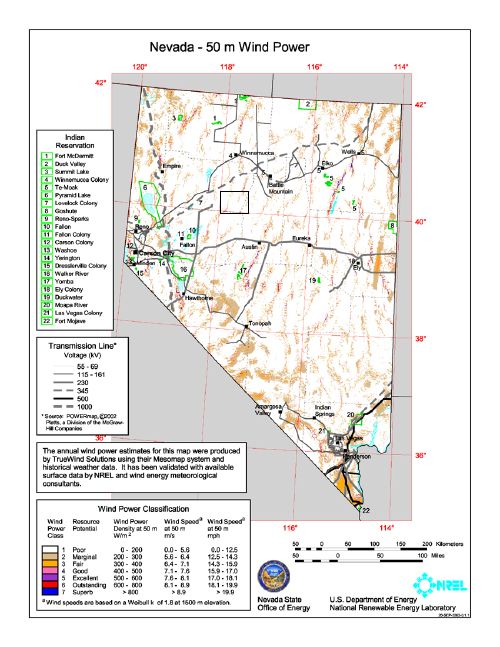

In addition to geothermal resource, MeV also observes that this location lies in the desert and is the recipient of copious amounts of sunshine year around. Given that benefit, solar surveys to characterize resource applicability for solar thermal electricity production will also be performed. Finally, there may be wind resource in the area and as such a wind resource analysis will be performed. This will help determine the feasibility of a “double” or “triple” play allowing multi-dimensional harvest of renewable resource below the surface level with geothermal, at surface level with solar thermal, and above surface level with wind all on the same physical property.

(Sou Hills Prospect in Rectangle Area >5 kwh/m2)

(Sou Hills Prospect in Rectangular Area – Detail in cutout below)

In concert, the wind, solar, and geothermal resources can share the same operations and transmission infrastructure. Solar thermal and geothermal can share the same physical generation resources. As solar resources become unavailable (darkness) wind resources in this area tend to increase and peak during night time hours. Of course, geothermal resources are not subject to sunlight and wind conditions and provide a constant baseload power output from the renewable energy park. Presently, the size and feasibility of this approach are unknown and will not be known until the resource assessment has been completed. However, the conditions are right for this approach to work in this specific property and perhaps others located around the world.

As results of resource surveys become available, we will share those results and the progress of our project in general. Comments are off for this post

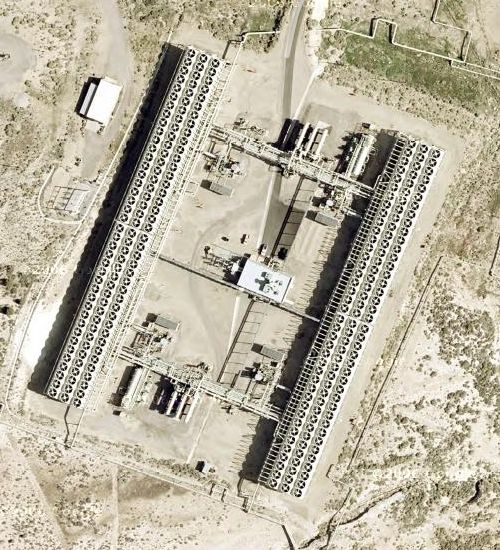

Steamboat Springs Geothermal Plant

Last week on the way home from the GRC annual meeting, we decided to take a side trip that would take us by the Lower Steamboat Springs Geothermal plant operated by Ormat. The view above is courtesy of Google Maps, the view below was snapped from US 395 about 10 miles south of Reno, Nevada. The entire Steamboat Springs complex (4 plants, Upper and Lower Steamboat Springs) has a nameplate capacity of just over 64 MW.