Archive for the 'Fossil Power' Category

McDonald’s slick oil recycling

With over 150 delivery trucks (lorries if you prefer,) McDonalds consumes over 6 million litres of diesel fuel each year. That many people have been asking the restaurant (and others) for their used cooking oil has not gone unnoticed and as a result, McDonalds UK plans to use a mix of 85% recycled cooking oil and 15% rafeseed oil to power their fleet.

At the beginning of this month, a subset of 50 trucks was converted to run on the bio fuel and the full fleet should be converted shortly. From a financial perspective, this is great news for the company as they could realize savings of up to $12M per year in fuel costs and potentially have excess fuel to resell providing even more bottom line boost. Reuters published an interesting writeup on this earlier in the month.

Another case where recycling and smart ecological thought translates to positive cashflow.

Calpine ready to go it alone

Despite persistent rumors of various groups working to take Calpine private, it looks as though the company will try to make a go of it alone. The June 20 target to emerge from bankruptcy is fast approaching meaning one window for this decision is about to close, of course, another will open thereafter but the terms and situation will be vastly different.

One has to wonder if the run up in the stock price will be sustained with the changing view point on going private? Will investors be patient enough to see what the impact of Calpine’s relatively clean power can bring on the market? Given that the company has some 25,000MW of generation (700MW geothermal the balance natural gas) it is positioned as a clean energy provider in a time that coal generation is under attack. The company has made progress on restructuring its debt and streamlining its portfolio. But it’s unclear if the resulting company will be consistently profitable.

But is that enough? Prices of natural gas continue to rise squeezing margins. The geothermal bit of the portfolio is very interesting and productive, but is less than 1/25th the entire company’s generation capability. Yes, the fuel is “free”, but the cost of accessing the fuel over the lifetime of the plant is paid up front with exploration and drilling costs. Clean energy will command a premium price, that’s clear. How much of their portfolio can take advantage of that market trend? We shall see.

It’s unclear what Calpine is really worth at this point and we can’t tell if the issue provides good value or not. But, we’ll watch with interest as Calpine emerges from bankruptcy and as we can determine a fair valuation for the company, we’ll share it. Right now, it’s chock full of unknowns and potential upside.

Court ruling changes economics

From Renewable Energy Access:

Comments are off for this postIn simple terms, the Court rejected arguments by many electric utilities whose power plants were grandfathered into the Clean Air Act, and then maintained that if they upgraded these power plants — they still would not have to meet Clean Air Act standards.

Renewable energy experts hailed the ruling as the first step to force baseload coal plants to invest in meeting emissions standards like all other energy sources — and that these investments will be reflected in increased rates, making baseload renewables such as biopower, concentrated solar, geothermal and wind more competitive.

Chrysler Challenge

Earlier this week there was news that Kirk Kerkorian made a $4.5B cash bid for Chrysler. Must be nice to have that much change lying around…

But to get to the point of this post, it is Easter weekend and for a couple of billion people around the globe, that means celebrating the resurrection of Jesus (or, something to do with rabbits laying colorful eggs and various chocolate treats.) But I digress. Let’s assume Kerkorian gets Chrysler from the good folks at Daimler, what should he do with it?

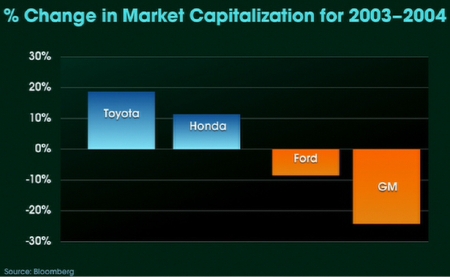

Like all American auto makers, it has a fleet of non-competitive vehicles, which coupled with rising fuel costs, is simply hammering sales. I snagged the graph below from the film An Inconvenient Truth, unfortunately, Chrysler’s market cap wasn’t on the slide since it is a subsidiary company.

It doesn’t take a Wall Street expert to interpret this chart. Fuel efficient vehicles are winning, and winning big. Last week, Toyota announced that it sold 28,453 hybrid vehicles in March. More than all of Saturn, GM’s fastest growing brand. This is not a temporary shift, it is permanent, inexorable, and accelerating.

As Easter suggests, sometimes things need to die before they can be resurrected and come back even stronger. I think that’s where the US Auto Industry is, it’s clearly dying because it is incapable of change.

Mr. Kerkorian, here’s the challenge: Don’t use half-measures, don’t compromise with hybrids. Crucify the gasoline and diesel engine. The 640hp Electric Mini project has already proved this is possible. Take the bold step forward to launch the following all electric vehicles from Chrysler:

- Full-sized pickup

- 4 door sedan

- Minivan

- Station wagon

- Coupe

Don’t get cute with this stuff, no distinctive designs, no hybrid systems, keep the range over 250 miles (400km,) and engineer the systems to use 4 motors, one on each wheel. Use your existing designs, rip the combustion engines, emissions equipment, and transmissions out and replace them with deep cycle batteries, 4 wheel mounted motors, and a 100 foot (30m) retractable extension cord. Engineer the power system to have the right performance characteristics: i.e., good low-end torque on the truck and fast acceleration on the passenger vehicles.

Get to market next year. It’s possible. What do you lose? The old market. The long haul market. But, do you care? Chrysler has lost, or is rapidly losing those markets anyway. Use your brand, your dealer network, and your manufacturing and distribution infrastructure to make this happen and to make it happen fast. And if Chrysler ultimately dies as a result of this decision? At least it went out swinging. And hey, you’re worth $15B now, you’ve still got $10B left.

This is not the time for half-measures, it’s the time for bold leadership. We’re closing factories and shipping work offshore, we’re sending billions into the middle east to fund terror each time we fill our gas tank, the temperature of the earth is quickly rising as a result of greenhouse gases. We’re facing a crisis on multiple dimensions.

Mr. Kerkorian, when you bought those surplus World War II bombers you took an enormous risk. When you built the original MGM Grand Casino, at the time, the world’s largest hotel, you took an enormous risk. You’ve got a track record, you’ve got the cash, you can do this.

The question is, will you?

Carbon Sequestration of Coal Emissions

Much has been made of this technology for extracting the carbon dioxide from the emissions of coal fired electricity generation plants. The basic premise is that the waste gas is circulated through chilled ammonia which “captures” the carbon dioxide which is then pressurized and stored for reuse. The French power company Alstom is the inventor of this process which it claims is less expensive and feasible at utility scale.

Alstom and American Electric Power have agreed to collaborate on a 30MW proof-of-concept that will capture flue gas from AEP’s 1,300MW Mountaineer Plant located near New Haven, West Virginia. The PoC should be complete by late 2008. After the results are evaluated, AEP and Alstom may proceed to two other projects at utility scale with a 200MW capture facility on a 450MW AEP plant in Oklahoma.

Ideas for what to do with all the excess carbon dioxide include using it as a pressurization agent in enhanced oil recovery and storing the gas in stable salt domes (like present natural gas and strategic petroleum reserve facilities.) Other approaches are to use and enhance natural carbon processing ecosystems like plant mass and the ocean to reduce carbon dioxide levels.

As a matter of practicality, these are reasonable steps to take given that 50% of the US electrical power is created by burning coal and reducing the impact of that activity is a very good thing. But, it’s not sufficient, it needs to happen in concert with conservation as well as increasing the non-fossil fuel generation of electricity. As carbon sequestration becomes mandatory, that should help push the price of coal burning generation facilities to levels where renewable generation technologies are more cost effective. That’s just the catalyst needed to start vast change in the way we generate our electric power.